Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

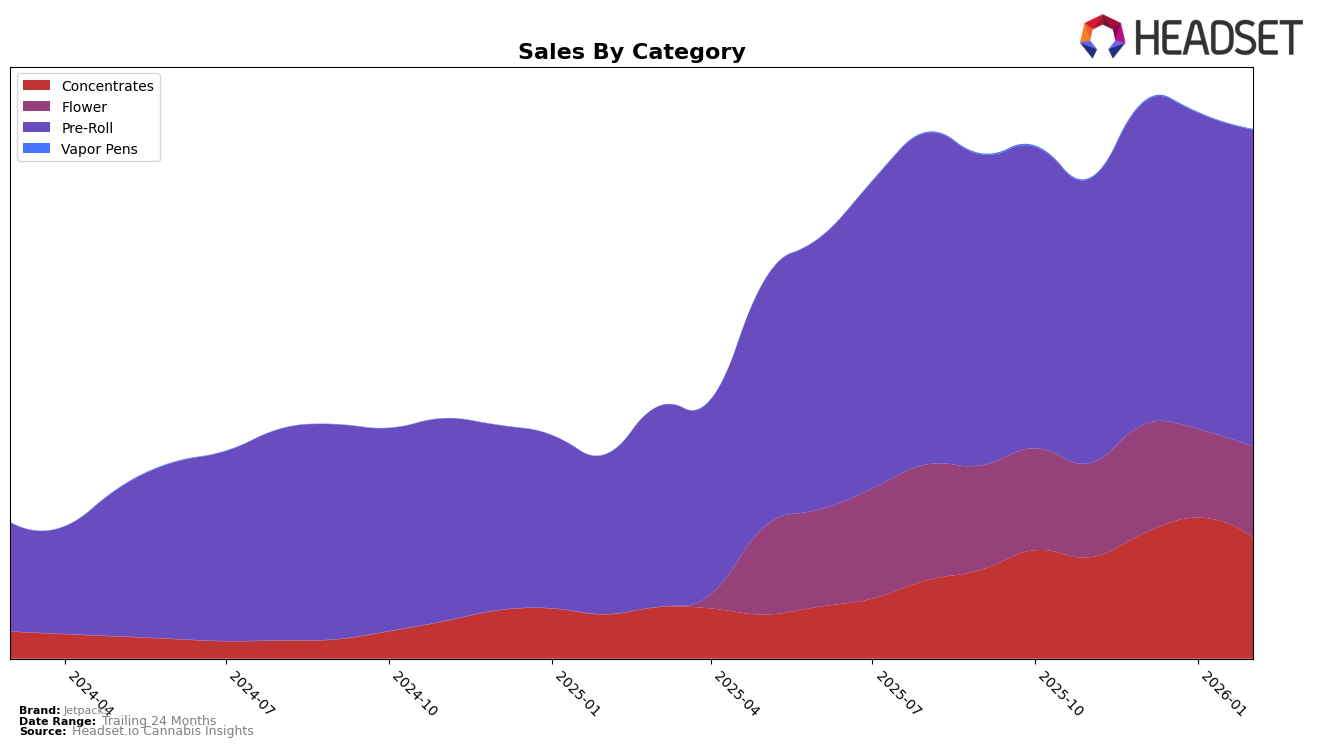

Jetpacks has shown a consistent performance in the New York market, particularly in the Concentrates and Pre-Roll categories. For four consecutive months, Jetpacks maintained a strong hold on the second rank in both categories, indicating a stable consumer preference and solid market presence. The sales figures for Concentrates experienced an upward trend from November 2025 to January 2026, peaking at $738,314 in January before a slight decline in February. This pattern suggests that while Jetpacks has a loyal customer base, there are fluctuations likely due to market dynamics or seasonal changes. Meanwhile, the Pre-Roll category remained robust, with sales consistently surpassing $1.6 million, reflecting a steady demand for Jetpacks' offerings in this segment.

