Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

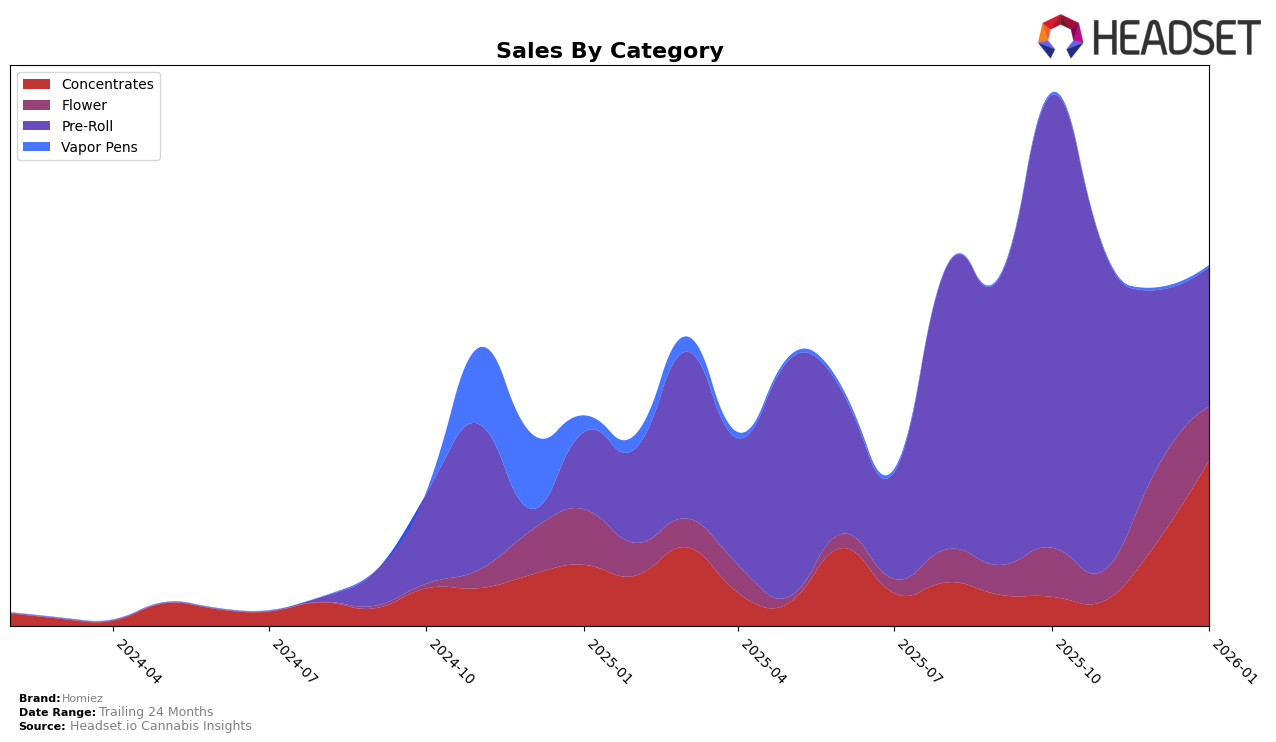

Homiez has shown notable progress in the Michigan Concentrates category over the past few months. Starting from outside the top 90 in October 2025, the brand made a significant leap to reach the 16th position by January 2026. This upward trajectory is indicative of a strong market strategy or product acceptance, as evidenced by the increase in sales from October to January. However, the journey in the Pre-Roll category tells a different story, with Homiez slipping from the 20th rank in October 2025 to 56th by January 2026. This decline suggests potential challenges or increased competition, which might require strategic adjustments to regain ground.

While the Concentrates category in Michigan has been a success story for Homiez, their performance in the Pre-Roll segment highlights the volatility and competitive nature of the cannabis market. The absence of Homiez from the top 30 in both categories in earlier months suggests that their recent success in Concentrates is a relatively new development, marking a positive shift in their market presence. The contrasting performance across these categories underscores the importance of diversified strategies and highlights areas where the brand could potentially focus more resources to enhance their market position.

