Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

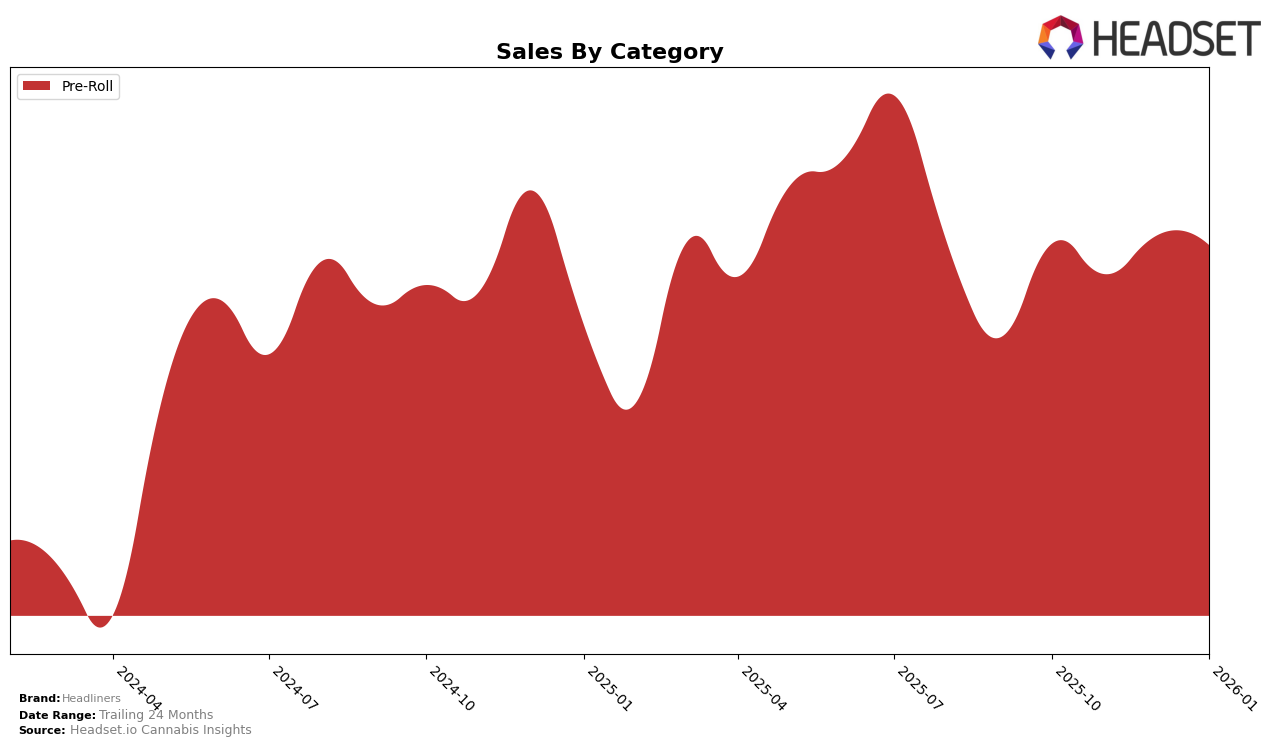

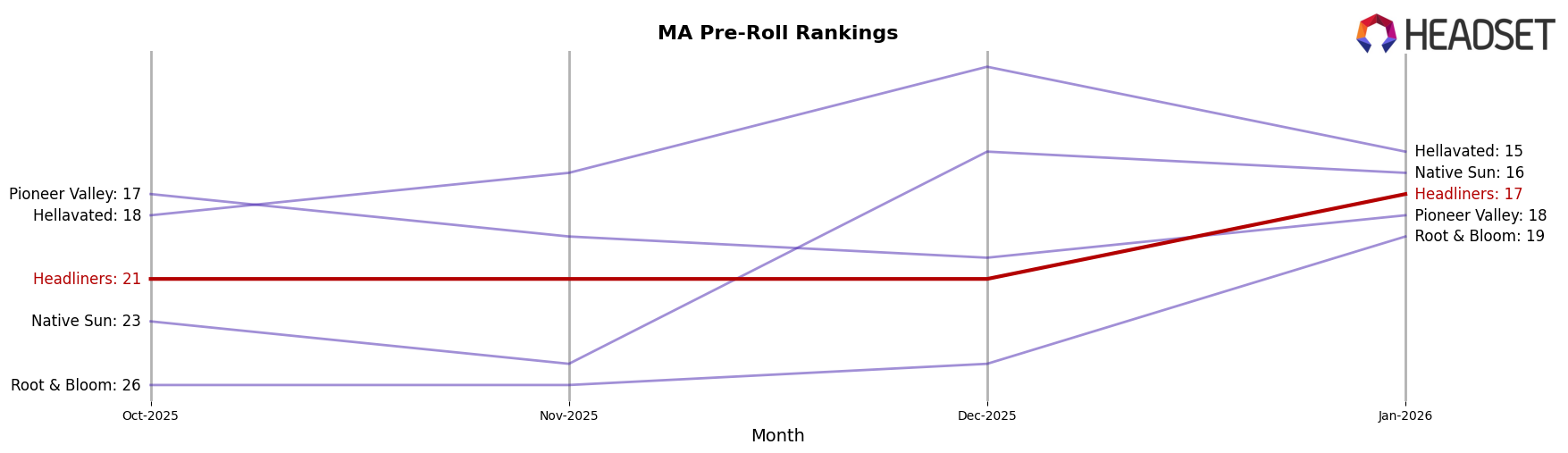

Headliners has demonstrated notable performance in the Pre-Roll category within the state of Massachusetts. Over the span from October 2025 to January 2026, the brand maintained a consistent presence in the top 30, starting at the 21st position and moving up to 17th by January. This upward movement indicates a strengthening market position and suggests effective strategies in capturing consumer interest in this category. While the sales figures fluctuated slightly, the overall trend remained stable, reflecting resilience in a competitive market.

In other states and categories, Headliners' performance was less visible, as they did not make it into the top 30 rankings. This absence could either signal challenges in penetrating other markets or a strategic focus on specific regions like Massachusetts. Without a presence in these rankings, it suggests that Headliners might need to reassess their approach or expand their efforts to achieve broader recognition and success across more states and categories. Such insights offer a glimpse into the brand's strategic positioning and potential areas for growth.

Competitive Landscape

