Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

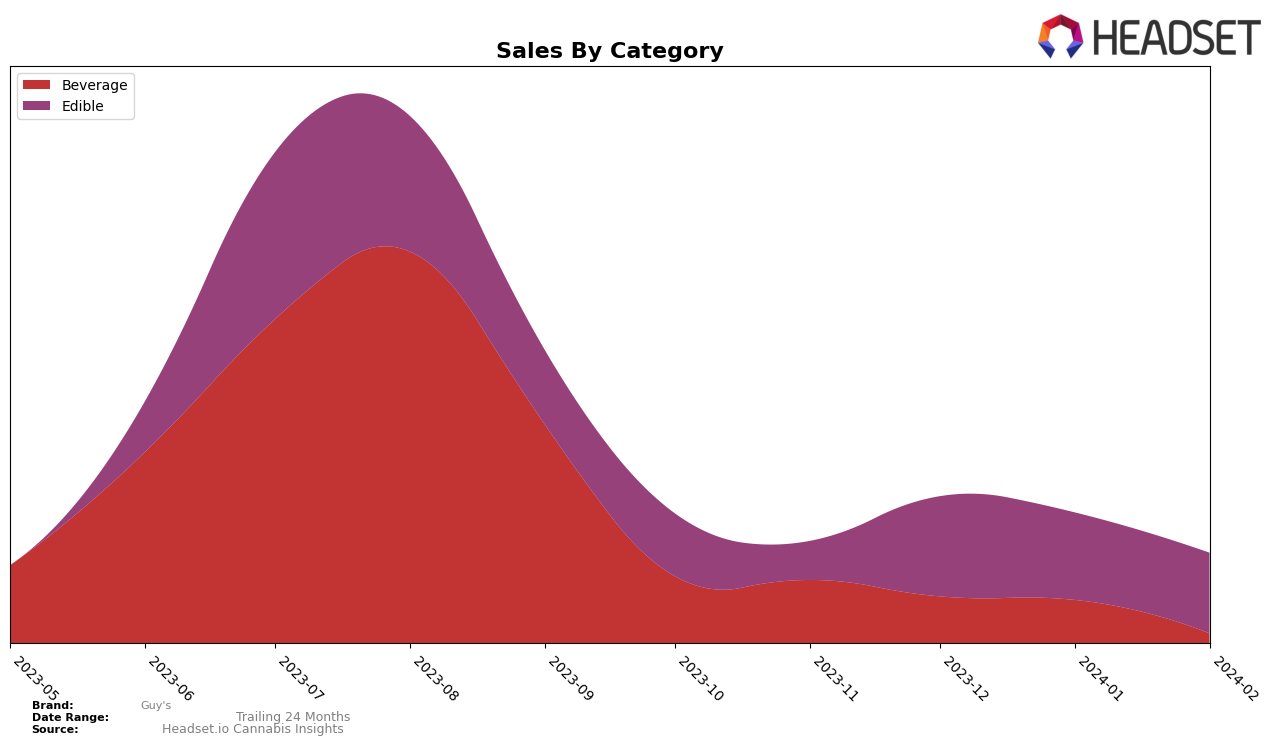

In Missouri, Guy's has shown a consistent performance in the Beverage category, maintaining its position within the top 20 brands across the observed months. The rankings from November 2023 to February 2024 have seen slight fluctuations, moving from 14th to 13th and back to 14th place, indicating a stable demand for their products in this category. However, it's noteworthy that their sales in February 2024 significantly dropped to 157 units, a substantial decrease from the 1001 units sold in November 2023. This sharp decline raises questions about market dynamics or potential shifts in consumer preferences that could be influencing Guy's performance in the Beverage sector within the state.

Conversely, Guy's presence in the Edible category tells a different story. Despite not breaking into the top 20 brands, their rankings have shown minor improvements, moving from 61st in November 2023 to 59th in January 2024, before slightly dropping back to 60th in February 2024. This indicates a struggle to capture a significant market share in the Edible sector, yet the sales figures tell a more optimistic story. Remarkably, December 2023 saw a surge in sales to 1660 units from 643 units in November 2023, suggesting a growing interest or possibly successful marketing efforts during that period. However, maintaining this momentum appears to be challenging, as indicated by the gradual sales decrease in the following months, emphasizing the competitive nature of the Edibles market in Missouri.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Missouri, Guy's has shown a consistent performance, maintaining its position in the lower ranks but demonstrating resilience and potential for growth. Notably, Guy's moved from a rank of 61 in November 2023 to 60 in December, and then to 59 in January 2024, before slightly dropping to 60 in February 2024. This fluctuation in rank, while minor, indicates a competitive battle with close rivals such as Vibe Cannabis (MO), which saw a more significant rank improvement from not being in the top 20 in November to ranking 56 by February 2024. Other competitors like Shango, Moxie, and Bhang have also experienced shifts in their ranks, with Shango notably maintaining higher sales figures despite a slight rank decrease. Guy's sales trends, while lower than some competitors, show a positive trajectory, suggesting a growing consumer interest that could, with strategic marketing and product development, position Guy's more favorably in the Missouri edibles market over time.

Notable Products

In February 2024, Guy's Original Potato Chips 10-Pack (20mg) from the Edible category maintained its top position for the third consecutive month, with sales figures reaching 80 units, marking it as the best-selling product. Following closely, the Root Beer Soda (10mg THC, 12oz) in the Beverage category secured the second rank, despite a significant drop in sales compared to previous months. Notably, the Original Potato Chips 10-Pack (20mg) has shown a consistent performance by staying within the top 2 ranks since November 2023. On the other hand, the Root Beer Soda experienced a fluctuation in its ranking, moving from the top position in November 2023 to the second spot by February 2024. These rankings indicate a stable consumer preference for edibles, specifically the Original Potato Chips 10-Pack (20mg), within Guy's product line over the analyzed period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.