Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

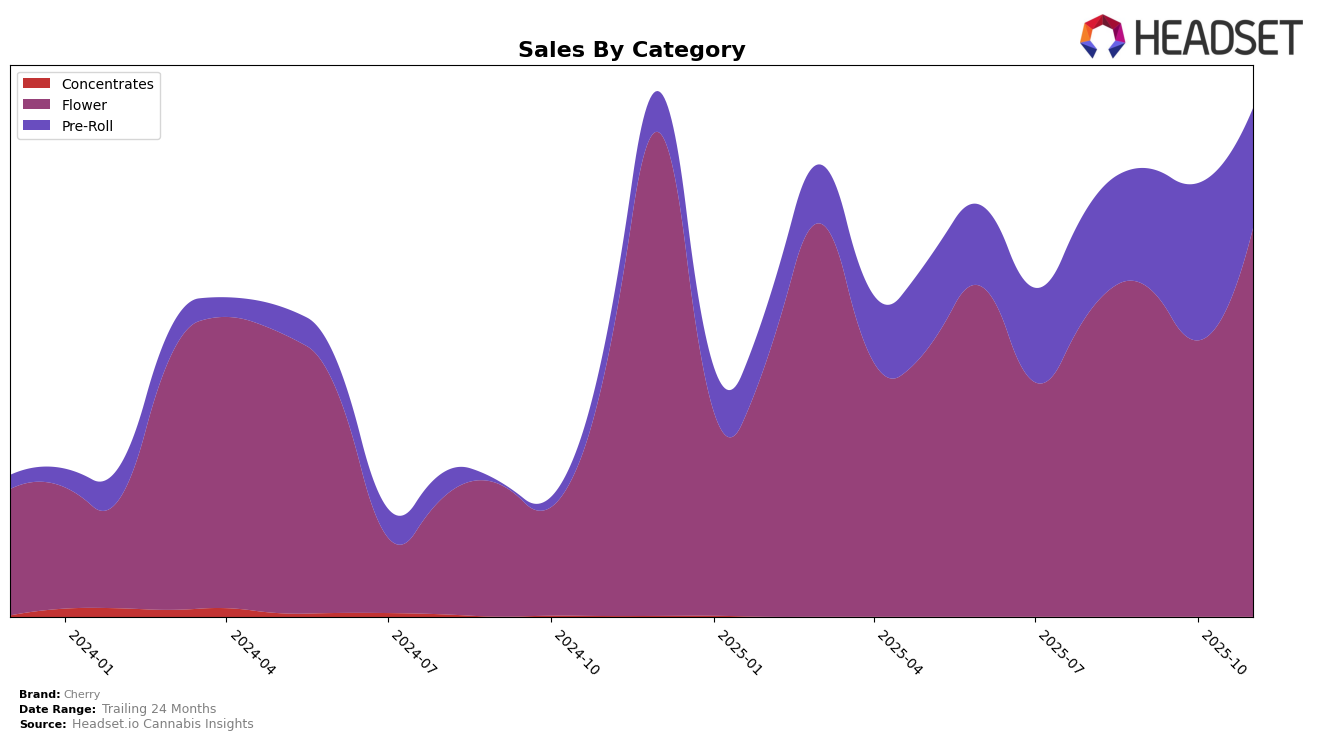

In the Colorado market, Cherry has shown notable performance improvements in the Flower category. In November 2025, Cherry broke into the top 30 brands, achieving a rank of 28, a significant leap from its position outside the top 30 in previous months. This upward movement indicates a growing consumer preference for Cherry's Flower products in this competitive market. The brand's sales also reflect this positive trend, with a notable increase from October to November, suggesting that Cherry's Flower offerings are resonating well with consumers in Colorado.

Cherry's performance in the Pre-Roll category in Colorado has also been on an upward trajectory, albeit more gradually. The brand consistently improved its ranking each month, moving from 38 in August to 30 by November 2025. This steady climb into the top 30 suggests that Cherry is gaining traction in the Pre-Roll market, although the sales figures show some fluctuations. Despite a dip in sales from October to November, Cherry maintained its position, indicating a stable consumer base. However, it remains crucial for Cherry to continue this momentum to further solidify its standing in the Pre-Roll category.

