Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

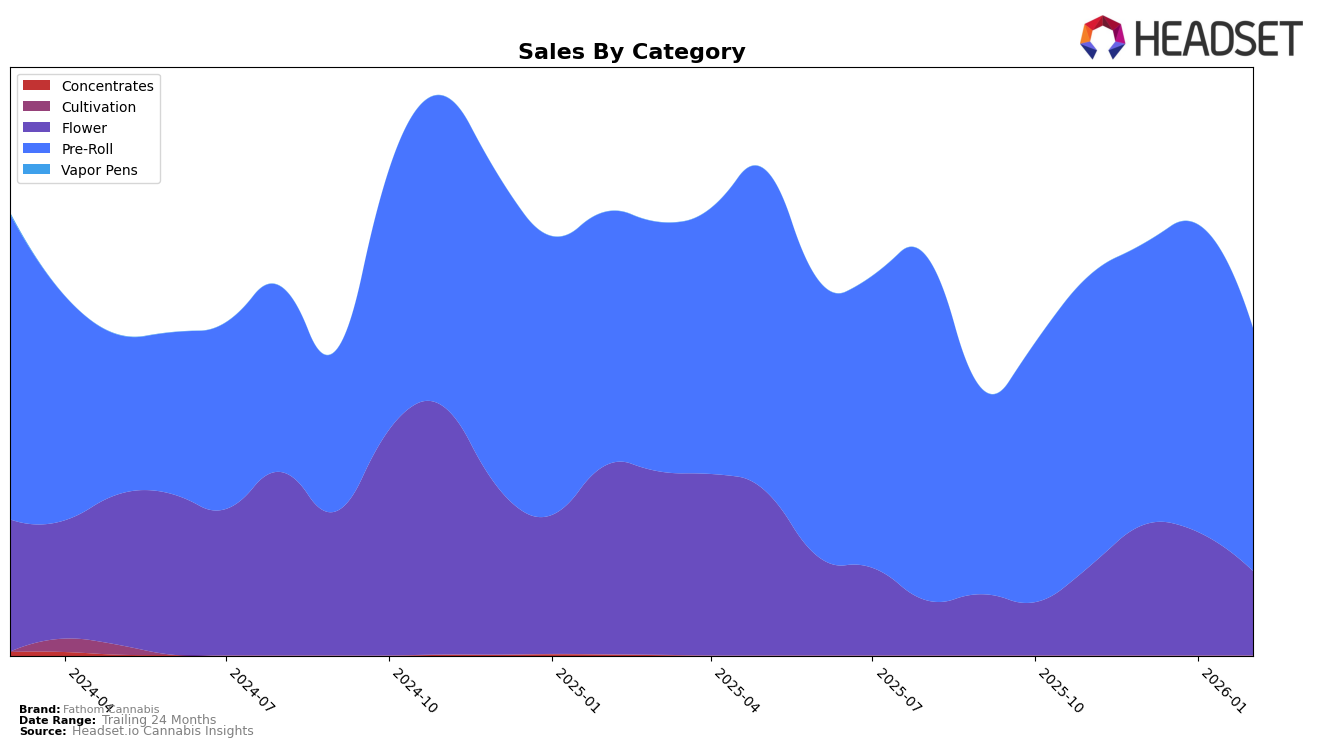

Fathom Cannabis has shown varied performance across different product categories and states. In the Massachusetts market, the brand's presence in the Flower category has been relatively stable but not particularly strong, with rankings fluctuating in the lower tier beyond the top 80. Despite a peak in sales in December 2025, Fathom Cannabis did not manage to break into the top 30 rankings, indicating a competitive landscape in this category. This suggests that while there was a temporary boost in sales, it was not enough to significantly elevate their standing in the Flower category.

Conversely, Fathom Cannabis has demonstrated a more robust performance in the Pre-Roll category within Massachusetts. The brand consistently maintained a position within the top 30, with a notable improvement in January 2026 where it reached the 20th spot. This indicates a stronger foothold and consumer preference in the Pre-Roll category compared to Flower. Despite a dip in February 2026, the brand's ability to stay within the top rankings suggests a solid presence and potential for growth in this segment. The contrast between the two categories highlights the importance of strategic focus and market dynamics in shaping brand performance.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Massachusetts, Fathom Cannabis experienced fluctuating rankings from November 2025 to February 2026, indicating a dynamic market position. Starting at rank 23 in November 2025, Fathom Cannabis saw a dip to rank 26 in December before climbing to rank 20 in January 2026, only to fall back to rank 24 in February. This volatility contrasts with competitors such as Miss Grass, which consistently maintained a presence in the top 20 until January 2026, and Farmer's Cut, which started strong at rank 13 but dropped out of the top 20 by January. Meanwhile, INSA and Root & Bloom showed more stable rankings, with Root & Bloom improving its position to rank 22 by February. These shifts suggest that while Fathom Cannabis has the potential to climb the ranks, it faces stiff competition and must strategize to maintain and improve its market share amidst these dynamic competitors.

Notable Products

In February 2026, the top-performing product from Fathom Cannabis was Shoki Pre-Roll (1g), maintaining its leading position from the previous two months, with sales reaching 6302. Ghost OG Pre-Roll (1g) retained its second-place ranking from January 2026, although its sales decreased from the prior month. Glitterbomb Pre-Roll (1g) improved to third place from fifth in January, indicating a positive upward trend in its ranking. Cap Junky Pre-Roll (1g) made its debut in the rankings at fourth place, showing promising sales figures. Papaya Runtz Pre-Roll (1g) re-entered the rankings at fifth place, after being absent in January, showing a consistent performance compared to December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.