Competitive Landscape

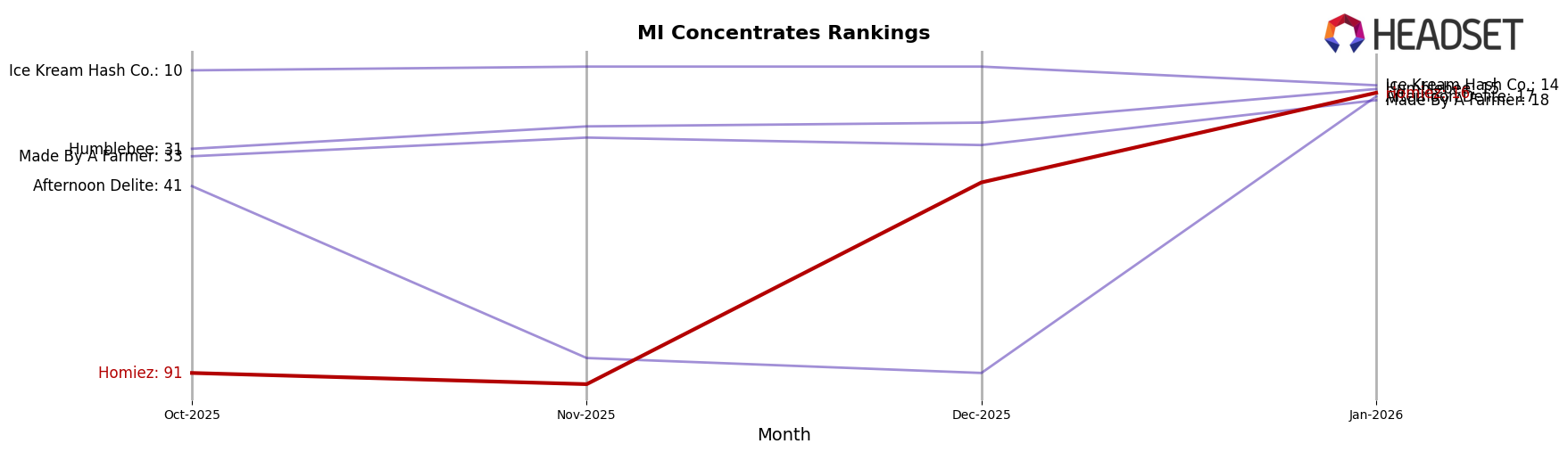

In the Michigan concentrates market, Homiez has demonstrated a remarkable upward trajectory in brand ranking, moving from outside the top 20 in October and November 2025 to an impressive 16th position by January 2026. This significant climb in rank is paralleled by a substantial increase in sales, indicating a strong market presence and growing consumer preference. Notably, Humblebee and Afternoon Delite have also shown notable improvements, with Humblebee advancing from 31st to 15th and Afternoon Delite making a dramatic leap from 91st to 17th in the same period. Meanwhile, Ice Kream Hash Co., although starting from a higher rank, experienced a slight decline from 9th to 14th, suggesting a potential opportunity for Homiez to capture more market share. The competitive landscape indicates that while Homiez is gaining momentum, it faces stiff competition from both established and emerging brands, emphasizing the importance of strategic marketing and product differentiation to maintain its upward trend.

Notable Products

In January 2026, Candyland Infused Pre-Roll 14-Pack (14g) reclaimed its top position as the best-selling product for Homiez, with impressive sales reaching 2472 units. Peaches & Cream Live Resin (1g) moved up to the second rank, showing a significant surge from its fourth position in December 2025. Watermelon Zkittles Infused Pre-Roll (1.3g) entered the rankings at third place, marking its debut in the top performers list. Bomb Pop Live Resin (5g) experienced a slight decline, dropping from fourth to fifth place, while Blue Slushy Live Resin (5g) secured the fifth position for the first time. These shifts indicate a dynamic change in consumer preferences within the Concentrates and Pre-Roll categories.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.