Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

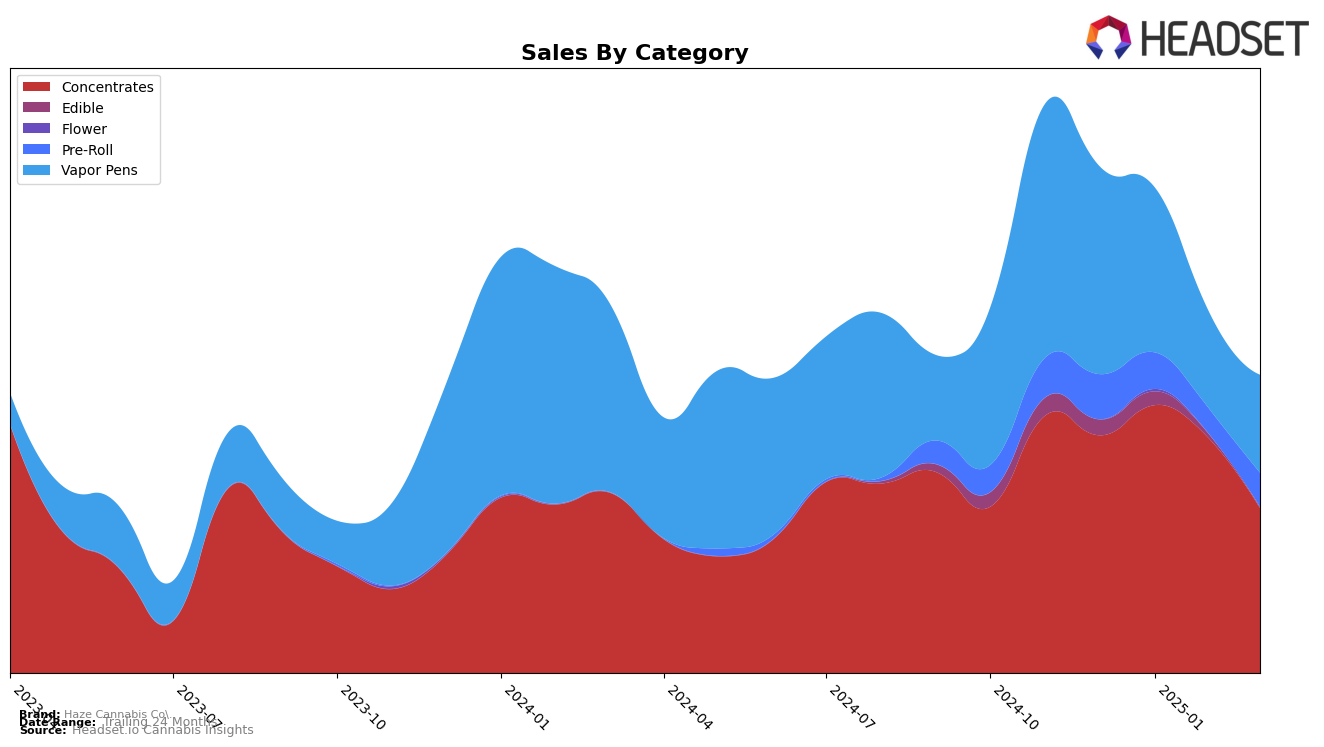

Haze Cannabis Co. has demonstrated varied performance across different states and product categories. In New Jersey, the brand has shown a steady presence in the Concentrates category, maintaining a ranking within the top 20, although it saw a decline from 13th in December 2024 to 16th by March 2025. The Pre-Roll category in New Jersey, however, tells a different story, where Haze Cannabis Co. did not rank in the top 30 for several months, only appearing at 47th in January 2025. This indicates a potential area for growth or a need for strategic adjustments to gain a stronger foothold. Meanwhile, their performance in the Vapor Pens category has remained relatively stable, though outside the top 30, hinting at a consistent but modest presence.

In Nevada, Haze Cannabis Co. has shown a strong and consistent performance in the Concentrates category, climbing to 3rd in February 2025 before slightly dropping to 4th in March. This suggests a solid market position and potential leadership in this category. The Pre-Roll category in Nevada saw some fluctuations, with rankings moving from 40th to 44th over the four-month span, reflecting potential volatility or competitive pressure. In the Vapor Pens category, the brand improved its position from 32nd in December 2024 to 27th in February 2025, before settling at 34th in March, indicating a generally positive trend despite some recent challenges. Meanwhile, in Ohio, Haze Cannabis Co. saw its Vapor Pens ranking drop out of the top 30 in February 2025, highlighting a significant opportunity for improvement in this market.

Competitive Landscape

In the competitive landscape of the Nevada concentrates market, Haze Cannabis Co. has demonstrated notable resilience and adaptability. From December 2024 to March 2025, Haze Cannabis Co. maintained a strong presence, peaking at the 3rd rank in February 2025 before slightly dropping to 4th in March. This fluctuation in rank highlights the dynamic nature of the market and the competitive pressure from brands like City Trees, which consistently held a top position, moving from 8th in December 2024 to 3rd by March 2025. Despite these shifts, Haze Cannabis Co.'s sales trajectory showed a promising increase until February, indicating robust consumer demand and effective market strategies. However, the slight dip in March sales suggests potential areas for strategic adjustments to regain momentum. Meanwhile, Alternative Medicine Association / AMA maintained a steady 2nd rank throughout, underscoring the competitive challenge Haze faces in climbing higher in the rankings.

Notable Products

In March 2025, the top-performing product for Haze Cannabis Co. was the Hybrid Full Spectrum Cartridge (0.5g) in the Vapor Pens category, maintaining its number one rank from previous months with sales of 1,337 units. The Donny Burger Live Resin Badder (1g) in the Concentrates category secured the second position, showing improved sales from its debut at the top rank in February. The Iced Runtz #17 Cured Resin Badder (1g), also in Concentrates, held steady in third place since its introduction. Fresh Squeezed Sugar Wax (0.5g) and Zoap Live Resin Badder (1g) entered the rankings at fourth and fifth positions, respectively, indicating a growing interest in these new offerings. Notably, the Concentrates category has shown dynamic changes with new products emerging in the top five positions.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.