Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

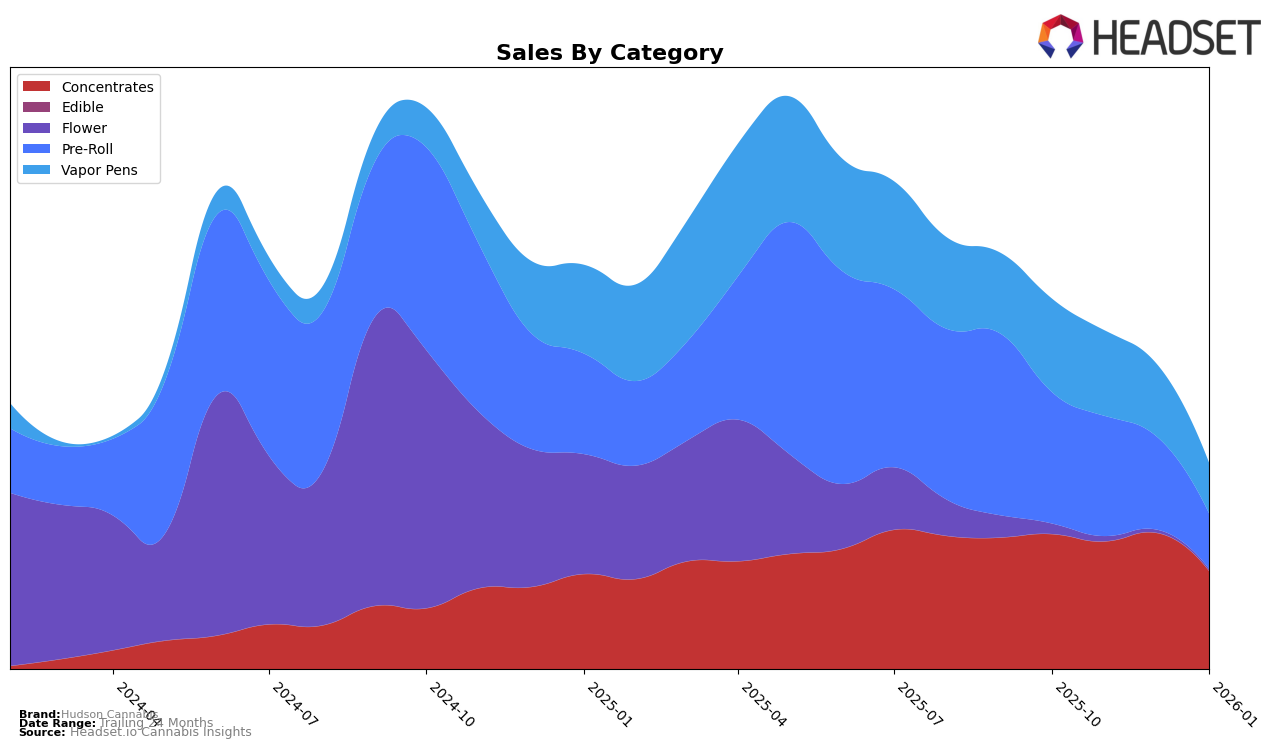

Hudson Cannabis has demonstrated varying performance across different product categories in New York. In the Concentrates category, the brand maintained a strong presence, consistently ranking within the top five brands over the past four months, despite a gradual decline from third to fifth place. This consistent ranking highlights their strong foothold in this category, although the slight dip in sales from November to January indicates potential challenges. Conversely, in the Pre-Roll category, Hudson Cannabis experienced a notable decline in rankings, falling from 20th in October to 48th by January. This drop suggests increased competition or shifting consumer preferences away from their offerings in this segment.

The Vapor Pens category tells a similar story of declining performance for Hudson Cannabis. Starting from the 36th position in both October and November, the brand slipped to 47th by January, indicating a struggle to maintain market share in this competitive category. The absence of a ranking in the top 30 for recent months further underscores the challenges the brand is facing in this space. While the sales figures for Vapor Pens have decreased month-over-month, the overall trend suggests a need for strategic adjustments to regain momentum. As Hudson Cannabis navigates these shifts, understanding the nuances of consumer demand and competitive dynamics will be crucial for future growth.

Competitive Landscape

In the competitive landscape of the New York concentrates market, Hudson Cannabis has experienced notable fluctuations in its ranking and sales over recent months. From October 2025 to January 2026, Hudson Cannabis saw a decline from 3rd to 5th place, indicating increased competition. The brand's sales also decreased significantly from November to January, contrasting with the upward trend of competitors like Jetpacks, which maintained a consistent 2nd place ranking and saw a steady increase in sales. Meanwhile, #Hash made a remarkable leap from 15th to 5th place in November, although it later settled at 7th place in January, showcasing its volatile yet competitive presence. Nyce also improved its position, moving from 5th to 4th place by January, suggesting a growing market share. These shifts highlight the dynamic nature of the market and the need for Hudson Cannabis to strategize effectively to regain its competitive edge.

Notable Products

In January 2026, the top-performing product for Hudson Cannabis was Farmer's Blend Pre-Roll (0.5g), maintaining its consistent number one ranking from previous months despite a decrease in sales to 1815 units. Following closely, Sour Unicorn Infused Pre-Roll (0.5g) held its position at number two, also experiencing a sales dip. Cider Spice Infused Pre-Roll (0.5g) ranked third, dropping from its second place in December 2025. Cider Spice Infused Pre-Roll 7-Pack (3.5g) moved up to fourth place from its previous fifth place in November 2025, showing a slight improvement in its ranking. Sour Unicorn Infused Pre-Roll 7-Pack (3.5g) rounded out the top five, maintaining its position from December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.