Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

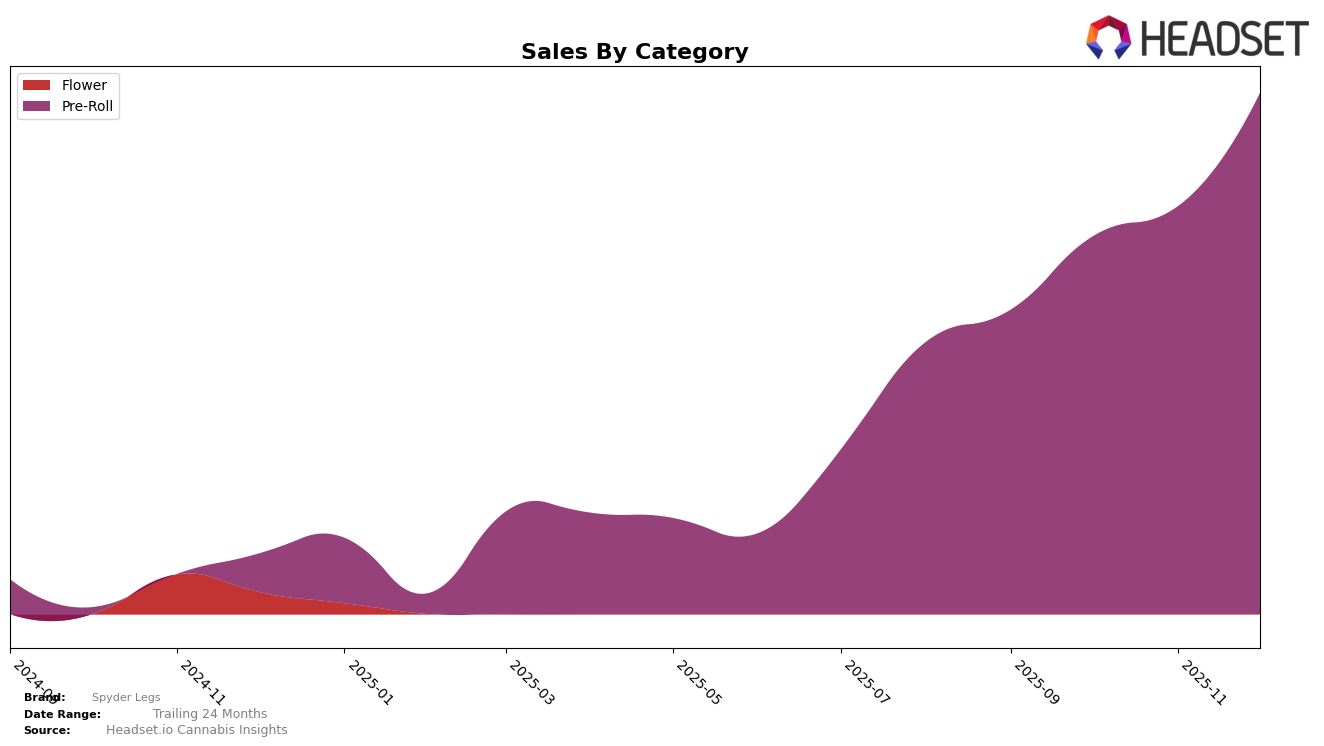

Spyder Legs has demonstrated a noteworthy upward trajectory in the Pre-Roll category in Michigan. Beginning in September 2025, the brand was ranked 41st, but by December, it had climbed to the 22nd position. This consistent improvement over the months indicates a strengthening presence in the market, suggesting effective strategies in product placement or consumer engagement. The increase in sales from $241,129 in September to $413,177 in December further underscores the brand's growing appeal among consumers in Michigan. However, it is important to note that outside of this state, Spyder Legs did not make it into the top 30 rankings, which might suggest areas for potential growth or market expansion.

Focusing solely on Michigan, Spyder Legs' rise in the Pre-Roll category indicates a positive reception of their products, possibly due to quality, branding, or competitive pricing strategies. While the brand did not appear in the top 30 rankings in other states, which could be seen as a limitation, the significant progress in Michigan offers a promising opportunity to replicate this success in other markets. This pattern of performance could serve as a case study for strategic expansion, helping the brand to identify key factors that contributed to their success in Michigan and apply them elsewhere. The absence from top rankings in other regions suggests untapped potential, which could be leveraged for broader market penetration.

Competitive Landscape

In the competitive landscape of the Michigan Pre-Roll category, Spyder Legs has demonstrated a notable upward trajectory in rankings over the last few months of 2025. Starting from a position outside the top 40 in September, Spyder Legs climbed to rank 22 by December, reflecting a significant improvement in market presence. This ascent is particularly noteworthy when compared to competitors like Muha Meds, which also improved its rank from 36 to 21, and Ice Kream Hash Co., which moved from 35 to 24. Meanwhile, High Minded experienced fluctuations, dropping from rank 20 in October to 23 in December, and Rollz maintained a relatively stable position, ending the year at rank 20. The consistent increase in Spyder Legs' sales suggests a growing consumer preference, positioning the brand as a rising contender in the Michigan market.

Notable Products

In December 2025, the top-performing product from Spyder Legs was Blue Dream Infused Pre-Roll 5-Pack (3g), maintaining its number one rank from November with sales reaching 3600 units. Wedding Cake Infused Pre-Roll 5-Pack (3g) climbed to the second position, marking a significant improvement from its previous absence in November's top ranks. Strawberry Cough Infused Pre-Roll 5-Pack (3g) held steady in third place, showing remarkable consistency over the past months. Superboof Infused Pre-Roll 5-Pack (3g) remained in fourth place, reflecting stable demand. Donkey Butter Infused Pre-Roll 5-Pack (3g) dropped to the fifth position, descending from its top rank in September, indicating a shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.