Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

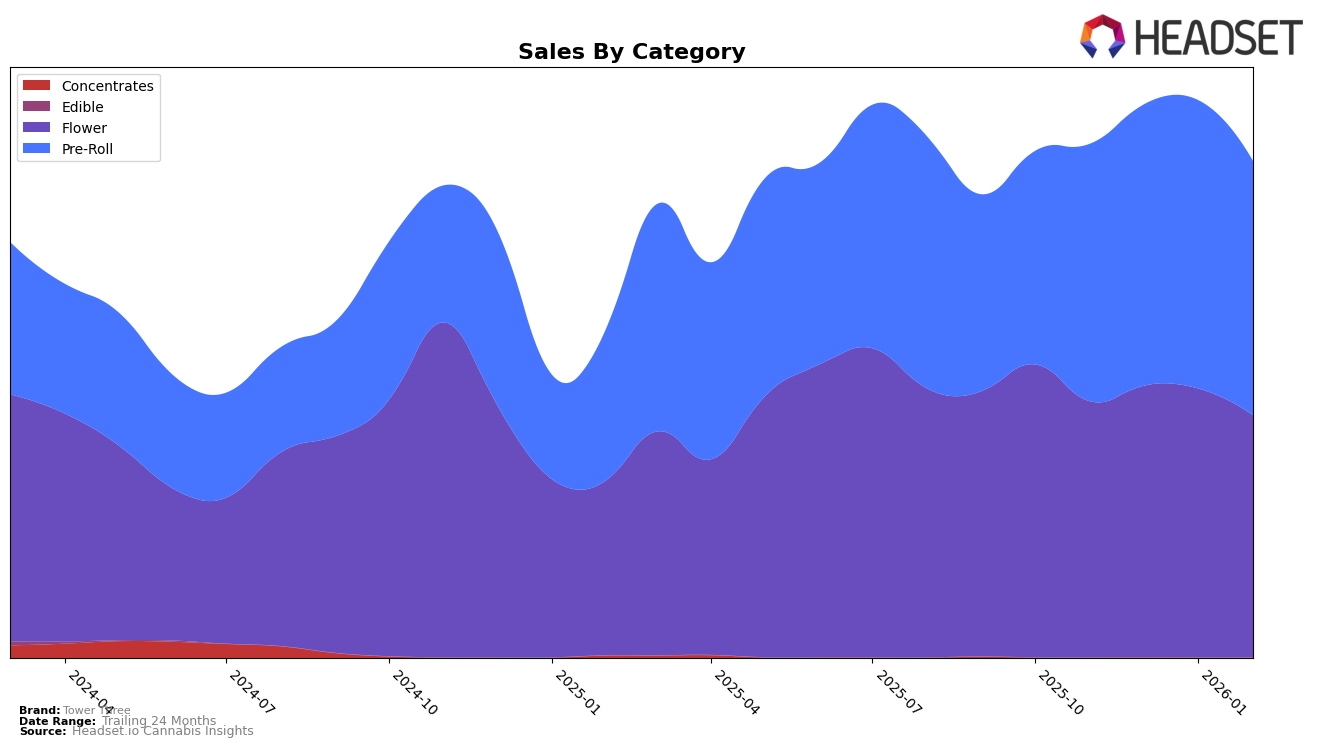

In the ever-competitive cannabis market of Massachusetts, Tower Three has shown noteworthy performance across different product categories. In the Flower category, the brand's ranking fluctuated slightly, starting at 30th in November 2025, moving up to 28th in December, dropping to 31st in January 2026, and then returning to 28th in February. Despite these fluctuations, Tower Three managed to maintain its presence within the top 30, which is a positive indicator of its resilience in a highly competitive market. However, the sales figures did show a downward trend from December to February, suggesting potential challenges in maintaining momentum.

On the other hand, Tower Three's performance in the Pre-Roll category in Massachusetts has been more promising. The brand consistently improved its ranking, reaching as high as 9th in January 2026 before slightly dropping to 12th in February. This upward movement from November to January highlights the brand's growing popularity and strength in the Pre-Roll segment. The sales figures support this trend, showing an increase from November to January, followed by a slight dip in February. This indicates a strong market presence and suggests that Tower Three is effectively capitalizing on consumer preferences in this category.

Competitive Landscape

In the competitive landscape of the Massachusetts pre-roll category, Tower Three has demonstrated notable resilience and adaptability. Over the months from November 2025 to February 2026, Tower Three maintained a relatively stable rank, peaking at 9th place in January 2026 before slightly dropping to 12th in February. This fluctuation in rank is indicative of a dynamic market where competitors like Dogwalkers and Hellavated also experienced shifts, with Dogwalkers returning to the 10th position in February after a brief dip. Meanwhile, Perpetual Harvest consistently outperformed Tower Three, maintaining a top 10 position until February. Despite these challenges, Tower Three's sales figures remained robust, even surpassing Good Chemistry Nurseries in January, showcasing its competitive edge and potential for growth in this evolving market.

Notable Products

In February 2026, Tower Three's top-performing product was Kush Mints Pre-Roll (1g) in the Pre-Roll category, which rose to the number one spot from its previous third place in January, with notable sales of 4694. Lemon S'mores Pre-Roll (1g) also showed strong performance, climbing to the second position from fourth, demonstrating an increase in demand. The 007 Up Pre-Roll (1g) made its debut in the rankings, landing in third place. Oishii Pre-Roll (1g) experienced a drop from first place in January to fourth in February, indicating a shift in consumer preference. East Coast Irene Pre-Roll (1g) maintained a consistent presence, securing the fifth position after reappearing in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.