May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

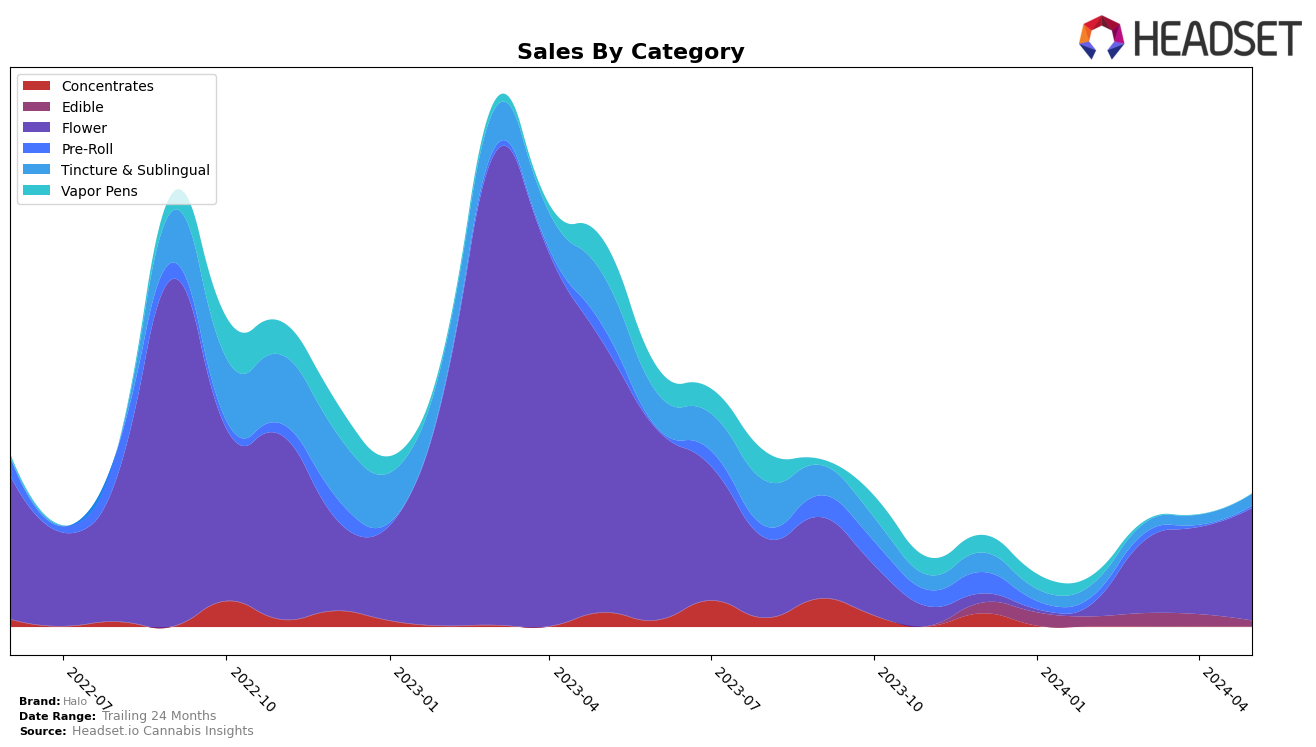

Halo's performance in the Flower category in Oregon has shown a notable decline over the past few months. The brand did not rank in the top 30 from February to May 2024, indicating a significant drop in its market presence. This absence from the top rankings suggests that Halo is facing stiff competition or possibly a shift in consumer preferences within the state. Despite this, the brand managed to generate substantial sales, with February sales figures reaching $90,000, demonstrating that while it may not be a top contender, it still maintains a loyal customer base.

The lack of top 30 rankings across multiple months is a concerning trend for Halo in Oregon's Flower category. This could imply that the brand needs to reassess its market strategies or product offerings to regain its competitive edge. The data suggests that while Halo has a presence, it struggles to capture a significant share of the market. This pattern could be indicative of broader challenges within the Flower category, or it might reflect the need for innovation and stronger marketing efforts to boost its standing. Overall, Halo's current trajectory in Oregon serves as a critical point for strategic evaluation and potential reinvention.

Competitive Landscape

In the competitive landscape of the Oregon Flower category, Halo has shown a notable re-entry into the top 20 brands in May 2024, ranking at 90th after being absent in the previous months. This re-entry indicates a positive directional trend for Halo, potentially driven by strategic changes or market demand shifts. In comparison, Nelson & Co. has experienced fluctuations, dropping from 74th in February to 84th in May. Meanwhile, Drewby Doobie / Epic Flower saw a significant rise to 43rd in March but fell out of the top 20 in April, only to reappear at 92nd in May. Decibel Farms consistently ranked within the top 60 until May, where it also fell out of the top 20. Lastly, Kites showed a strong upward trend, moving from 94th in February to 52nd in April, before settling at 80th in May. These shifts highlight a dynamic market where Halo's recent re-entry could signal a potential for growth, especially when compared to the fluctuating ranks of its competitors.

Notable Products

In May-2024, the top-performing product for Halo was Animal Mints (Bulk) in the Flower category, which climbed to the number one spot with sales of $16,235. Wedding Cake (Bulk), also in the Flower category, secured the second position, showing a significant rise from the fourth rank in April-2024. Blue Magoo (Bulk) maintained its third position consistently from the previous month. Black Mamba (Bulk) saw a drop from first place in April-2024 to fourth place in May-2024. Notably, Lemon Meringue x C Land Saucy J Infused Pre-Roll (1g) entered the top five for the first time, ranking fifth.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.