Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

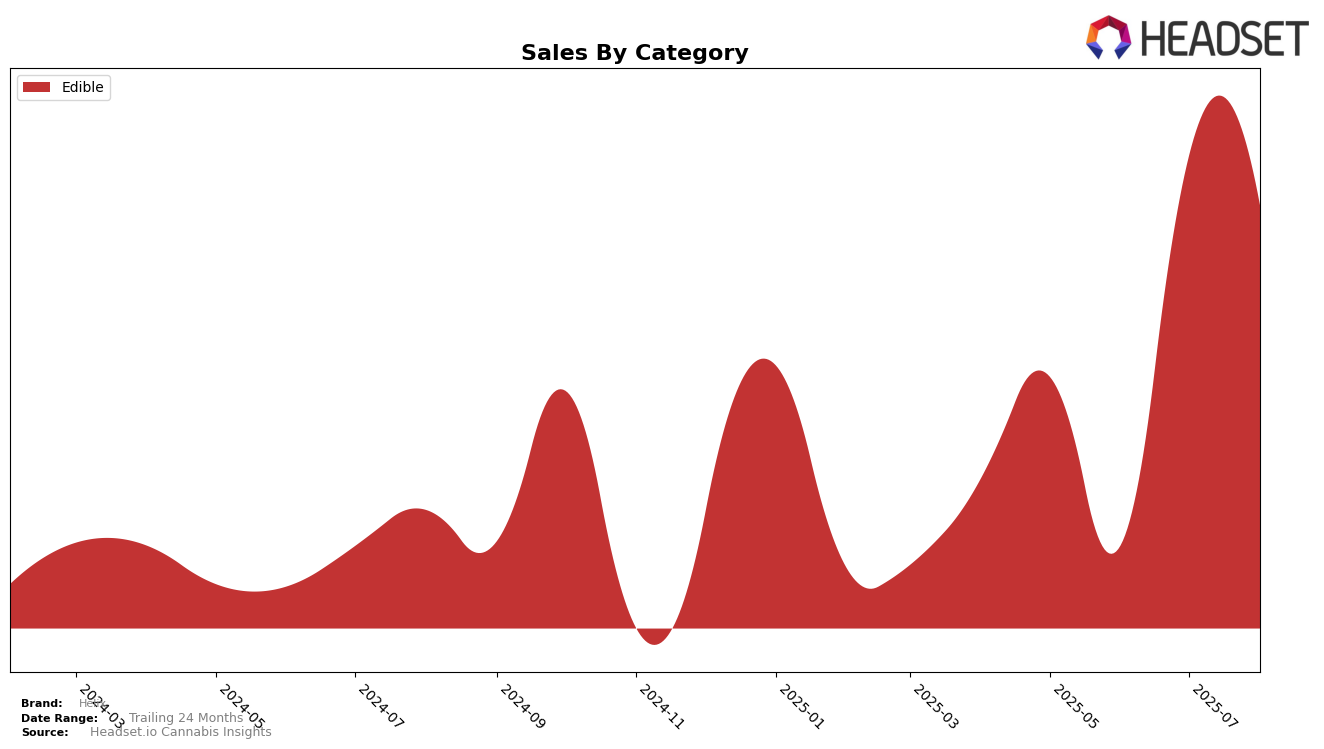

Helix has shown a noteworthy performance in the Nevada market, particularly within the Edible category. In May and June 2025, Helix was not ranked within the top 30 brands, indicating potential challenges in gaining traction or visibility during those months. However, by July, Helix emerged at the 31st position and further improved to the 30th spot by August. This upward trend suggests a positive momentum and a growing acceptance or popularity of Helix's edible products in Nevada, despite the competitive landscape. Such a progression highlights the brand's potential to climb further in the rankings if the trend continues.

The sales figures for Helix in Nevada's Edible category reveal an interesting dynamic over the summer months. Although specific sales numbers are not detailed for May and June, the available data shows a decline from July to August, with sales decreasing from $12,328 to $11,028. This decline in sales, despite an improvement in ranking, may suggest strategic adjustments or changes in consumer preferences that Helix might need to address. The ability to maintain or enhance their ranking while experiencing a drop in sales could imply effective brand positioning or marketing strategies that are yet to translate into higher sales volumes.

Competitive Landscape

In the Nevada edible market, Helix has experienced a fluctuating presence, with its rank absent from the top 20 until it emerged at 31st in July 2025 and improved slightly to 30th by August 2025. This suggests a gradual upward trend, albeit from a lower starting point compared to competitors. For instance, Gron / Grön consistently maintained a strong position at 6th place in May and June 2025, indicating a significant lead in market presence. Meanwhile, Cheeba Chews saw a decline, dropping out of the top 20 by August 2025, which may present an opportunity for Helix to capture some of its market share. Additionally, Hippies showed a consistent improvement, moving from 29th in May to 26th by August, which could indicate a competitive threat if Helix does not continue its upward trajectory. Overall, Helix's recent ranking improvements suggest potential for growth, but it faces stiff competition from established brands in the Nevada edible market.

Notable Products

In August 2025, the top-performing product for Helix was the Sour Blue Raspberry Gummy 10-Pack (100mg), reclaiming its number one position with impressive sales of 1324 units. The Blood Orange Gummies 10-Pack (100mg) followed closely in second place, maintaining a consistent ranking from the previous month, though its sales decreased from July. The Sour Cherry Gummies 10-Pack (100mg) held steady at third place, showing a modest increase in sales compared to July. The CBD/THC 1:1 Indica Sour Cherry Gummies 10-Pack (100mg CBD, 100mg THC) dropped to fourth place, reflecting a decline in sales figures. Freestone Peach Gummies 10-Pack (100mg), which entered the rankings in July, fell to fifth place in August with a notable drop in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.