Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

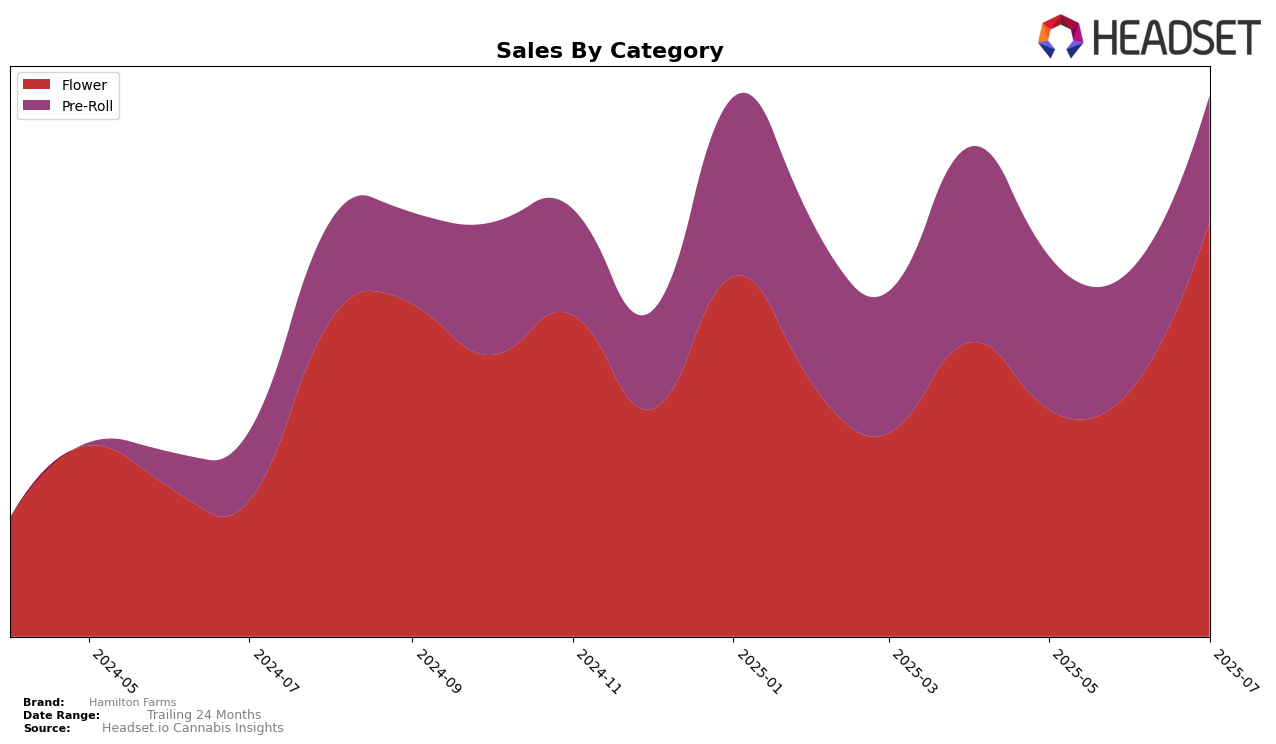

Hamilton Farms has shown notable performance fluctuations across different categories and states, particularly in New Jersey. In the Flower category, Hamilton Farms experienced a significant improvement in ranking from 33rd in June to 25th in July 2025, indicating a positive trend in consumer preference or market strategy. The sales figures support this upward movement, with a notable increase in sales from June to July, suggesting enhanced market penetration or consumer loyalty. However, the brand did not make it into the top 30 in April and May, which could imply either a strategic shift or seasonal factors influencing their market position.

In the Pre-Roll category, Hamilton Farms' performance has been more volatile. Starting at 14th place in April, the brand saw a gradual decline, landing at 25th by July. This downward trend might suggest increased competition or changing consumer preferences within the pre-roll segment in New Jersey. Despite the drop in ranking, the sales figures remained relatively stable, indicating a consistent consumer base that might be loyal to the brand. Such dynamics highlight the competitive nature of the cannabis market and underline the importance of strategic adjustments to maintain or improve market standing.

Competitive Landscape

In the competitive landscape of the New Jersey flower category, Hamilton Farms has shown a notable upward trajectory in recent months, climbing from a rank of 38 in May 2025 to 25 by July 2025. This improvement in rank is accompanied by a significant increase in sales, suggesting a positive market response to their offerings. Compared to competitors, Revelry Herb Company also experienced a similar upward trend, moving from 36 to 24 in the same period, indicating strong competition in this segment. Meanwhile, Niche saw a decline from 14 in May to 27 by July, which may reflect shifting consumer preferences or strategic missteps. Happy Farmer emerged as a formidable competitor, advancing from 35 to 23, surpassing Hamilton Farms in July. These dynamics highlight the competitive pressure in the New Jersey flower market, emphasizing the need for Hamilton Farms to continue innovating and adapting to maintain its upward momentum.

Notable Products

In July 2025, Hamilton Farms' top-performing product was Panama Red (3.5g) in the Flower category, securing the first rank with a notable sales figure of 2215 units. Apple Jelly (3.5g), also in the Flower category, maintained its strong performance, holding steady at the second rank with increased sales from June to July. Garlic Knots Pre-Roll 2-Pack (1g) emerged as the third top product in the Pre-Roll category, showcasing its popularity among consumers. Night Charmer (3.5g) and Royal Blue Dream Pre-Roll (1g) rounded out the top five, ranking fourth and fifth, respectively. Compared to previous months, these rankings indicate a consistent preference for Flower products, with Pre-Rolls gaining traction as well.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.