Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

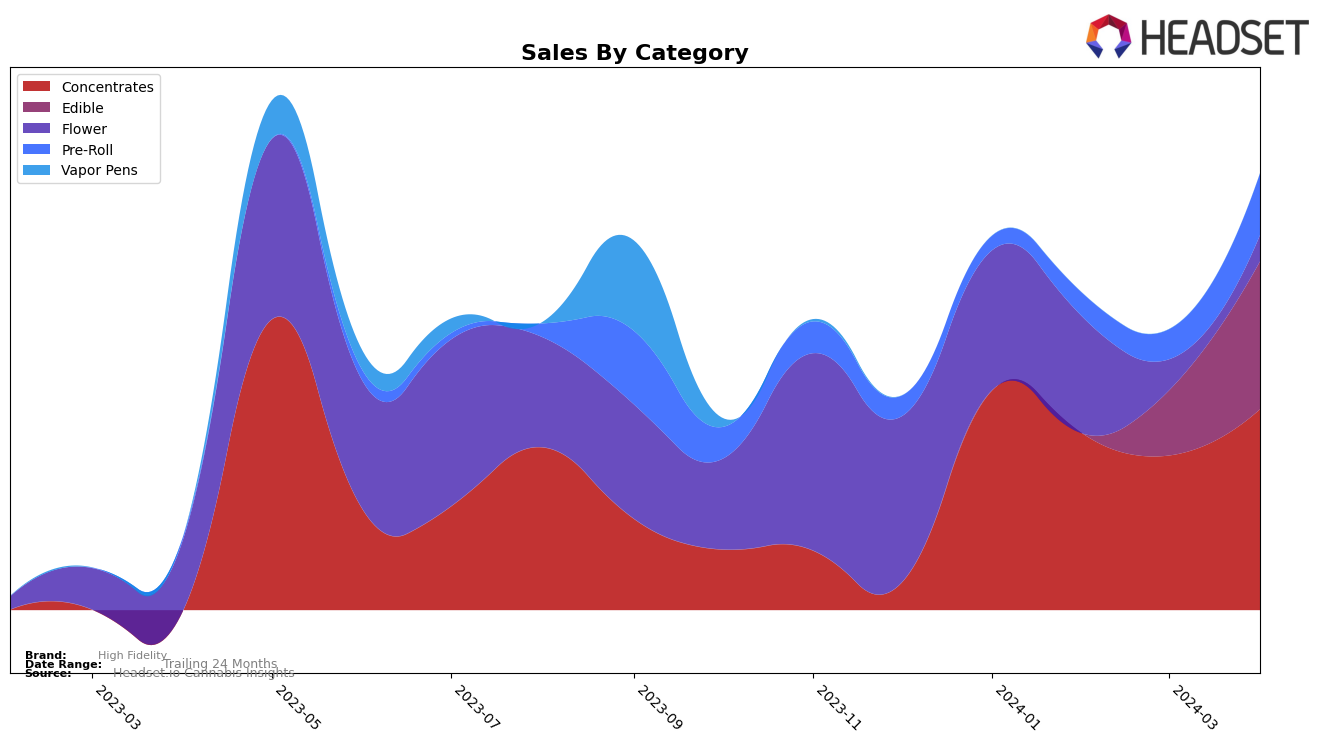

In British Columbia, High Fidelity has shown a consistent presence in the concentrates category, although its ranking fluctuated over the observed period. Starting at 13th in January 2024, it experienced a slight dip in February and March, dropping to 15th and then 17th, respectively, before making a notable recovery to 12th place in April. This rebound is particularly impressive, considering the sales in January were the highest at 53,896 units, before seeing a decline in February and March, and then an increase again in April to 49,219 units. The fluctuating rankings indicate a competitive market in British Columbia for concentrates, with High Fidelity managing to regain some of its earlier lost ground.

Meanwhile, in California, High Fidelity's performance in the edibles category tells a story of late entry or significant improvement, as it was not ranked in the top 30 brands for January and February 2024. However, by March, it had surged to 72nd place, followed by an impressive leap to 56th in April. This dramatic entrance into the rankings, accompanied by a sales jump from 15,850 units in March to 36,218 in April, suggests a growing momentum for High Fidelity's edibles in California. The absence from the top rankings in the initial months could be seen as a challenge, yet the subsequent rankings underscore a potentially strong upward trajectory in a highly competitive market.

Competitive Landscape

In the competitive landscape of the concentrates category in British Columbia, High Fidelity has shown a notable fluctuation in its market position from January to April 2024. Initially ranked 13th in January, it experienced a slight decline in February and March, falling to 15th and 17th place, respectively, before making a significant jump to 12th place in April. This trajectory suggests a resilient recovery in a competitive market, outperforming Phyto Extractions in April, which dropped to 14th from earlier positions. However, High Fidelity faces stiff competition from brands like Tremblant Cannabis, which consistently ranked higher and showed a strong upward trend, securing the 9th position in April. Similarly, RAD (Really Awesome Dope) and Adults Only have shown volatile yet generally strong performances, with RAD experiencing a slight decline to 15th in April from a high of 7th in February, and Adults Only making a notable entry in February and climbing quickly in the ranks. High Fidelity's ability to navigate this competitive environment, marked by its April rebound, indicates a dynamic market presence but also highlights the challenge of maintaining a consistent upward trajectory amidst fierce competition.

Notable Products

In April 2024, High Fidelity's top-performing product was the Londonchello Pre-Roll (1g) within the Pre-Roll category, achieving the number one rank with notable sales figures amounting to 5868 units. Following closely, the Blue Raspberry Gummies 10-Pack (100mg) from the Edible category secured the second position, maintaining its rank from the previous month. The Sour Apple Gummies 10-Pack (100mg) also from the Edible category, improved its ranking to third place, up from fifth in March. The Sour Mango Gummies 10-Pack (100mg), another product in the Edible category, entered the top rankings for the first time in April, securing the fourth position. Lastly, the Sour Watermelon Gummies 10-Pack (100mg) experienced a slight drop in its ranking, moving from fourth in March to fifth in April, indicating a competitive shift within the Edible category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.