Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

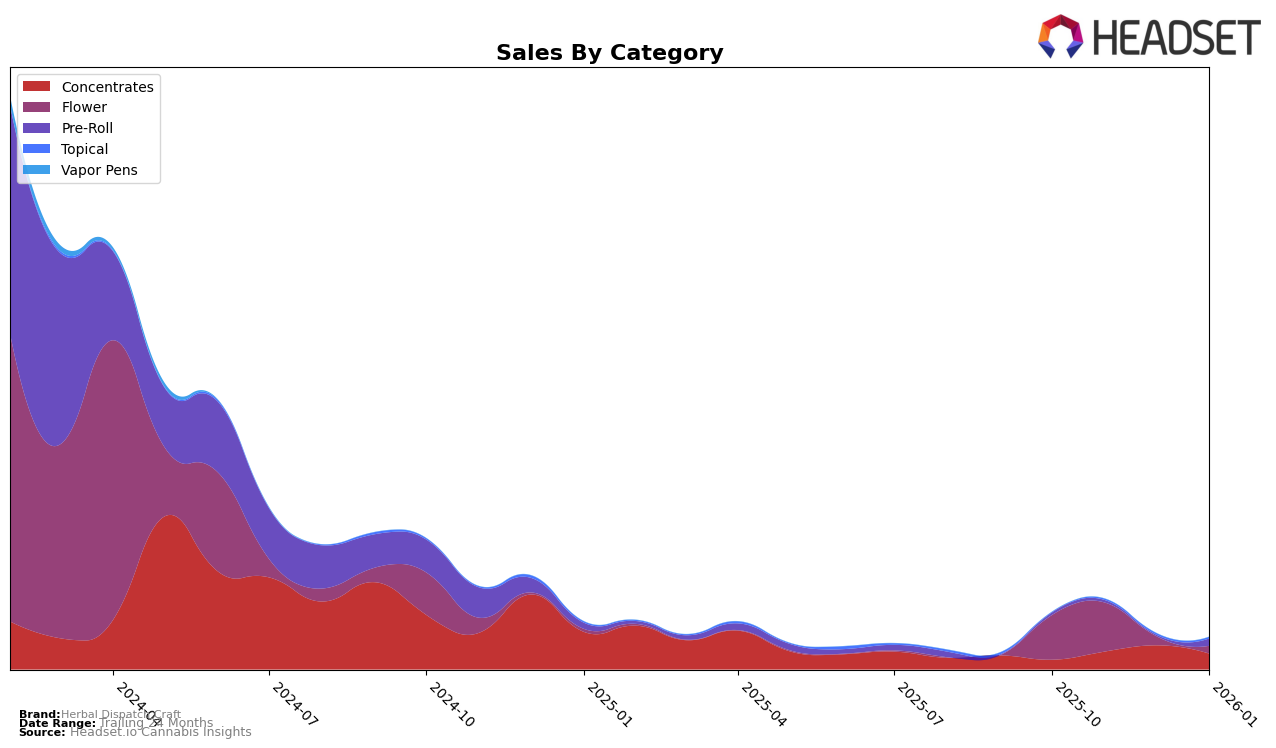

Herbal Dispatch Craft has shown varied performance across different categories and regions, with noticeable trends in British Columbia. In the concentrates category, the brand did not appear in the top 30 rankings from October 2025 to January 2026, indicating a potential area for improvement or increased competition in this segment. This absence from the top ranks might suggest that the brand is facing challenges in gaining traction or visibility in the concentrates market. Conversely, the flower category saw some movement, with Herbal Dispatch Craft ranking 78th in October 2025 and dropping to 97th by November 2025. This decline could point to increased competition or changing consumer preferences, which might require strategic adjustments to regain market position.

Despite some challenges in the rankings, there are positive signals in the sales figures for Herbal Dispatch Craft in British Columbia. The sales of flower products increased from $23,859 in October 2025 to $26,251 in November 2025, suggesting a growing consumer interest or successful promotional efforts during this period. However, the lack of ranking data for December 2025 and January 2026 in both concentrates and flower categories could imply that the brand did not make it into the top 30, potentially highlighting areas for growth and market penetration. Monitoring these trends over the coming months will be crucial for understanding the brand's trajectory and identifying opportunities for improvement or expansion in these categories.

Competitive Landscape

In the competitive landscape of the concentrates category in British Columbia, Herbal Dispatch Craft has shown a notable entry by securing the 38th rank in December 2025. This is a significant achievement considering that they were not in the top 20 in the preceding months. In comparison, Wildcard Extracts showed a downward trend from 16th in October to 28th by December, while All Nations consistently remained outside the top 20. Meanwhile, BLAST entered the rankings at 34th in November, indicating a competitive push. Sizzle also experienced a decline from 21st to 40th over the same period. The fluctuating ranks of these competitors suggest a dynamic market where Herbal Dispatch Craft's entry into the top 40 could position them for further growth, especially as they capitalize on the declining trends of some established brands.

Notable Products

In January 2026, Mac OG Pre-Roll (1g) emerged as the top-performing product for Herbal Dispatch Craft, climbing from third place in December to first, with a notable sales figure of 388 units. Premium Live Hash Rosin RSO (1g) maintained a strong position, ranking second after leading in December. RSO Phoenix Tears Live Hash Rosin (1g) saw a drop, moving from second place in previous months to third in January. Purple Nuken (28g) continued its decline, falling to fourth place after starting as the top product in October. The CBD/THC 1:1 Relief Cream (125mg CBD, 125mg THC, 50ml) remained consistent, holding steady in fifth place across the last three months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.