Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

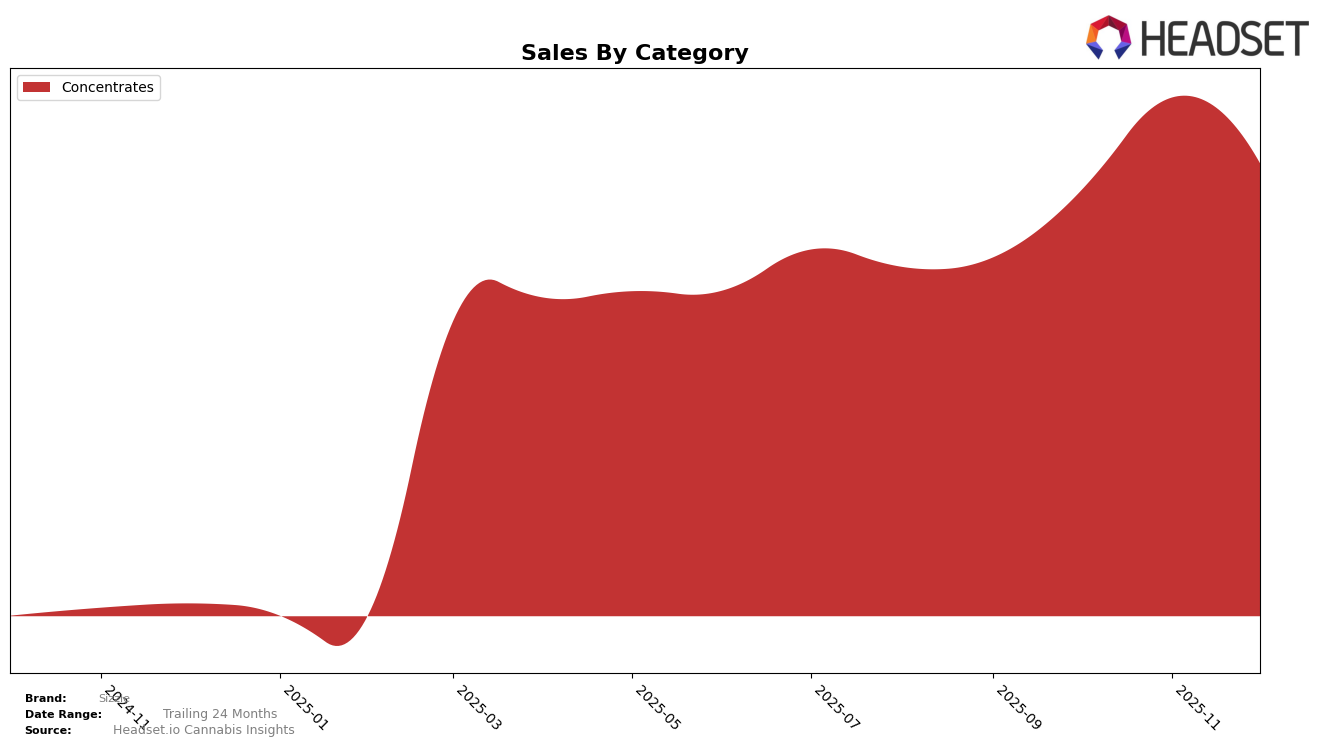

Sizzle's performance in the Concentrates category across various provinces shows a mixed yet intriguing pattern. In Alberta, the brand has maintained a consistent presence, hovering around the 20th and 21st ranks from September to December 2025. This stability suggests a steady consumer base and possibly a loyal following in the province. However, in British Columbia, Sizzle's presence fluctuates more dramatically. The brand made it into the top 30 in October and November but fell to the 38th position by December, indicating potential challenges in maintaining market share or perhaps increased competition.

In Saskatchewan, Sizzle has consistently performed well, maintaining a top 4 position throughout the last four months of 2025. This sustained high ranking could be indicative of a strong brand affinity or effective market strategies tailored to the province's consumers. Interestingly, while Sizzle's sales figures in Saskatchewan show an upward trend, the brand's rank in Alberta remains relatively unchanged despite similar sales growth patterns. This could imply differing competitive landscapes or consumer preferences across these provinces. Such insights might be valuable for stakeholders looking to understand regional market dynamics and Sizzle's strategic positioning.

Competitive Landscape

In the competitive landscape of concentrates in Saskatchewan, Sizzle has maintained a consistent presence, ranking third in September, November, and December 2025, with a slight dip to fourth in October. Despite this minor fluctuation, Sizzle's sales showed resilience, particularly with a notable increase from October to December. However, the brand faces stiff competition from Endgame, which consistently held the top spot, and Herba Farms, which fluctuated between first and second place. Notably, Herba Farms saw a significant sales surge in December, overtaking Endgame for the top rank. Meanwhile, Dom Jackson and Phant showed competitive dynamics, with Dom Jackson improving its rank towards the end of the year. These shifts highlight the dynamic nature of the market, emphasizing the need for Sizzle to innovate and strategize to maintain and improve its standing amidst strong competitors.

Notable Products

In December 2025, Sizzle's top-performing product was Sativa Shatter (1g) in the Concentrates category, reclaiming its number one rank with a notable sales figure of 644 units. Indica Shatter (1g) dropped to second place, showing a decline from its top position in the previous two months. Maple Kush Terp Diamonds (1g) entered the rankings for the first time, securing the third spot. Boosted Orange Flavoured Liquid Diamond Shatter (1g) and Boosted Vanilla Flavoured Liquid Diamond Shatter (1g) followed closely, ranking fourth and fifth, respectively. These new entries highlight a dynamic shift in consumer preferences towards a more diverse range of Concentrates products from Sizzle.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.