Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

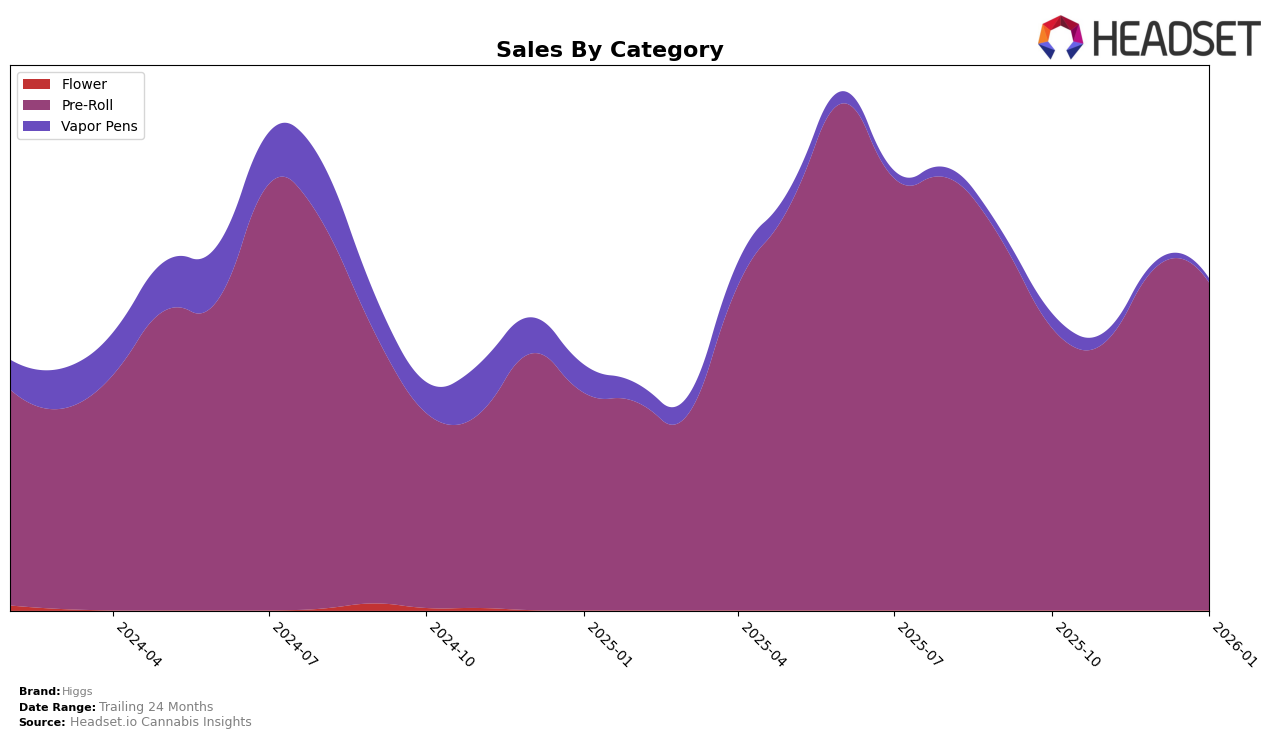

In New York, Higgs has shown a notable upward trajectory in the Pre-Roll category. Starting from October 2025, the brand was not in the top 30, ranking at 37th, but has steadily climbed to reach 28th by January 2026. This positive movement indicates a strengthening presence in the New York market, with sales peaking in December 2025 at $279,731. Such an increase suggests that Higgs is effectively capturing consumer interest and potentially expanding its market share in this competitive category.

While Higgs has made significant strides in New York, the brand's performance across other states remains less visible due to its absence from the top 30 rankings in those regions and categories. This lack of presence could be seen as a challenge, highlighting areas where the brand might focus its efforts to enhance visibility and market penetration. The steady improvement in New York, however, could serve as a model for strategic growth in other markets, suggesting that there are opportunities for Higgs to replicate its success elsewhere, provided it can identify and leverage similar market dynamics.

```Competitive Landscape

In the competitive landscape of the Pre-Roll category in New York, Higgs has shown a promising upward trend in rankings from October 2025 to January 2026, moving from 37th to 28th place. This improvement is notable given the competitive pressures from brands like Toast, which maintained a strong position but experienced a slight dip from 23rd to 27th in January 2026. Meanwhile, Dragonfly Cannabis and Golden Garden have fluctuated in rankings, with Dragonfly Cannabis dropping to 31st and Golden Garden climbing back to 30th in January. Despite these shifts, Higgs has managed to increase its sales significantly from November to December 2025, which likely contributed to its rise in rank. This suggests that Higgs is effectively capturing market share and could continue to climb the rankings if these trends persist.

Notable Products

In January 2026, the top-performing product for Higgs was Log Cabin OG Pre-Roll 10-Pack (3g), which climbed to the first rank with notable sales of 908 units. Durban Pre-Roll 10-Pack (3g) secured the second position, showing a steady improvement from its fifth-place ranking in December 2025. 22's Pre-Roll 10-Pack (3g) maintained a strong presence by ranking third, despite a slight drop from fourth place in the previous month. 84's Pre-Roll 10-Pack (3g) entered the top five, achieving fourth place, while 55' Pound Cake Pre-Roll 10-Pack (3g) rounded out the top five, dropping from third place in December 2025. Overall, the pre-roll category showed dynamic shifts in product rankings, reflecting changing consumer preferences.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.