Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

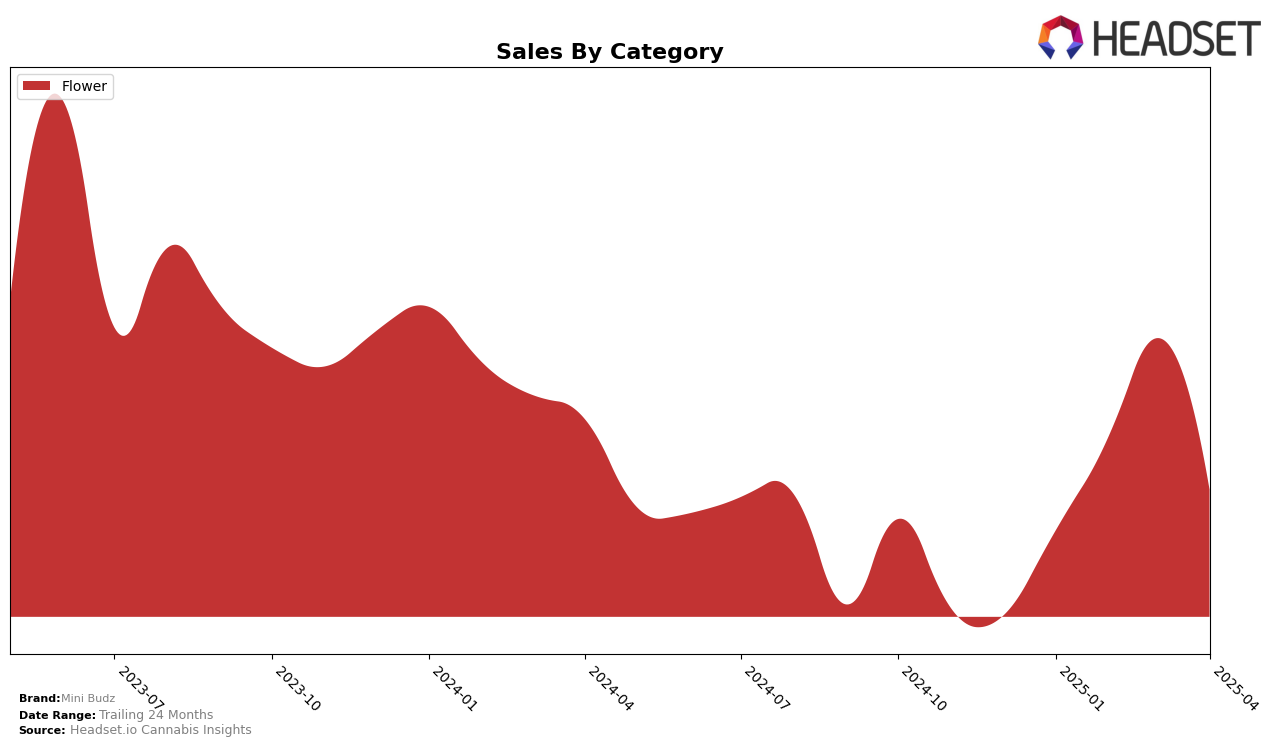

Mini Budz has shown varied performance across different states and categories, reflecting a dynamic presence in the cannabis market. In Illinois, Mini Budz has fluctuated in the Flower category rankings, starting the year outside the top 30 and reaching a peak ranking of 35 in February 2025 before declining to 44 by April. This suggests a volatile market position, although the February sales surge indicates potential for growth. Meanwhile, in Massachusetts, the brand displayed a promising upward trajectory in the first quarter, climbing from a rank of 88 in January to 37 in March, before slipping to 58 in April, which might be indicative of seasonal purchasing trends or competitive pressures.

In Washington, Mini Budz maintained a more stable presence in the Flower category, consistently ranking within the top 30 throughout the reported months, though with a slight dip from 18 to 25 by April. This stability suggests a strong foothold in the Washington market, contrasting with the more erratic performance observed in other states. The brand's ability to sustain a relatively high ranking in Washington may be attributed to consumer loyalty or effective market strategies. The differences in ranking and sales performance across these states highlight the importance of understanding regional market dynamics and consumer preferences for cannabis brands like Mini Budz.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Mini Budz experienced notable fluctuations in its market rank from January to April 2025. Initially ranked 18th in January, Mini Budz maintained a consistent position at 19th through February and March, before dropping to 25th in April. This decline in rank coincided with a decrease in sales from March to April, suggesting a potential challenge in maintaining market share. Competitors such as Passion Flower Cannabis and Smokey Point Productions (SPP) also experienced rank changes, with Passion Flower Cannabis improving its rank from 25th in March to 23rd in April, and Smokey Point Productions (SPP) dropping from 15th to 24th in the same period. Meanwhile, Sweetwater Farms and Good Earth Cannabis showed varying sales trends, which could indicate shifting consumer preferences or competitive pressures impacting Mini Budz's positioning in the market.

Notable Products

In April 2025, Washington Apple Mini Budz (3.5g) emerged as the top-performing product for Mini Budz, climbing from the consistent second rank in previous months to first place with sales reaching 2690 units. Georgia Pie Popcorn (3.5g), previously leading in January and February, fell to second place with a notable decrease in sales. Washington Apple Popcorn (7g), which had held the top spot in March, dropped to third place in April. Garlic Z Smalls (7g) entered the rankings for the first time in April, securing the fourth position. Gary Peyton Popcorn (3.5g), which was ranked fifth in January, returned to the same position in April following a period of absence in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.