Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

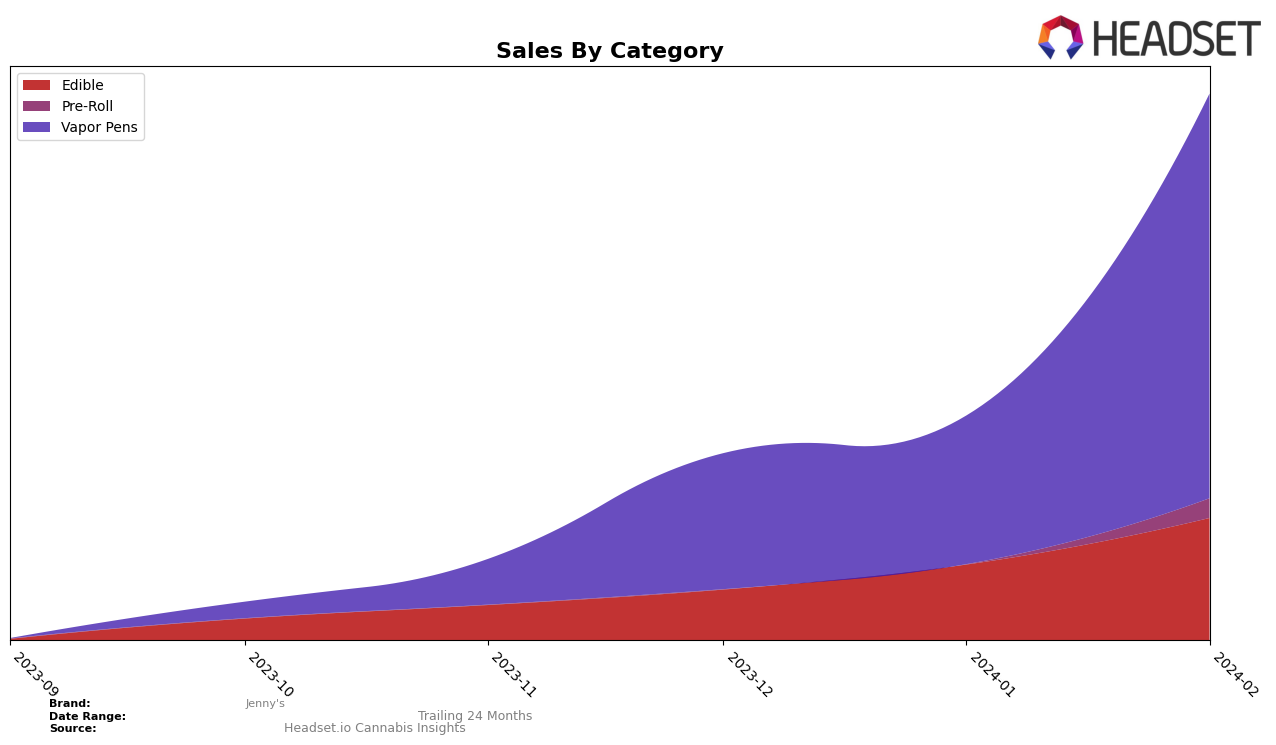

In New York, Jenny's brand has shown a notable presence across several cannabis categories, with varying degrees of success. In the Edible category, the brand demonstrated a consistent upward movement, improving its rank from 43rd in November 2023 to 32nd by February 2024. This positive trend is indicative of growing consumer preference and increased sales, with February 2024 sales more than tripling November 2023's figures. However, in the Pre-Roll category, Jenny's only made its first appearance in the rankings in February 2024 at 79th place. This late entry into the top rankings could suggest a new product launch or a recent push in this category, but its position outside the top 30 indicates there's significant room for growth and improvement.

Conversely, Jenny's performance in the Vapor Pens category within the same state underlines its stronger market position in this segment. Starting at 43rd in November 2023, the brand made a substantial leap to 28th by February 2024, showcasing a robust upward trajectory. The sales in this category saw an impressive increase, with February 2024 sales nearly nine times the November 2023 figure. This remarkable growth not only highlights Jenny's as a significant player in the Vapor Pens market but also suggests a well-received product line by the consumers. Despite these achievements, the absence from the top 30 in the Pre-Roll category for three consecutive months before February 2024 underscores a potential area for strategic focus and growth for Jenny's in New York.

Competitive Landscape

In the competitive landscape of Vapor Pens in New York, Jenny's has shown a notable trajectory in terms of rank and sales, despite starting from a lower position. Initially not ranking in the top 20 in November 2023, Jenny's made a significant leap to 35th in December, and continued to climb to 37th in January 2024, before reaching 28th in February. This upward movement is particularly impressive when considering the performance of its competitors. For instance, dosist (formerly hmbldt) made a remarkable jump from not ranking to 26th place in just two months, indicating a highly volatile market. Meanwhile, Hudson Cannabis and Snobby Dankins have shown more stability but also experienced slight declines in rank over the same period. Honest Pharm Co, similar to Jenny's, improved its standing, albeit starting from a higher rank. Jenny's sales growth, from being significantly lower in November to closely competing with these brands by February, underscores its potential to disrupt the Vapor Pens category in New York's cannabis market.

Notable Products

In Feb-2024, Jenny's top-performing product was Posh Puffs - Blueberry Runtz Cured Resin Disposable (1g) within the Vapor Pens category, maintaining its number one rank from previous months with an impressive sales figure of 506 units. Following closely in the rankings, the CBD/THC 1:2 Elegant Chocolates 10-Pack (25mg CBD, 50mg THC) and CBG/THC 1:2 Go-Go Gummies 10-Pack (25mg CBG, 50mg THC), both from the Edible category, held steady at second and third places respectively. The consistency in top product rankings from previous months indicates a stable consumer preference for these items. Notably, Posh Puffs - Kush Mints Live Resin Disposable (1g) made its debut in the rankings at the fifth position, suggesting a growing interest in the Vapor Pens category. This analysis highlights Jenny's sustained success with its leading products, while also pointing towards potential growth areas.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.