Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

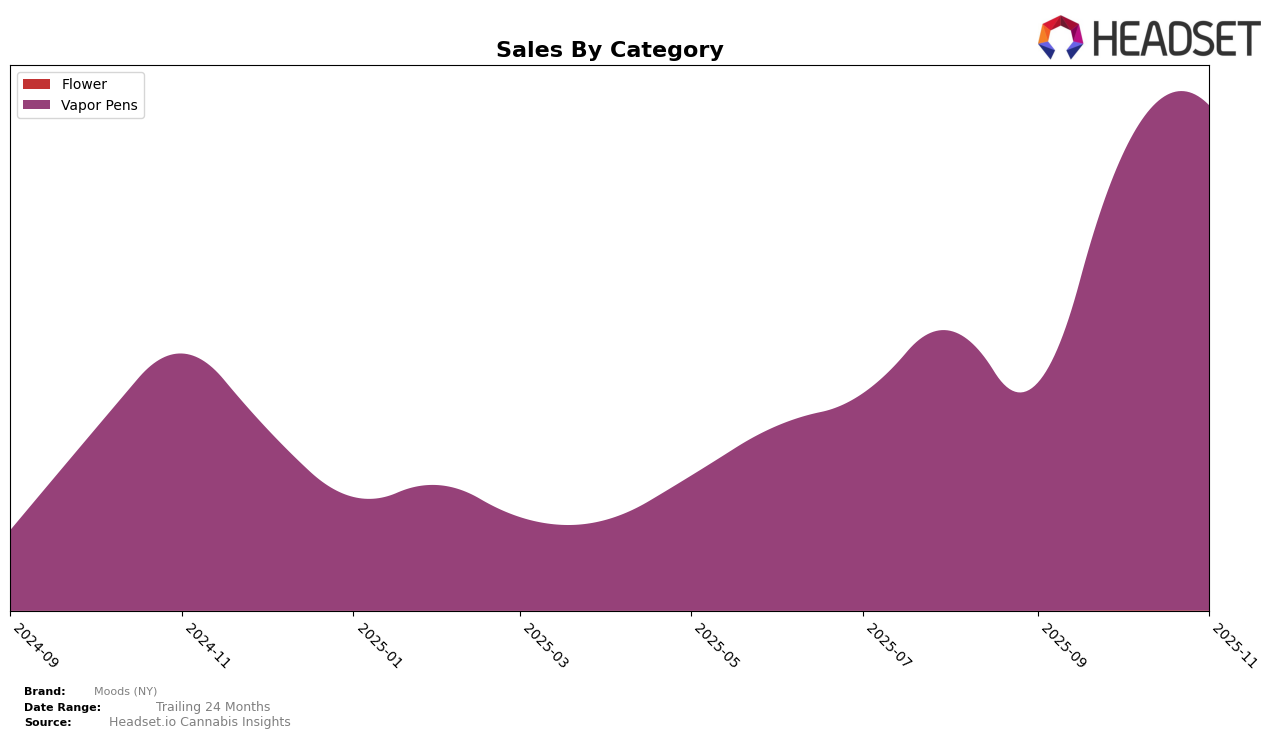

Moods (NY) has shown a notable improvement in the Vapor Pens category within the state of New York. After not being in the top 30 brands in August and September 2025, Moods (NY) made a significant leap to rank 32nd in October and further climbed to 30th by November. This upward trend is indicative of a growing consumer interest and a successful strategy in capturing market share in this category. The brand's sales figures also reflect this positive trajectory, with a substantial increase from September to November, highlighting an effective response to market dynamics.

While Moods (NY) has made commendable strides in the Vapor Pens category in New York, it is important to note that their absence from the top 30 in earlier months suggests there is still room for growth and improvement. The competitive landscape in New York's cannabis market demands continuous innovation and adaptation. As Moods (NY) continues to refine its offerings and strategies, it will be interesting to observe how these efforts translate into future rankings and sales performance across other categories and potentially other states or provinces.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Moods (NY) has shown a notable upward trend in its ranking from August to November 2025, moving from 35th to 30th place. This improvement in rank is indicative of a significant increase in sales, especially when compared to competitors like Bonanza Cannabis Company, which also experienced a rise in rank from 48th to 34th, albeit with a less dramatic sales increase. Meanwhile, High Garden and Dime Industries have maintained relatively stable positions, with High Garden fluctuating slightly but remaining outside the top 20. Moods (NY)'s ability to climb the ranks despite the competitive pressure highlights its growing market presence and suggests a positive consumer reception, which could be leveraged for further market penetration and sales growth.

Notable Products

In November 2025, the top-performing product for Moods (NY) was Miami Vibes Mini Distillate Disposable (1g) in the Vapor Pens category, securing the number one rank with a notable sales figure of 3470 units. Everglade Haze Mini Distillate Disposable (1g) followed closely, maintaining its consistent presence in the top three over the months and achieving the second rank. Golden Hour Distillate Mini Disposable (1g), which had been the leader for three consecutive months, dropped to third place in November. Kingdom Dreams Distillate Disposable (1g) held steady at fourth place, while Lemon Berry Crisp Distillate Disposable (1g) made its debut in the rankings at fifth place. This shift in rankings highlights a dynamic change in consumer preferences, with Miami Vibes and Everglade Haze gaining popularity over the previously dominant Golden Hour.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.