Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

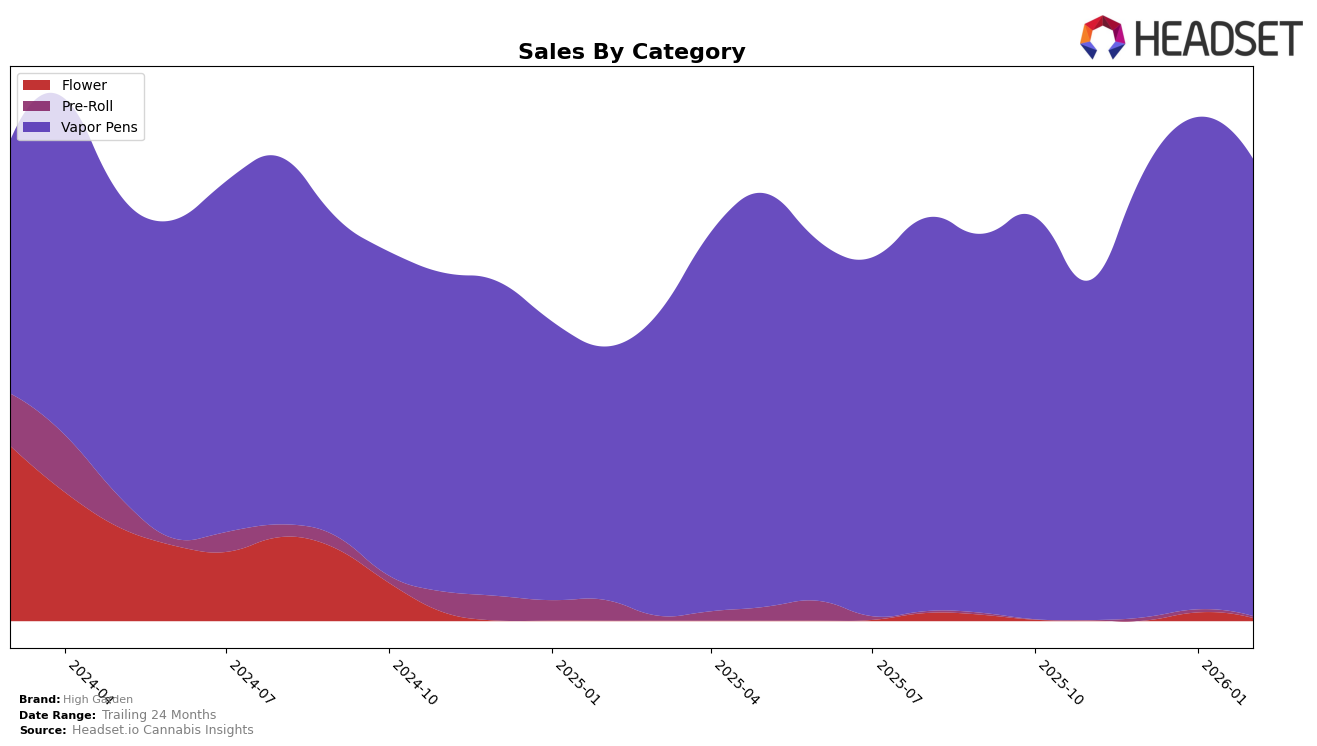

High Garden has shown a steady performance in the vapor pens category in New York, demonstrating a consistent upward trajectory in the rankings over the past few months. Starting from a rank of 29 in November 2025, the brand improved to 27 in December and further climbed to 25 in January 2026, before slightly dropping to 26 in February. This movement suggests a strengthening presence in the New York market, with sales peaking in January 2026. The increase in sales from November to January indicates a positive reception of their products, although the slight dip in February might warrant a closer look to maintain momentum.

In other states, High Garden's performance is not captured within the top 30 brands, which could be seen as a challenge or opportunity depending on the market dynamics. The absence from the top 30 in these areas suggests that while High Garden is gaining traction in New York, there might be untapped potential or increased competition in other regions. This disparity highlights the importance of localized strategies to enhance market penetration and brand recognition across different states. Understanding the factors driving success in New York could provide insights into how High Garden can replicate this performance elsewhere.

Competitive Landscape

In the competitive landscape of vapor pens in New York, High Garden has shown a gradual improvement in its rank from November 2025 to February 2026, moving from 29th to 26th position. This upward trend in rank, despite not breaking into the top 20, indicates a positive trajectory in market presence. In contrast, Mfused, which started at 9th place in November 2025, saw a significant decline, falling out of the top 20 by February 2026. Meanwhile, Bloom and Sapphire Farms experienced fluctuating ranks, with Bloom maintaining a relatively stable position around the mid-20s and Sapphire Farms dropping from 18th to 28th. ghost. also saw a decline, moving from 19th to 27th. High Garden's steady increase in sales, despite these competitive shifts, suggests a strengthening brand loyalty and market strategy that could be leveraged for further growth in the vapor pen category.

Notable Products

In February 2026, the top-performing product for High Garden was Ghost Train Haze Live Resin Cartridge (1g) in the Vapor Pens category, achieving the number 1 rank with sales of 2,216 units. Berry Trainwreck Live Resin Reload Cartridge (1g) rose to the 2nd position from 5th in January 2026, indicating a strong sales increase. OG Kush Live Resin Cartridge (1g) secured the 3rd spot, while Fruity Pebblez Live Resin Cartridge (1g) followed closely in 4th place. Skywalker OG Live Resin Cartridge (1g) maintained its position at 5th, showing consistent performance. Overall, February saw significant movement in rankings, particularly for Berry Trainwreck, reflecting dynamic changes in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.