Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

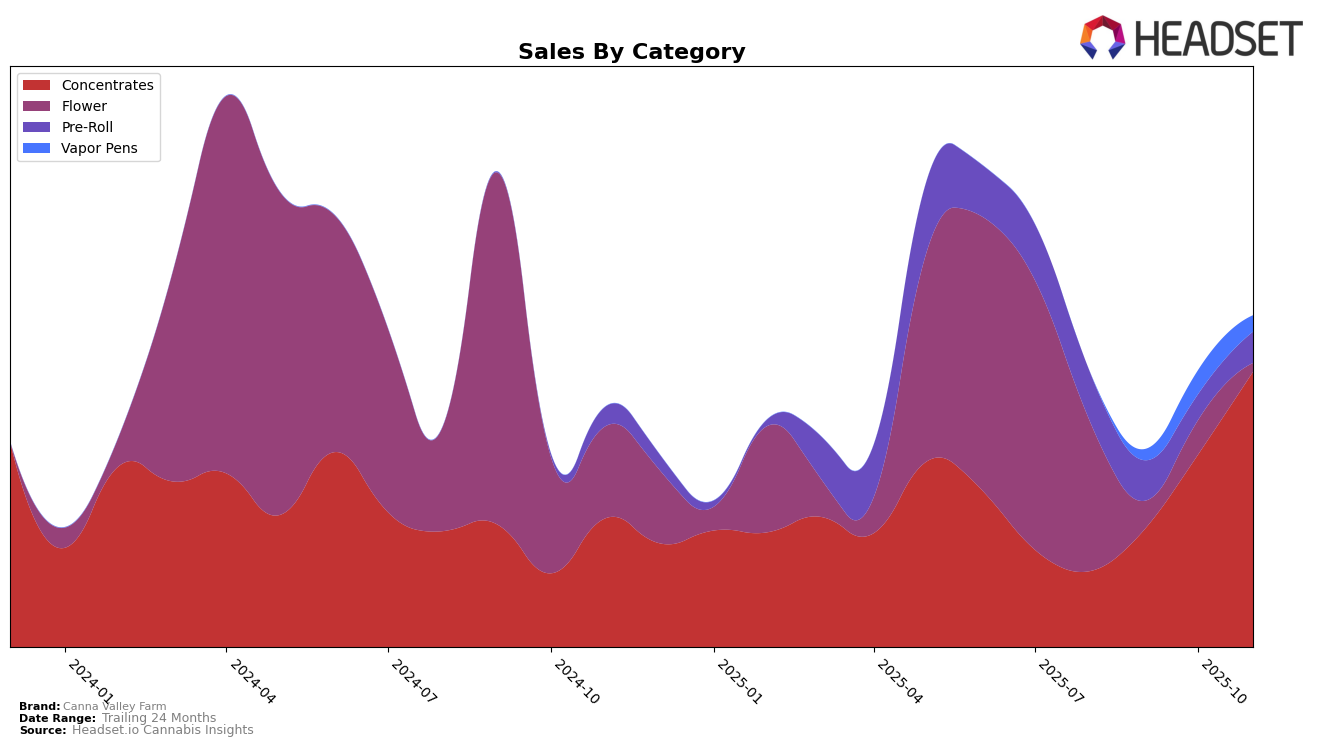

Canna Valley Farm has shown a remarkable upward trajectory in the Concentrates category in California. Starting from a rank of 66 in August 2025, the brand made significant strides to break into the top 30 by November 2025, achieving a rank of 28. This progression indicates a strong performance and increasing market presence in a competitive category. The steady climb in rankings is matched by a notable increase in sales, demonstrating effective market penetration and growing consumer preference for their products. The rapid climb from 66 to 28 over just four months suggests that Canna Valley Farm is successfully leveraging market trends and consumer demand to enhance its market position.

However, outside of California, Canna Valley Farm's presence in the Concentrates category does not appear in the top 30 rankings, indicating that their influence is more concentrated within this state. This absence in other states could be seen as a potential area for growth or a strategic focus on strengthening their base in California. It is important for the brand to consider expanding its reach to other states to diversify its market base and mitigate any risks associated with being heavily reliant on a single market. The current trend in California could serve as a blueprint for replicating success in other regions, should they choose to expand.

Competitive Landscape

In the competitive landscape of concentrates in California, Canna Valley Farm has shown a significant upward trajectory in its rankings over the past few months. Starting from a rank of 66 in August 2025, it climbed to 28 by November 2025, indicating a strong growth in market presence. This improvement is particularly notable when compared to brands like Have Hash, which fell out of the top 20 by November, and Community Cannabis, which also dropped to 30. Meanwhile, Pistil Whip and Sluggers Hit have maintained relatively stable positions, though they did not exhibit the same upward momentum as Canna Valley Farm. This positive shift for Canna Valley Farm suggests a growing consumer preference and increased sales, positioning it as a rising contender in the concentrates category.

Notable Products

In November 2025, Canna Valley Farm's top-performing product was Super Cherries Sugar Wax (1g), maintaining its first-place position from October with a notable sales figure of 1924 units. Amaretto Mintz Sugar Wax (1g) climbed from fifth to second place, demonstrating a significant increase in popularity. Fatso Sugar Wax (1g) dropped one rank, moving from second to third place. MK Ultra Sugar Wax (1g) held steady in fourth place, showing consistent performance over the past two months. Mimosa Sugar Wax (1g) re-entered the rankings in fifth place, indicating a resurgence in demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.