In contrast, Jetpacks' performance in the Flower category in New York has been less consistent. The brand ranked 23rd in November and December 2025 but experienced a drop to 31st in January 2026, before slightly recovering to 30th in February. This indicates challenges in maintaining competitiveness within this category, possibly due to a saturated market or stronger competition. The sales figures also reflect this inconsistency, with a notable dip in January 2026. This fluctuation could point to potential areas for strategic improvement or innovation for Jetpacks to enhance its standing in the Flower category.

Competitive Landscape

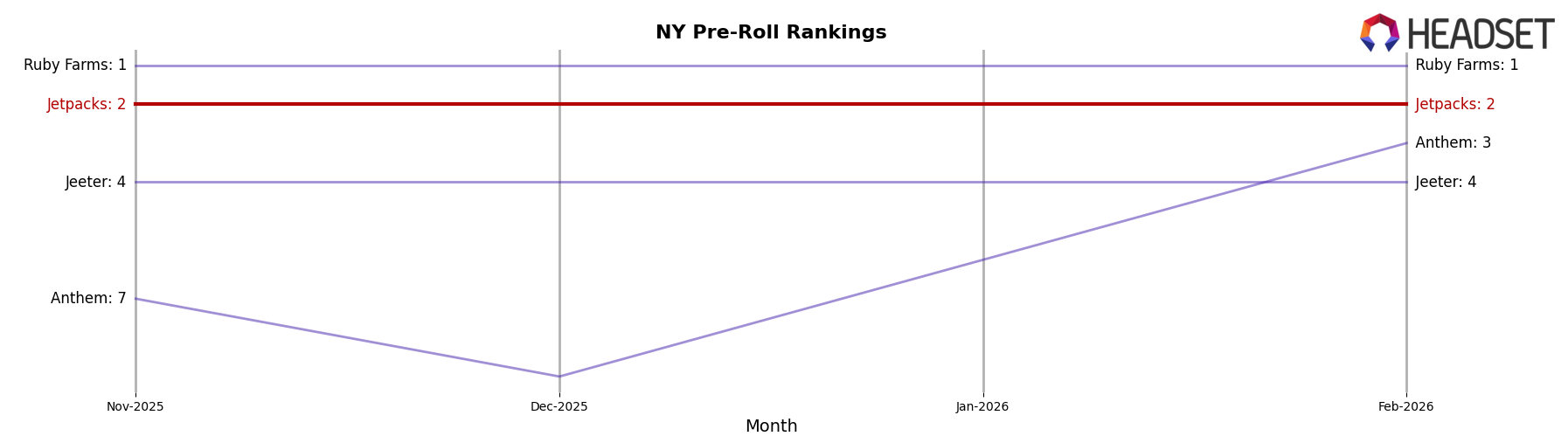

In the competitive landscape of the pre-roll category in New York, Jetpacks has consistently maintained its position as the second-ranked brand from November 2025 through February 2026. Despite its stable rank, Jetpacks faces stiff competition from Ruby Farms, which has dominated the top spot throughout the same period, boasting significantly higher sales figures. Meanwhile, Jeeter holds steady at fourth place, indicating a consistent yet lower market presence compared to Jetpacks. Notably, Anthem has shown remarkable growth, climbing from ninth in December 2025 to third by February 2026, which could pose a future threat to Jetpacks' position if this upward trend continues. This competitive dynamic highlights the importance for Jetpacks to innovate and differentiate to maintain its rank and potentially close the sales gap with the leading brand.

Notable Products

For February 2026, Jetpacks' top-performing product was the Big Bang- Chernobyl Resin Infused Pre-Roll 5-Pack, maintaining its position at rank 1. The FJ-3 - Cereal Milk Kief Infused Pre-Roll 5-Pack rose to rank 2, showing a significant improvement from its rank 4 in January. Tangieberto Badder, a concentrate, entered the rankings at position 3 for the first time. Chernobyl Big Bang Mini Infused Pre-Roll moved up to rank 4 from rank 5 in January. The Big Bang - Empire OG Mini Encrusted Diamond Live Resin Infused Pre-Roll dropped to rank 5, despite previously holding the 3rd position in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.