Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

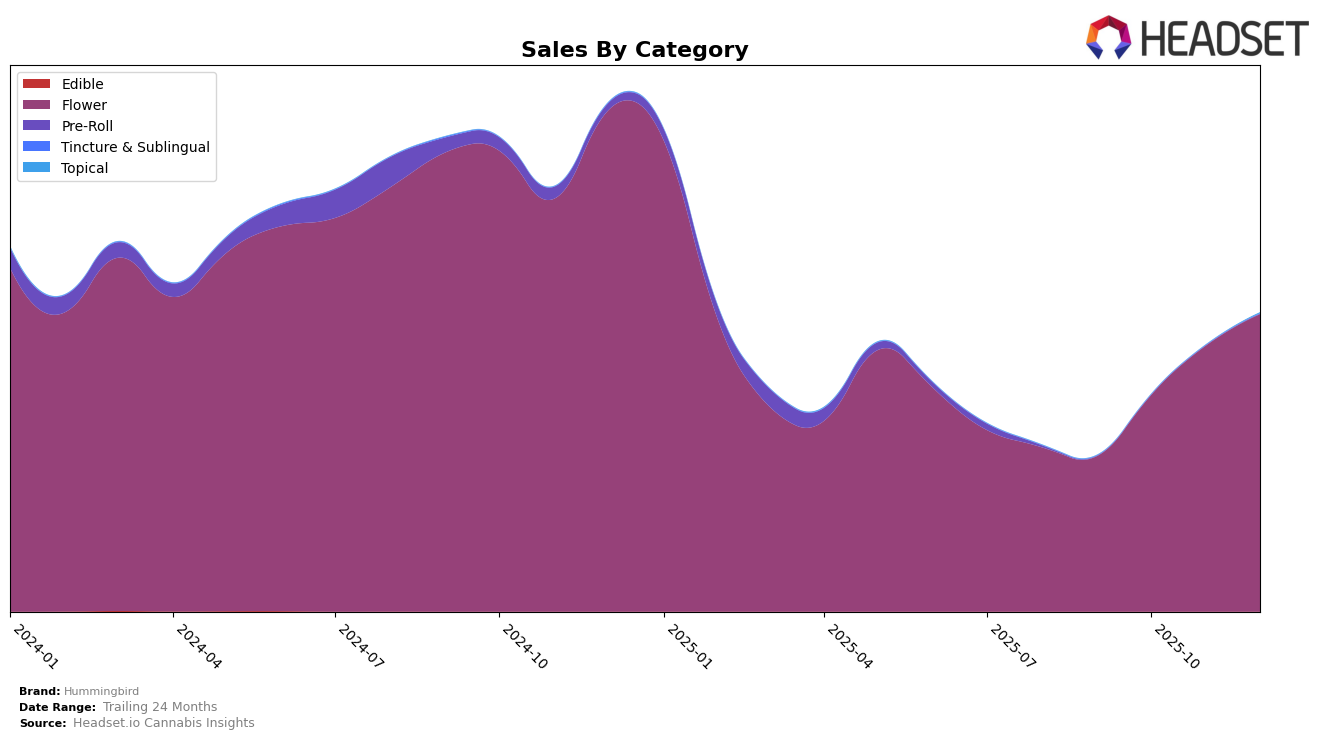

Hummingbird has shown a notable upward trajectory in the Flower category within Colorado. Starting from a rank of 68 in September 2025, the brand has steadily climbed to the 40th position by December 2025. This consistent improvement over the months suggests a growing consumer preference and increased brand recognition in the state. The sales figures support this trend, with a clear increase from September to December, indicating a robust demand for Hummingbird's products. However, it's important to note that despite this progress, the brand has not yet entered the top 30, which would signify a more dominant market presence.

Across other states and categories, Hummingbird's performance seems less prominent as they have not appeared in the top 30 rankings. This absence might suggest challenges in market penetration or competition from more established brands in those regions. The lack of top 30 rankings in other states could be seen as a potential area for strategic focus, where Hummingbird might need to enhance its marketing efforts or product offerings to gain a foothold. Understanding the dynamics of these markets could provide valuable insights for Hummingbird to expand its reach and improve its standings beyond Colorado.

Competitive Landscape

In the competitive landscape of the Colorado flower category, Hummingbird has shown a notable upward trajectory in its rankings over the last few months of 2025. Starting from a rank of 68 in September, Hummingbird climbed to 40 by December, indicating a significant improvement in market presence. This rise in rank is accompanied by a steady increase in sales, suggesting growing consumer preference and brand recognition. In contrast, competitors like Bloom County and Sunshine Extracts have experienced fluctuations, with Bloom County not even making it into the top 20 during this period. Meanwhile, Fresh Cannabis maintained a relatively stable position, though it did experience a slight dip in November. The consistent improvement in Hummingbird's rank and sales, despite the competitive pressures from brands like Seed and Smith (LBW Consulting), which also showed some positive movement, highlights Hummingbird's growing influence in the market.

Notable Products

In December 2025, Hummingbird's top-performing product was Gas Attack (Bulk) in the Flower category, securing the number one rank with notable sales of 1529 units. Peach Panther (Bulk) followed closely as the second top-seller, maintaining a strong position with 1515 units sold. RS11 (Bulk) held the third spot, demonstrating consistent demand. Blue Dream (3.5g) slipped from third place in November to fourth in December, while Blue Dream (14g) dropped from first in November to fifth in December. These shifts highlight the dynamic nature of consumer preferences within the Flower category over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.