Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

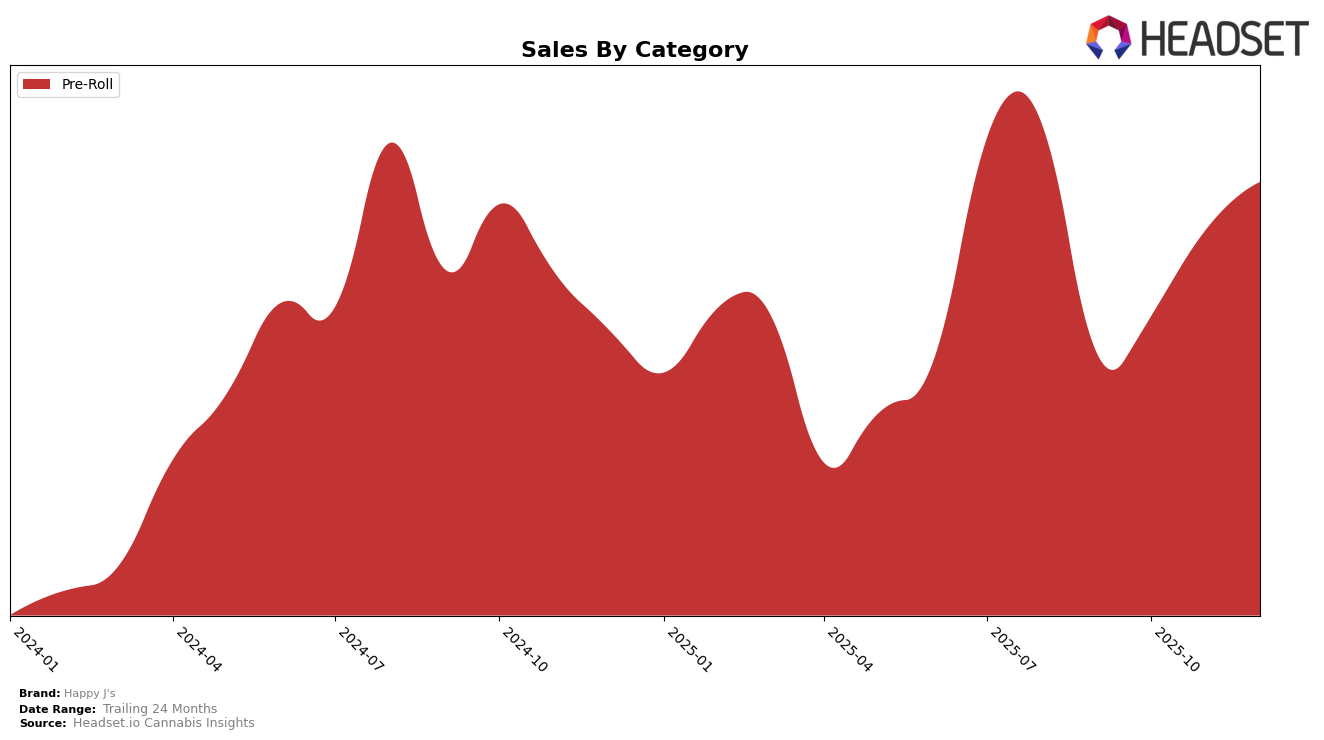

Happy J's has shown a consistent performance in the Pre-Roll category in Maryland. Over the last few months, the brand has maintained a stable ranking, holding the 16th position in both September and October 2025, before improving to the 13th position in November and December 2025. This upward movement in rankings suggests a growing consumer preference for Happy J's products in this category. The steady increase in sales from September to December further supports this trend, indicating a strengthening market presence in Maryland's competitive Pre-Roll segment.

While Happy J's has made notable strides in Maryland, it is important to consider their absence from the top 30 rankings in other states and categories, which suggests areas for potential growth and market expansion. The lack of presence in other markets could either be a strategic focus on strengthening their hold in Maryland or could indicate untapped opportunities elsewhere. Analyzing such patterns can provide insights into regional market dynamics and help identify where Happy J's might focus its future efforts to replicate its Maryland success in other regions.

Competitive Landscape

In the competitive landscape of the Maryland pre-roll category, Happy J's has shown a notable upward trend in rankings and sales from September to December 2025. Starting at rank 16 in September, Happy J's climbed to rank 13 by November and maintained this position in December, indicating a positive momentum in market presence. This improvement is significant when compared to competitors such as Garcia Hand Picked, which remained stable at rank 14 from October to December, and Grassroots, which experienced fluctuating ranks and was not in the top 20 in October. Moreover, Happy J's sales trajectory is on the rise, surpassing Garcia Hand Picked in November and December, although it still trails behind Kaviar and Grow West Cannabis Company, which consistently hold higher ranks and sales figures. This data suggests that while Happy J's is gaining ground, there is still room for growth to catch up with the leading brands in the Maryland pre-roll market.

Notable Products

In December 2025, the top-performing product from Happy J's was Deadband 12 Pre-Roll 2-Pack (1g), which climbed to the number one spot with sales reaching 5,110 units. Orange Drizzle Pre-Roll 2-Pack (1g) maintained its strong performance, securing the second position consistently from November to December. Rainbow Push Pop 4 Pre-Roll 2-Pack (1g) dropped to the third rank after leading in November, while Midnight Circus Pre-Roll 2-Pack (1g) re-entered the rankings at fourth place, showing a resurgence from previous months. Notably, Rainbow Push Pop 4 Pre-Roll 7-Pack (3.5g) appeared in the rankings for the first time in December, debuting at fifth place. These shifts highlight significant sales dynamics and changing consumer preferences within the pre-roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.