Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

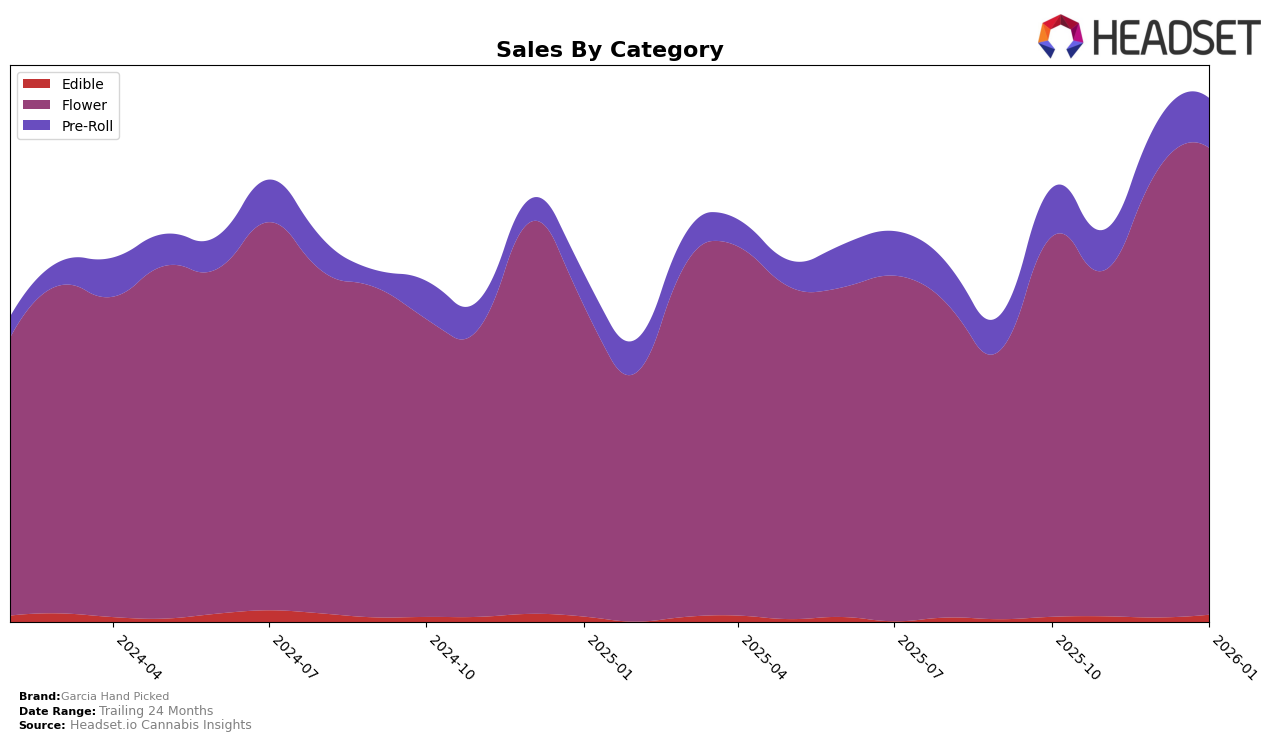

In the Massachusetts market, Garcia Hand Picked has shown a consistent performance in the Flower category, maintaining a steady position within the top 30 brands. The brand fluctuated between the 22nd and 27th ranks over the months from October 2025 to January 2026, with sales peaking in January 2026. However, in the Pre-Roll category, the brand's presence was less stable, with a notable absence in the top 30 in November 2025, indicating a potential area of concern or opportunity for growth. Despite this inconsistency, the brand managed to return to the rankings by December 2025, suggesting a recovery in market presence.

