Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

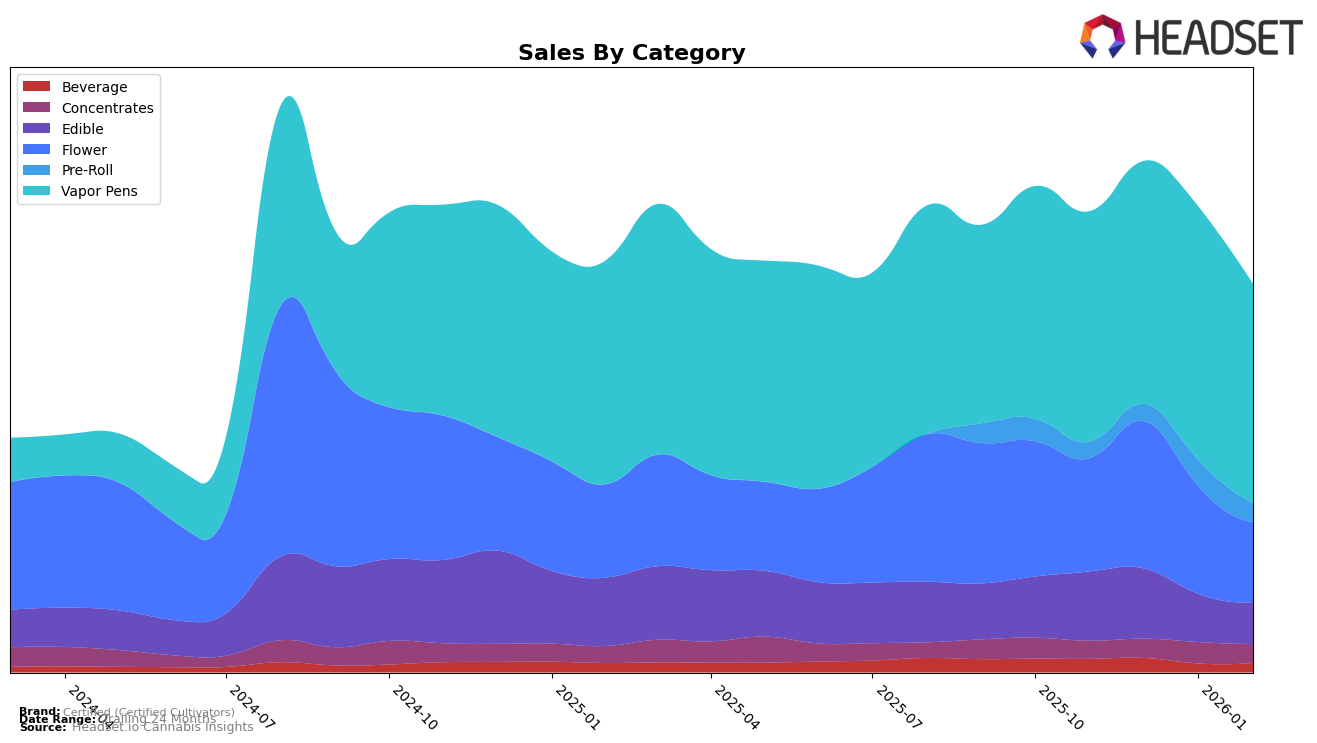

In the state of Ohio, Certified (Certified Cultivators) has demonstrated varying performances across different cannabis categories. Notably, the brand has consistently maintained a stronghold in the Vapor Pens category, securing the number one ranking from November 2025 through February 2026. This consistent top position underscores their dominance and likely indicates a strong consumer preference and loyalty within this product segment. Conversely, their presence in the Beverage category saw a decline, as they were not ranked in the top 30 in January 2026, which could suggest a need for strategic adjustments in that category to regain market traction.

Certified's performance in other categories such as Concentrates and Pre-Rolls shows a mix of stability and volatility. In Concentrates, the brand has remained relatively stable, consistently ranking between fifth and sixth place, which suggests a steady, albeit not leading, market presence. However, the Pre-Roll category saw more fluctuations, with a notable peak in January 2026 when they climbed to the fourth position, only to drop to ninth by February. This indicates potential market competition or shifts in consumer preferences that may affect their long-term positioning. Meanwhile, in the Edible category, a downward trend is observed as the brand slipped from a fourth-place ranking in November 2025 to eighth by February 2026, which may call for a reassessment of their product offerings or marketing strategies in this area.

Competitive Landscape

In the Ohio vapor pens category, Certified (Certified Cultivators) has consistently maintained its position as the top-ranked brand from November 2025 through February 2026. Despite a slight dip in sales in February 2026, Certified remains ahead of its closest competitors, Klutch Cannabis and &Shine, both of which have also shown stable rankings at second and third place, respectively, during the same period. This consistent top ranking underscores Certified's strong market presence and consumer preference in Ohio, suggesting that their brand loyalty and product quality are key differentiators in a competitive market. The steady sales figures for competitors indicate a robust market environment, but Certified's leadership position suggests they are effectively capturing consumer interest and maintaining a competitive edge.

Notable Products

In February 2026, the top-performing product from Certified (Certified Cultivators) was the Glitter Bomb Pre-Roll (1g) in the Pre-Roll category, maintaining its number one rank from January with sales of 3,429. The Glitter Bomb (2.83g) in the Flower category emerged as a strong contender, securing the second position despite not being ranked in the previous months. Miracle Mints (2.83g) saw a slight improvement, climbing from fourth to third place, while Shady Lemon (2.83g) slipped from third to fourth. The CBN/THC 1:2 Acai Sapphires Gummies 10-Pack (110mg THC, 50mg CBN) re-entered the rankings at fifth, demonstrating resilience in the Edible category after being unranked in January. These shifts in rankings highlight a dynamic sales environment for Certified (Certified Cultivators) as consumer preferences continue to evolve.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.