Competitive Landscape

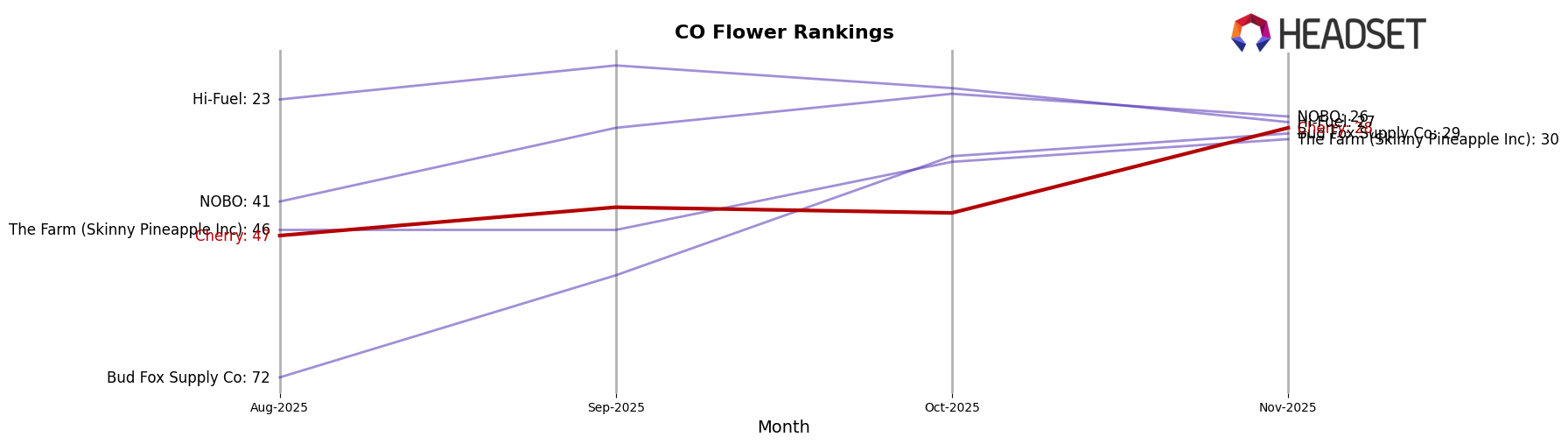

In the competitive landscape of the Flower category in Colorado, Cherry has demonstrated a notable upward trajectory in recent months. After starting at a rank of 47 in August 2025, Cherry improved its position to 28 by November 2025, reflecting a strategic gain in market presence. This rise is particularly significant when compared to competitors such as The Farm (Skinny Pineapple Inc) and Bud Fox Supply Co, both of which also showed improvement but started from lower ranks. Notably, Bud Fox Supply Co moved from rank 72 to 29, indicating a rapid ascent, while NOBO and Hi-Fuel experienced fluctuations, with Hi-Fuel dropping from 23 to 27. Cherry's sales figures also reflect this positive trend, with a significant increase in November, surpassing NOBO's sales despite their higher rank in previous months. This data suggests that Cherry's strategic initiatives are effectively enhancing its competitive edge in the Colorado Flower market.

Notable Products

In November 2025, Cherry's top-performing product was the Cherry x Ajoya - Indica Pre-Roll (1g), which climbed to the number one position from third place in October, with sales reaching 3319 units. The Cherry x Ajoya - Hybrid Pre-Roll (1g) also saw an impressive rise, moving up from fourth to second place. Meanwhile, the Cherry x Ajoya - Sativa Pre-Roll (1g) slipped from first to third, indicating a slight decline in its popularity. The Super Thug OG Pre-Roll (1g) entered the rankings at fourth place, showing strong sales for its debut. Lastly, the Dank Dough Pre-Roll (1g) maintained its fifth position, although its sales figures decreased compared to the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.