Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

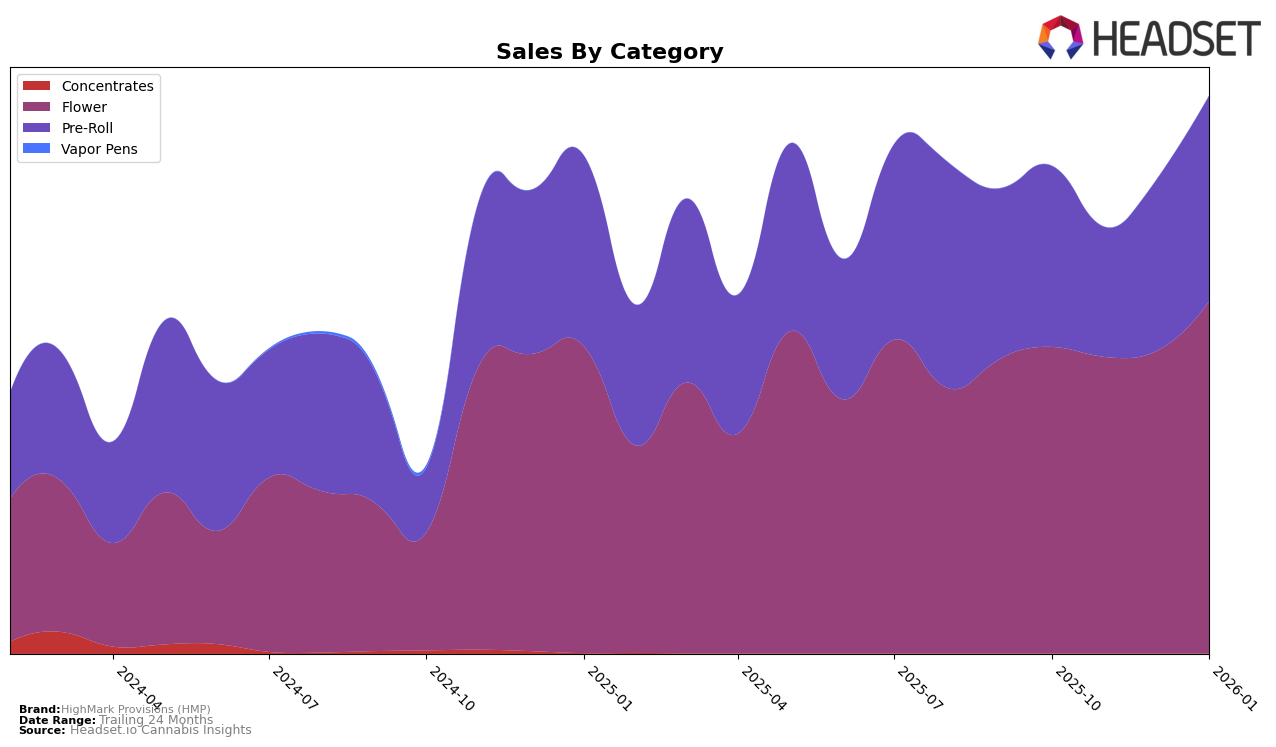

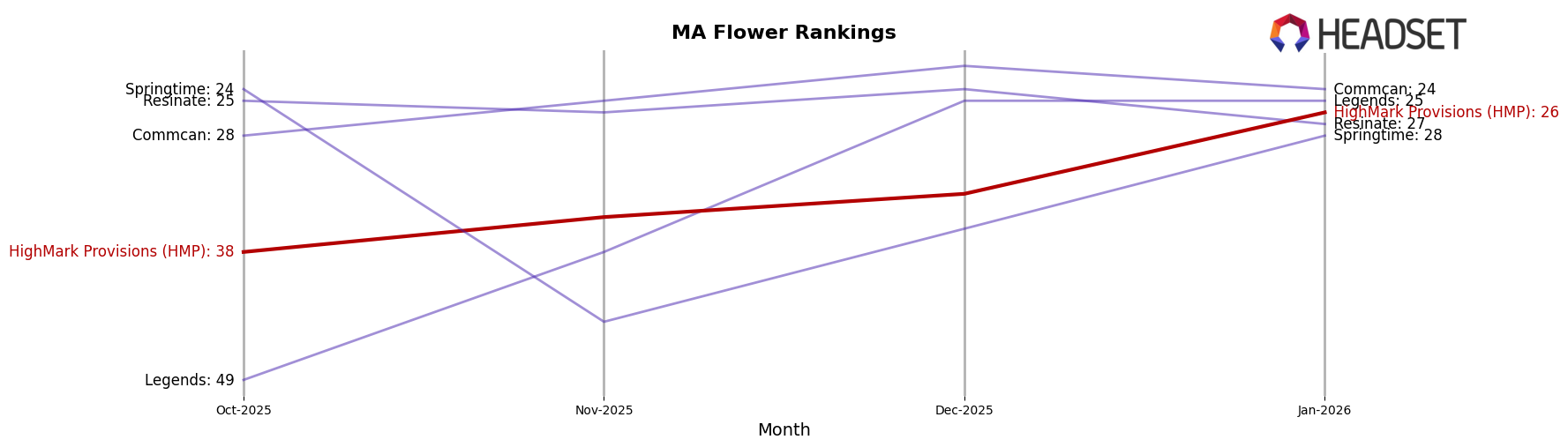

HighMark Provisions (HMP) has shown a notable upward trajectory in the Massachusetts market, particularly in the Flower category. Starting from a rank of 38 in October 2025, HMP climbed to 26 by January 2026, marking a significant improvement in their standing within this competitive category. This progress is mirrored by a steady increase in sales figures, which saw a substantial boost in January 2026. Such a trend indicates a growing consumer preference and acceptance of HMP's Flower products, suggesting effective strategies in product quality or marketing efforts that resonate well with the Massachusetts audience.

In the Pre-Roll category, HMP's performance in Massachusetts also highlights interesting dynamics. Despite a dip in ranking in November 2025, where they fell to 38, HMP rebounded to secure a rank of 25 by January 2026. This recovery, coupled with fluctuating sales figures, points to a potential volatility in consumer demand or perhaps adjustments in inventory or distribution strategies. The fact that HMP wasn't always in the top 30 in some months suggests areas for potential improvement or market challenges. However, their ability to bounce back into the top 30 indicates resilience and a capacity to adapt to market conditions.

Competitive Landscape

