Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

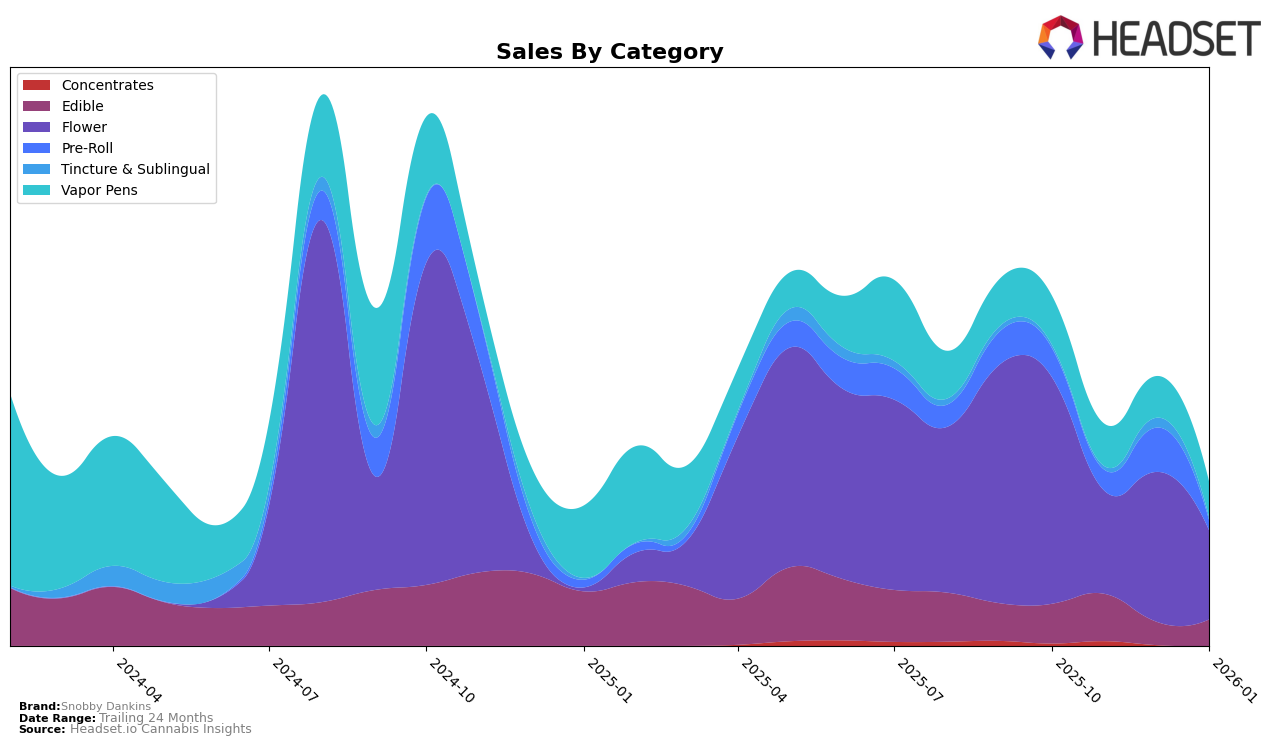

Snobby Dankins has shown a notable performance in the Edible category within New York. Despite not breaking into the top 30 rankings from October 2025 to January 2026, there is an upward trend in their sales, as evidenced by the increase from $11,796 in October to $14,065 in November. This suggests a growing consumer interest and potential for future growth in this category, even though they have yet to secure a top-tier position. The absence from the top 30 could be seen as a challenge, but the positive sales trajectory indicates that the brand is gaining traction in this competitive market.

The lack of ranking in the top 30 across these months might initially paint a discouraging picture for Snobby Dankins in New York's Edible category. However, the incremental increase in sales points to a potential untapped market that the brand could capitalize on with strategic marketing and product differentiation. As the brand continues to build its presence, it will be crucial to monitor how these sales trends translate into future rankings. This data-driven insight suggests that while Snobby Dankins is not currently a leading player, there is room for optimism and strategic growth in the coming months.

```Competitive Landscape

In the competitive landscape of the edible cannabis market in New York, Snobby Dankins has shown a modest upward trajectory in rank, moving from 67th in October 2025 to 64th by November 2025. This improvement is noteworthy, especially when compared to competitors like Happy Cabbage Farms, which did not make it into the top 20 ranks during the same period. Meanwhile, Matter. maintained a stronger position at 39th in October 2025, indicating a more dominant presence in the market. The sales figures for Snobby Dankins also reflect a positive trend, with an increase from October to November, suggesting effective marketing strategies or product reception. However, the brand still trails behind High Falls Canna New York, which, despite not being ranked, reported higher sales in October 2025. The data suggests that while Snobby Dankins is making progress, there is still significant room for growth to compete with the more established brands in New York's edible cannabis market.

Notable Products

In January 2026, the top-performing product from Snobby Dankins was La Fume (3.5g) in the Flower category, maintaining its leading position from December 2025 with an impressive sales figure of 733 units. Aldo OG (3.5g), also in the Flower category, held steady at the second position for the second consecutive month, with a noticeable increase in sales. Grimlato (3.5g) emerged as a new contender, securing the third spot in its debut month. Table Breakers - Sour Blue Raspberry Gummies 10-Pack (100mg) ranked fourth, marking its entry into the top five. Additionally, Table Breakers Infused Pre-Roll 2-Pack (1g) rounded out the top five, showcasing the growing popularity of pre-rolls in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.