Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

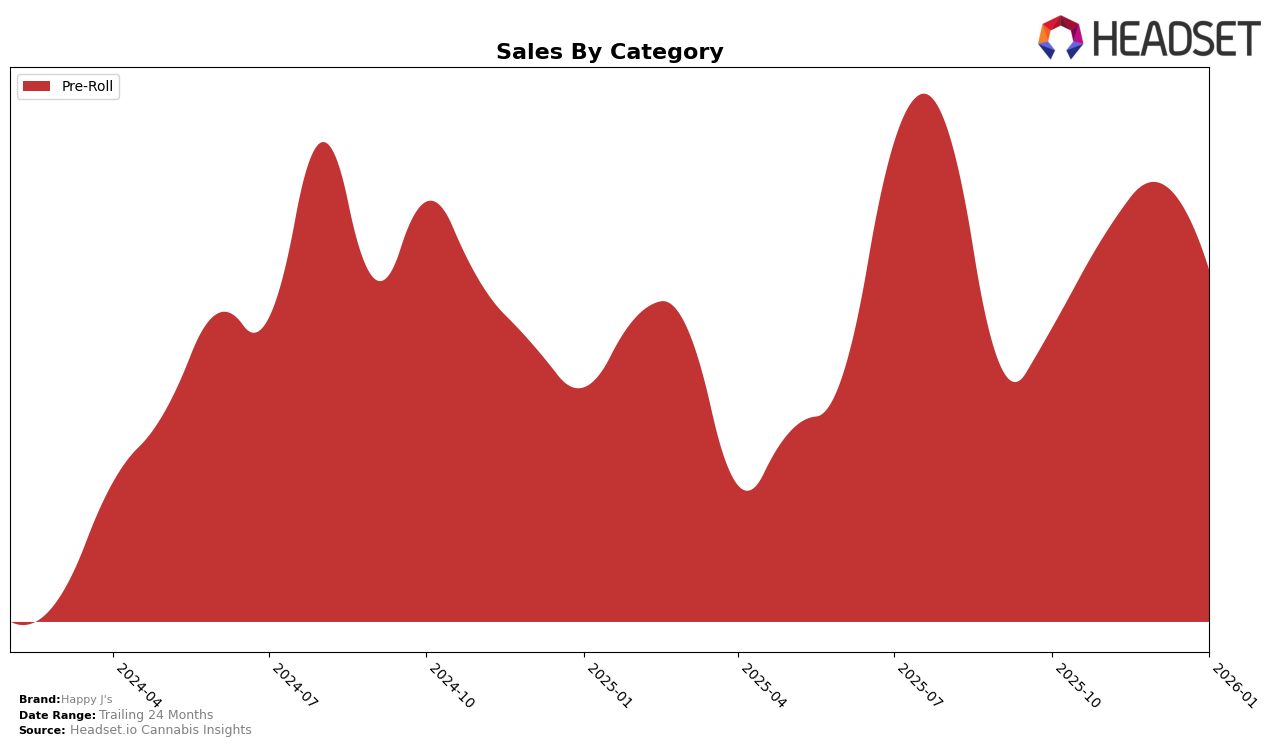

Happy J's has demonstrated a consistent performance in the Pre-Roll category within Maryland. Over the period from October 2025 to January 2026, the brand's ranking fluctuated slightly but remained within the top 20. Starting at rank 16 in October 2025, Happy J's improved to rank 13 in both November and December, before slightly declining to rank 14 in January 2026. This stability in rankings, coupled with a notable increase in sales from October to December, suggests a solid foothold in the Maryland market. However, the slight dip in January sales might be an indicator of seasonal trends or increased competition.

While the data for Happy J's in other states or categories is not provided, the absence of rankings beyond Maryland could imply that the brand has not yet achieved top 30 status elsewhere. This could be seen as a potential area for growth or as a challenge in expanding their market presence. The steady performance in Maryland might serve as a model for strategic improvements in other regions. Understanding the factors contributing to their success in Maryland could be key to replicating it in other markets, though further data would be required to draw more comprehensive conclusions.

Competitive Landscape

In the Maryland Pre-Roll category, Happy J's has experienced notable fluctuations in its competitive positioning from October 2025 to January 2026. Initially ranked 16th in October, Happy J's improved to 13th place in November and December, before slightly dropping to 14th in January. This movement reflects a dynamic market environment where competitors like Garcia Hand Picked and Modern Flower have also shown varying performances, with Garcia Hand Picked consistently maintaining a position around 14th and Modern Flower improving from 18th to 16th. Notably, District Cannabis saw a decline from 8th to 13th, indicating potential shifts in consumer preferences or strategic changes. Meanwhile, Grass made a significant leap from being unranked in October to 15th in January, underscoring the competitive pressures Happy J's faces. These dynamics suggest that while Happy J's has managed to maintain a relatively stable position, the brand must continue to innovate and adapt to sustain and improve its market share amidst aggressive competition.

Notable Products

In January 2026, the top-performing product for Happy J's was Deadband 12 Pre-Roll 2-Pack (1g) in the Pre-Roll category, maintaining its number one rank from December 2025 with sales of 3541 units. Rainbow Push Pop 4 Pre-Roll 2-Pack (1g) was the second best-seller, although it dropped from first place in November 2025 to third in December, before climbing back to second place in January. The Rainbow Push Pop 4 Pre-Roll 7-Pack (3.5g) improved its position from fifth place in December to third in January. Gumi #6 Pre-Roll 2-Pack (1g) entered the rankings in January, securing fourth place. Ice Cream Cake Pre-Roll 2-Pack (1g) appeared in the rankings for the first time, taking the fifth spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.