Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

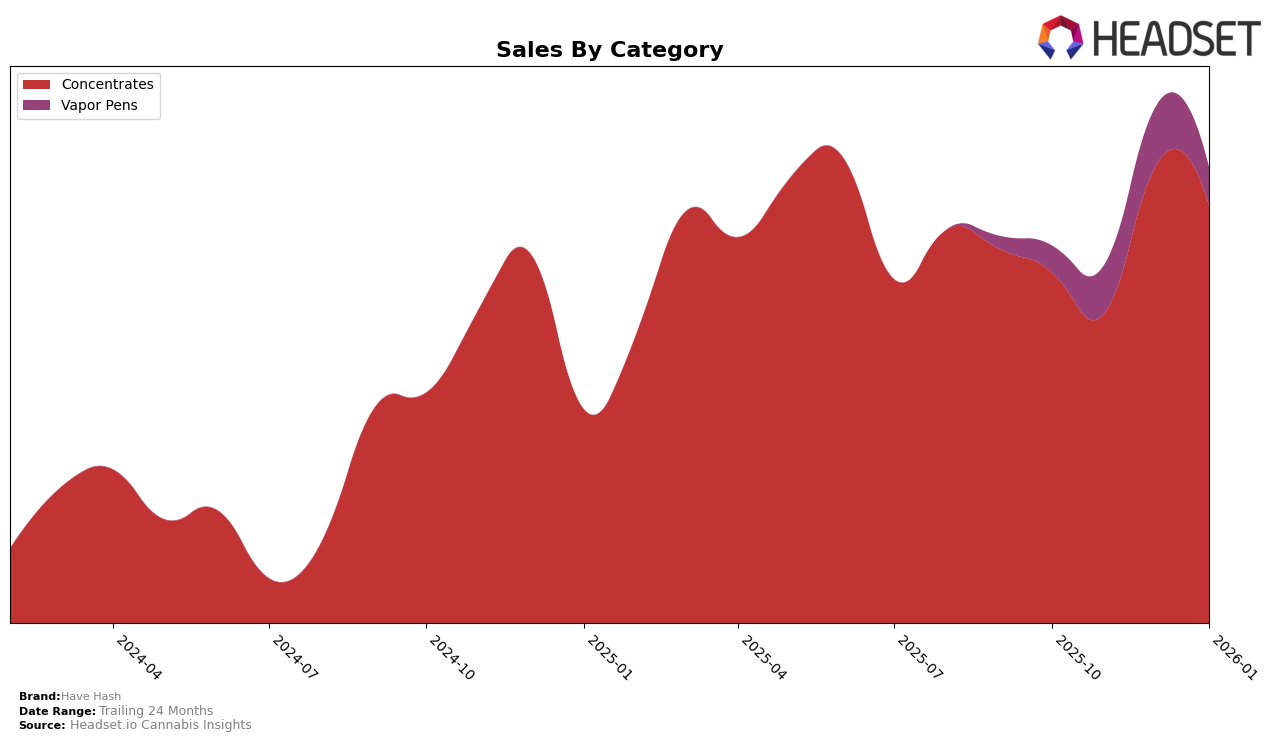

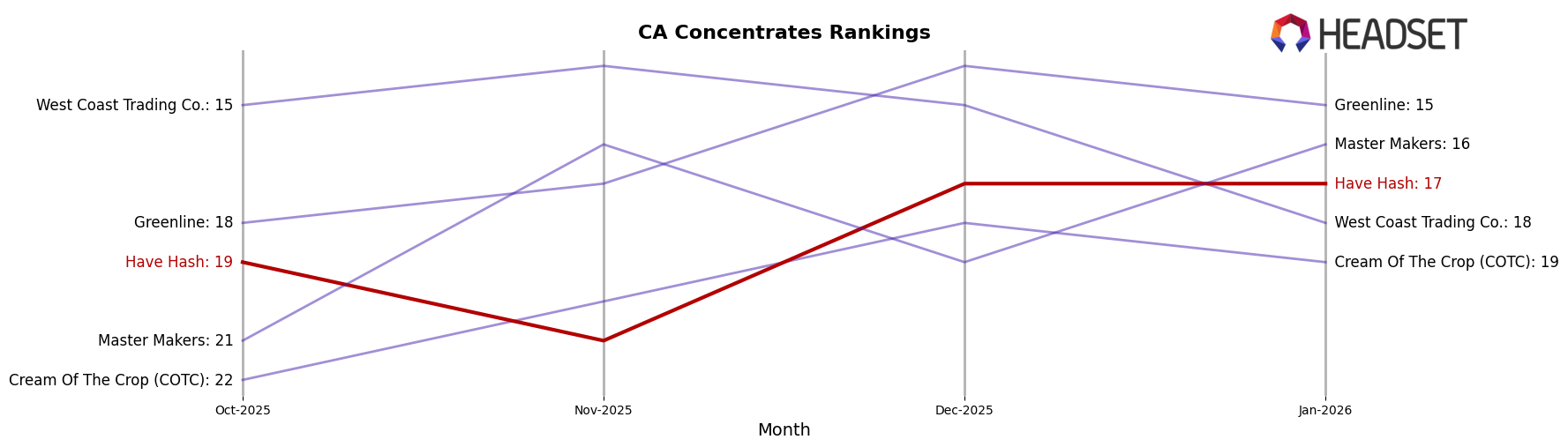

Have Hash has demonstrated notable consistency and improvement in the Concentrates category within the California market. Starting from a rank of 19 in October 2025, the brand experienced a slight dip to 21 in November, but quickly rebounded to 17 by December, maintaining this position into January 2026. This upward movement is particularly significant given the competitive nature of the California market, indicating a strengthening brand presence and possibly an effective strategy in product offerings or marketing. The sales figures support this trend, with a notable increase from November to December, suggesting a successful holiday season push or product launch.

However, it's important to note that Have Hash's performance across other states or provinces is not detailed in the top 30 rankings, which might indicate either a strategic focus on California or challenges in expanding their footprint in other regions. The absence of rankings in other states can be interpreted as a limitation in market penetration or perhaps a deliberate choice to concentrate efforts where they are most effective. This could be a potential area for growth or improvement, depending on the brand's long-term strategy. Understanding the dynamics in other markets could provide valuable insights into how Have Hash can replicate its California success elsewhere.

Competitive Landscape