In the competitive landscape of the Massachusetts pre-roll category, Headliners has shown a notable improvement in its rank from October 2025 to January 2026, climbing from 21st to 17th position. This upward trend indicates a positive reception and growing market presence. In comparison, Hellavated experienced fluctuations, peaking at 11th place in December 2025 before dropping to 15th in January 2026. Meanwhile, Pioneer Valley consistently remained in the lower ranks, ending at 18th in January 2026. Native Sun made a significant leap to 15th place in December 2025 but fell slightly to 16th in January 2026. Root & Bloom showed a steady rise, reaching 19th place by January 2026. These dynamics suggest that while Headliners is gaining traction, it faces stiff competition from brands like Native Sun and Hellavated, which have shown the ability to climb the ranks rapidly.

Notable Products

In January 2026, the top-performing product for Headliners was the Alaskan Unicorn Pre-Roll (1g), which maintained its leading position from December 2025, with sales reaching 3,113 units. The Cranberry Z Pre-Roll (1g) emerged as the second best-selling product, making a strong debut in the rankings. Rainbow Guava Pre-Roll (1g) secured the third spot, experiencing a slight drop from its previous second position in October 2025. Melted Strawberries Pre-Roll 2-Pack (1g) entered the rankings at fourth place, showing promising sales figures. Pura Vida Pre-Roll (1g) held steady at fifth place, consistent with its performance from November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.