Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

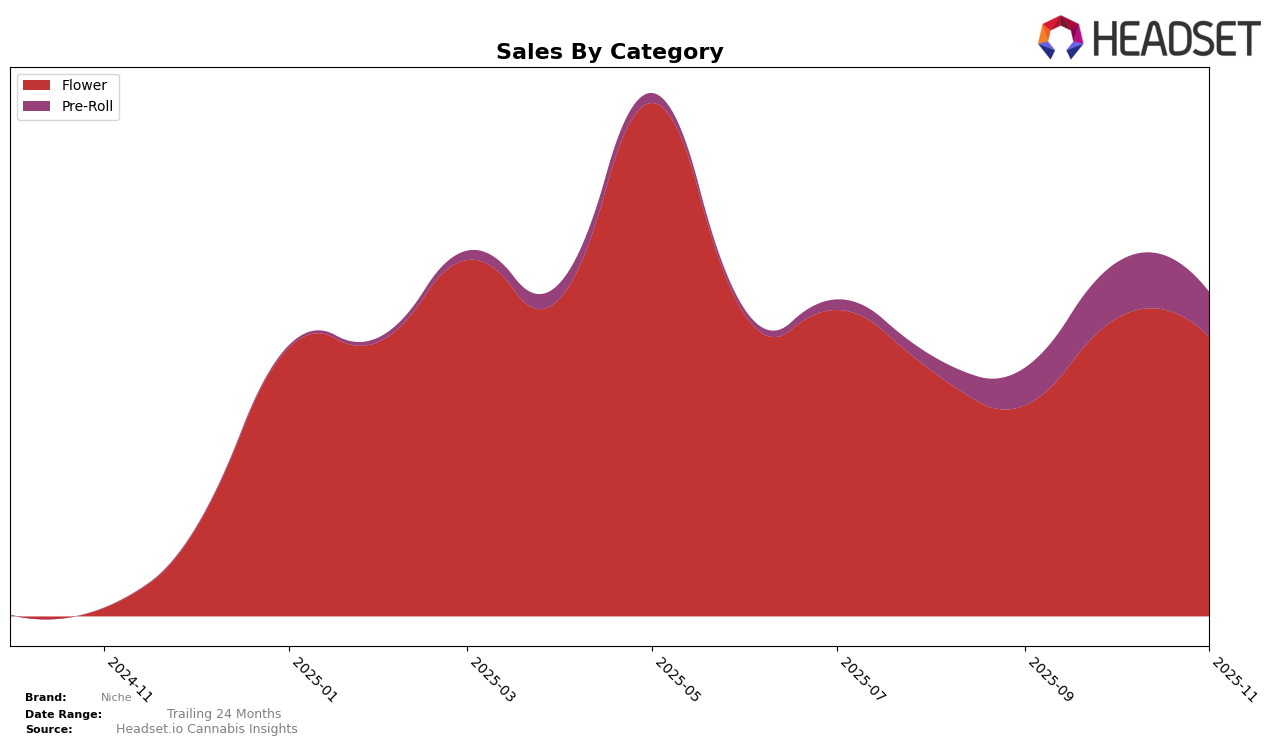

In New Jersey, Niche has shown a consistent presence in the Flower category, maintaining a position within the top 30 brands. Over the past few months, their rank has seen some fluctuations, moving from 29th in August to 25th in November. This indicates a positive trend, although there was a slight dip in November compared to October. Despite the ranking changes, Niche's sales figures in the Flower category have generally been robust, with a notable spike in October. Such movements suggest that while Niche is not at the top, it maintains a competitive edge within the market.

Conversely, in the Pre-Roll category, Niche has made significant strides in New Jersey. Starting from a rank of 69 in August, they improved to 37 by November, showcasing a strong upward trajectory. This improvement is particularly impressive given that they were initially outside the top 30. The sales figures reflect this growth, with a substantial increase from August to October, though there was a slight decline in November. This trend highlights Niche's growing popularity and potential in the Pre-Roll category, suggesting a promising area for further development and market penetration.

Competitive Landscape

In the competitive landscape of the Flower category in New Jersey, Niche has experienced notable fluctuations in its rank and sales over the past few months. In August 2025, Niche was ranked 29th, but it climbed to 23rd by October, before slightly dropping to 25th in November. This indicates a competitive positioning improvement, albeit with some volatility. In comparison, Brute's Roots maintained a relatively stable rank, starting at 20th in August and ending at 26th in November, suggesting a consistent presence in the market. Meanwhile, Breakwater showed a significant upward trajectory, moving from 79th in August to 23rd in November, indicating a strong market penetration that could pose a threat to Niche's position. On the other hand, Happy Farmer experienced a decline, from 23rd in August to 27th in November, which may provide an opportunity for Niche to capture some of its market share. Overall, while Niche has shown resilience and growth potential, the competitive dynamics suggest a need for strategic adjustments to maintain and enhance its market position amidst rising competitors like Breakwater.

Notable Products

In November 2025, Gas Tax (3.5g) emerged as the top-performing product for Niche, climbing from the fifth position in October to first place, with sales reaching 1,141 units. Following closely is Bubblegum Gelato Pre-Roll 2-Pack (1g) securing the second position, making a notable debut in the rankings. Yellow Mermaid (3.5g) and Peelz (3.5g) took the third and fourth spots respectively, both new entries for the month. Josh D OG Pre-Roll (1g) rounded out the top five, maintaining its position from the previous month. This shift highlights a strong preference for both Flower and Pre-Roll categories among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.