In the competitive landscape of California's concentrates market, Have Hash has experienced fluctuations in its ranking over the past few months, reflecting a dynamic and competitive environment. In October 2025, Have Hash was ranked 19th, but it slipped to 21st in November before climbing back to 17th in December and maintaining that position in January 2026. This indicates a recovery in sales momentum, particularly in December, where sales saw a significant uptick. Competitors like Greenline and West Coast Trading Co. have consistently stayed ahead, with Greenline improving its rank from 18th to 15th and West Coast Trading Co. maintaining a strong presence despite a slight dip in January. Meanwhile, Master Makers showed a notable rise from 21st to 16th, suggesting a strong competitive push. These movements highlight the importance for Have Hash to innovate and possibly expand its market strategies to improve its standing amidst aggressive competitors like Cream Of The Crop (COTC), which also showed a positive trend, moving from 22nd to 19th over the same period.

Notable Products

In January 2026, the top-performing product for Have Hash was Dragon Fruit Cold Cure Live Rosin (2g) in the Concentrates category, securing the number one rank with sales of 521 units. This was followed by Red Lemons Live Rosin (1g) and Banana Shack Live Rosin (1g), ranked second and third respectively. Forbidden Honey Cold Cure Live Rosin (1g) and its 2g variant took the fourth and fifth spots. Notably, all these products were not ranked in the previous months, indicating a significant change in consumer preferences or marketing strategies. The sudden high performance suggests a successful launch or promotion campaign in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.