In the competitive landscape of the Massachusetts flower category, HighMark Provisions (HMP) has shown a notable upward trend in rankings from October 2025 to January 2026, moving from 38th to 26th place. This improvement is significant when compared to competitors such as Resinate, which fluctuated between 24th and 27th place, and Springtime, which saw a decline from 24th to 28th place over the same period. Meanwhile, Commcan consistently outperformed HMP, maintaining a higher rank, peaking at 22nd in December 2025. Despite this, HMP's sales trajectory indicates a positive growth trend, particularly in January 2026, where it surpassed its previous months, suggesting effective strategies in capturing market share. This upward momentum positions HMP as a rising contender in the Massachusetts flower market, potentially challenging more established brands in the near future.

Notable Products

In January 2026, the top-performing product for HighMark Provisions (HMP) was the Purple Champagne Pre-Roll (1g) in the Pre-Roll category, maintaining its number one rank from October and November 2025, with sales reaching 2632 units. The Purple Champagne (3.5g) in the Flower category climbed to the second position, up from third place in December 2025, demonstrating a significant increase with 1800 units sold. Frostbite (3.5g), also in the Flower category, made a notable entry at the third position, marking its debut in the rankings. Crunch Berriez Pre-Roll (1g) secured the fourth spot, while Pop Tartz (3.5g) rounded out the top five. The consistent performance of Purple Champagne products highlights their strong market presence and consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.