Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

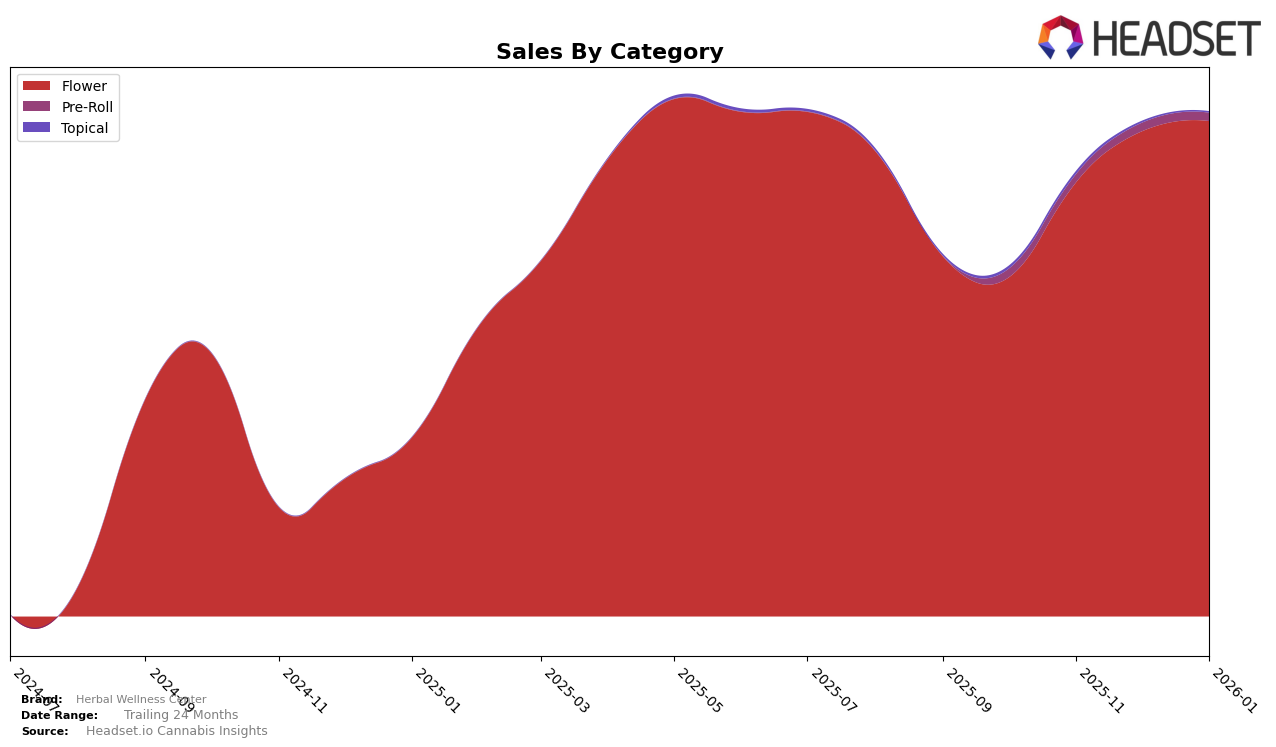

Herbal Wellness Center has shown a consistent performance in the flower category within Ohio. Over the span from October 2025 to January 2026, the brand maintained a steady presence in the top 20 rankings, fluctuating slightly from the 19th to the 17th position. This consistency is indicative of a stable market presence and possibly a loyal customer base in Ohio. Notably, the brand's sales figures have shown a positive trajectory, with sales increasing from October through January, suggesting a growing demand for their products in this particular category.

However, it's important to note that Herbal Wellness Center did not appear in the top 30 brands in any other states or provinces across any categories during this period. This absence could be seen as a limitation in their market reach or a potential area for growth and expansion. The brand's focus on Ohio might be a strategic decision, but diversifying their presence across more states could potentially enhance their market share and visibility. While the flower category in Ohio shows promise, examining the brand's strategy in other regions could provide further insights into their overall performance and growth potential.

Competitive Landscape

In the competitive landscape of the Flower category in Ohio, Herbal Wellness Center has shown a relatively stable performance, maintaining its rank around the 17th to 19th positions from October 2025 to January 2026. This consistency in ranking highlights a steady presence in the market, although it faces stiff competition from brands like Good Green and Appalachian Pharm, which have demonstrated more dynamic movements in rank. Notably, Appalachian Pharm experienced a significant rise in November 2025, reaching the 13th position, which could indicate a strategic push or successful marketing campaign during that period. Meanwhile, Cookies has been climbing steadily, improving its rank from 27th in October 2025 to 16th by January 2026, suggesting a growing market presence that Herbal Wellness Center may need to watch closely. Despite these competitive pressures, Herbal Wellness Center's sales figures have shown a positive trend, particularly in January 2026, where it reached its highest sales within the observed period, indicating effective customer retention or acquisition strategies that could be further leveraged to improve its market position.

Notable Products

In January 2026, the top-performing product for Herbal Wellness Center was YD Soda (14.15g) from the Flower category, maintaining its first-place ranking from the previous two months with sales of 10,021 units. Glitterbomb (2.83g), also in the Flower category, made a strong entry into the rankings at the second position. Kaiju Kush (14.15g) held steady in the third position, though its sales saw a slight decline from December. Ice Cream Cake (2.83g) and Black Soap (2.83g) rounded out the top five, both new entrants to the rankings. Notably, YD Soda has consistently been a top seller since October 2025, showing strong customer preference and loyalty.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.