Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

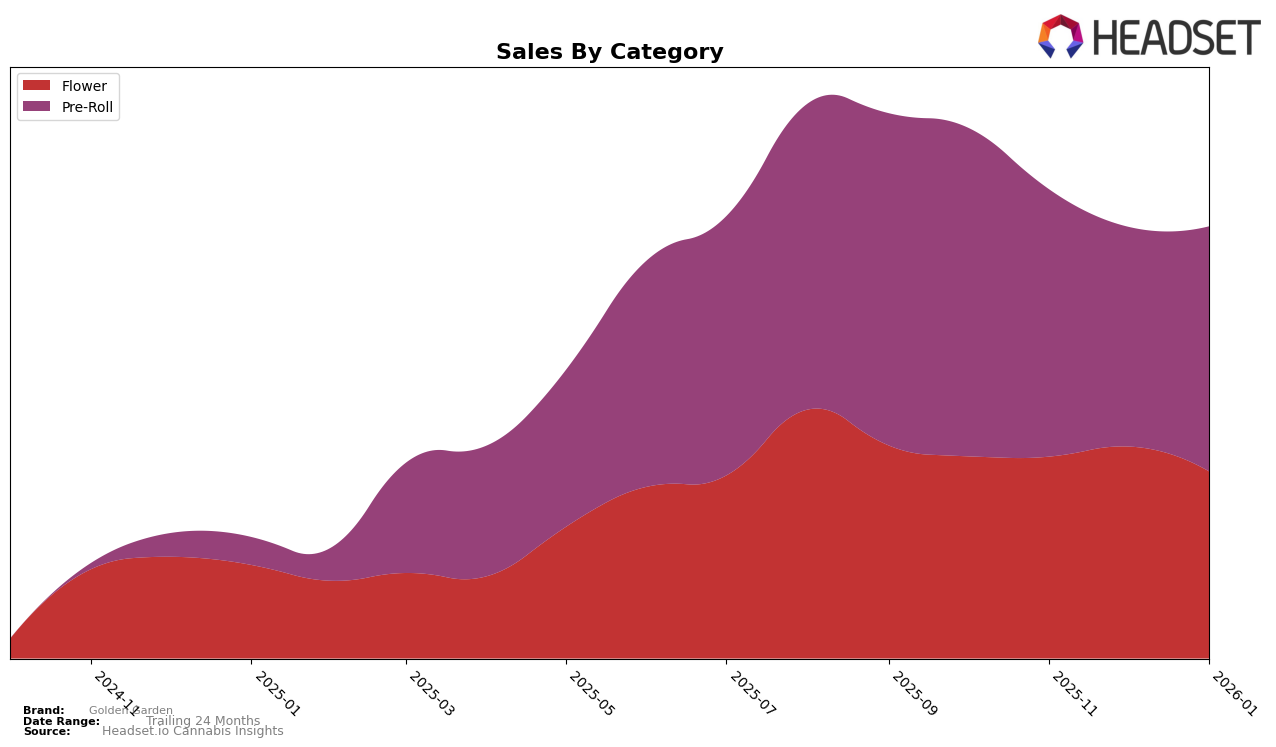

Golden Garden's performance in the New York market has shown varied trends across different product categories. In the Flower category, the brand has not managed to break into the top 30 rankings over the past few months, indicating a challenging competitive landscape. Despite consistent sales figures in October and November 2025, there was a noticeable decline in January 2026, which suggests potential market saturation or increased competition. On the other hand, the Pre-Roll category has seen more dynamic movements, with Golden Garden initially slipping from 22nd place in October 2025 to 37th in December, before recovering slightly to 30th in January 2026. This fluctuation could indicate either a strategic shift in focus or changing consumer preferences within the state.

While Golden Garden has not secured a top position in New York's Flower category, its presence in the Pre-Roll segment suggests an opportunity for growth. The decline in Pre-Roll rankings from October to December 2025, followed by a rebound in January, might reflect seasonal variations or targeted marketing efforts that paid off at the start of the new year. The fact that Golden Garden was absent from the top 30 in the Flower category throughout this period could be seen as a negative, signaling a need for strategic adjustments or innovation to capture market share. Nonetheless, the brand's ability to remain within the top 30 for Pre-Rolls, despite fluctuations, indicates a resilient position that could be leveraged for future growth.

Competitive Landscape

In the competitive landscape of the New York Pre-Roll category, Golden Garden has experienced notable fluctuations in its market position over the past few months. Starting from October 2025, Golden Garden was ranked 22nd but saw a decline to 29th in November and further to 37th in December, before rebounding to 30th in January 2026. This volatility in rank is mirrored by a corresponding decline in sales from October to December, followed by a slight recovery in January. In contrast, Toast maintained a relatively stable rank, hovering around the 23rd position before dropping to 27th in January, while Higgs showed a consistent upward trend, improving from 37th to 28th. Miss Grass also demonstrated resilience, climbing from 44th in October to 32nd in January. Meanwhile, Dragonfly Cannabis exhibited minor rank fluctuations, ending at 31st in January. These dynamics suggest that while Golden Garden faces challenges in maintaining its market position, competitors like Higgs and Miss Grass are capitalizing on growth opportunities, potentially impacting Golden Garden's sales and necessitating strategic adjustments to regain competitive ground.

Notable Products

In January 2026, the top-performing product from Golden Garden was Blue Zushi Pre-Roll (1g) in the Pre-Roll category, maintaining its leading position from the previous two months. Superboof Pre-Roll (1g) consistently held the second spot, with sales figures reaching 4023 units. Pancakes Pre-Roll (1g) climbed back to third place after dropping to fourth in December 2025, showing a slight recovery in sales. Buckin Runtz Pre-Roll (1g) slipped to fourth place, while London Pound Cake Pre-Roll (1g) remained steady in fifth place, after reappearing in December. Overall, the rankings for January indicate stability among the top products, with only minor shifts in positions compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.