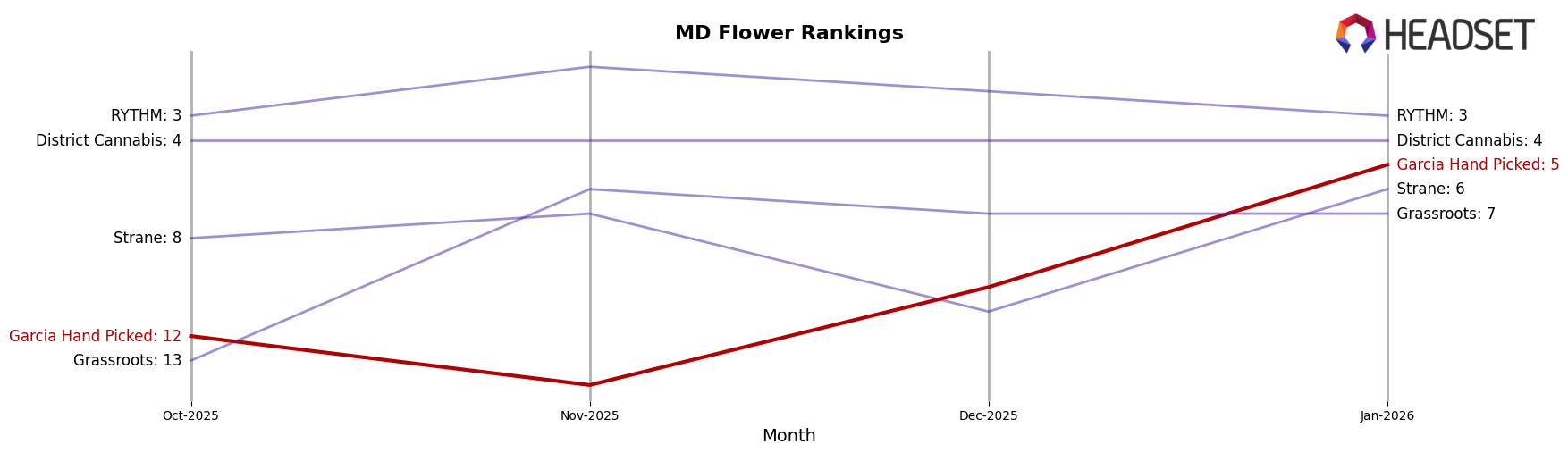

In Maryland, Garcia Hand Picked has demonstrated a strong performance, particularly in the Flower category. The brand improved its ranking significantly, climbing from 12th in October 2025 to an impressive 5th by January 2026, reflecting a positive trajectory in market share. The Edible category also saw consistent rankings, maintaining a position around the mid-20s, with a slight increase in sales in January 2026. Meanwhile, in the Michigan market, the Flower category showed some volatility, with rankings fluctuating between 61st and 38th, indicating a competitive landscape and potential challenges in maintaining a stable market position.

Competitive Landscape

In the Maryland flower category, Garcia Hand Picked has shown a notable upward trajectory in its rankings over the last few months, moving from 12th place in October 2025 to a commendable 5th place by January 2026. This improvement in rank suggests a positive reception and growing consumer preference, despite facing stiff competition. Notably, RYTHM consistently maintained a top position, fluctuating between 1st and 3rd place, indicating a strong market presence. Meanwhile, Strane and Grassroots also demonstrated competitive performances, with Grassroots achieving a peak rank of 6th in November 2025. Garcia Hand Picked's sales have shown a promising increase, particularly in January 2026, where it surpassed Strane in sales, indicating a potential shift in consumer loyalty. The consistent rank of District Cannabis at 4th place highlights the competitive landscape, where Garcia Hand Picked is emerging as a formidable contender.

Notable Products

In January 2026, the top-performing product from Garcia Hand Picked was LA Baker (3.5g) in the Flower category, maintaining its leading position from December 2025 with a sales figure of $13,709. Florida Kush (3.5g), also in the Flower category, closely followed in second place, holding steady from its December 2025 ranking. Finger Lime Haze Pre-Roll 2-Pack (1g) made a notable climb to third place from its previous fifth position in December 2025. Finger Lime Haze (3.5g) and Kush Fumez (3.5g) entered the rankings at fourth and fifth places respectively, showing emerging popularity. This shift indicates a dynamic change in consumer preferences towards a wider variety of products within the brand's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.