Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

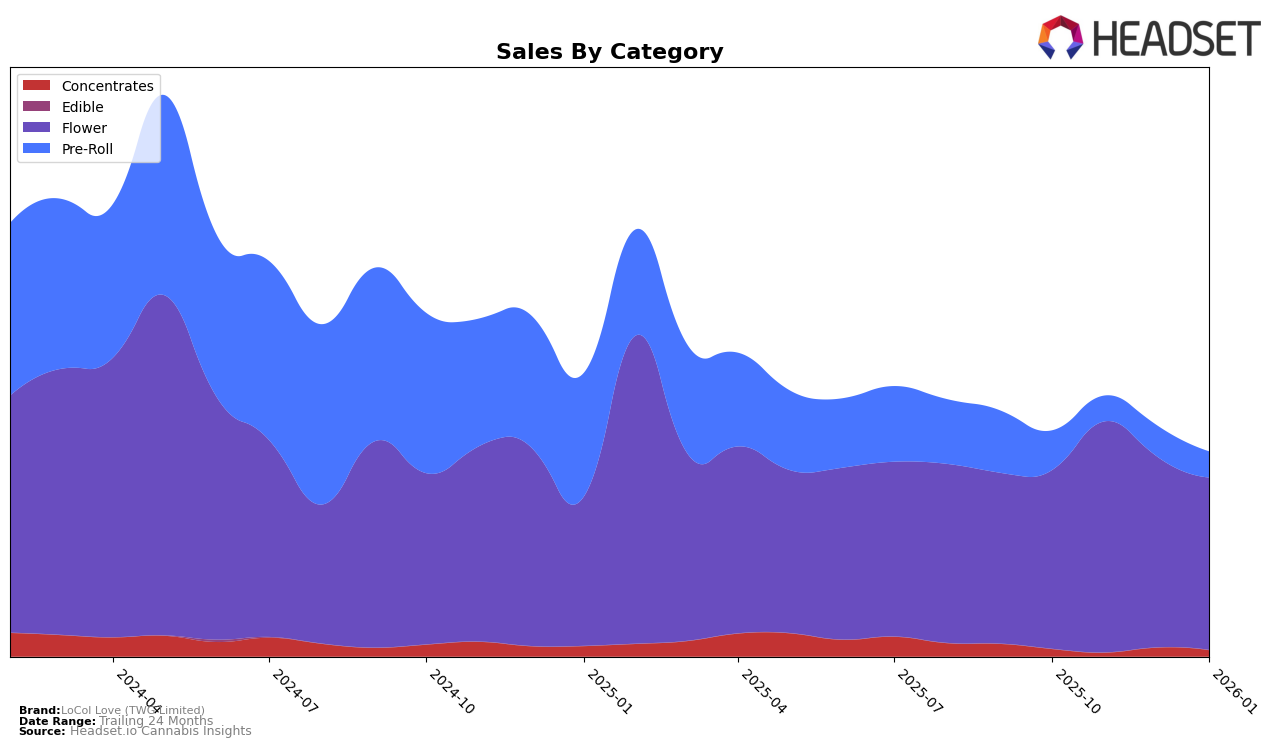

LoCol Love (TWG Limited) has shown varied performance across different product categories in Colorado. In the Flower category, the brand maintained a consistent presence in the top 30, peaking at 19th place in November 2025 before settling at 30th in January 2026. This indicates a strong and stable market presence, although there's a slight downward trend towards the end of the period. On the other hand, their performance in the Concentrates category was less consistent, with the brand failing to make it into the top 30 for several months, only appearing in October and December 2025. This suggests that while LoCol Love is a recognized name in the Flower category, they face challenges in maintaining a similar standing in Concentrates.

In the Pre-Roll category, LoCol Love's rankings fluctuated slightly but remained outside the top 30, with positions ranging from 38th to 44th. Despite not breaking into the top tier, the brand's consistent presence indicates a steady demand for their pre-roll products. However, the sales figures reflect some volatility, with a noticeable drop in November 2025 followed by a recovery in December. This pattern suggests that while the brand has a foothold in the Pre-Roll market, there may be external factors affecting their sales performance. Overall, LoCol Love's varied rankings across categories highlight both their strengths and areas for potential improvement in Colorado.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, LoCol Love (TWG Limited) has experienced fluctuations in its market position, with its rank oscillating between 19th and 30th from October 2025 to January 2026. Despite a brief rise to 19th place in November 2025, LoCol Love's rank slipped to 30th by January 2026, indicating potential challenges in maintaining consistent market traction. Comparatively, The Health Center showed a positive trend, climbing from 36th to 28th, suggesting a strengthening market presence. Meanwhile, Old Pal exhibited volatility, peaking at 16th in December 2025 but dropping to 36th by January 2026, reflecting possible sales instability. Vera also faced ranking challenges, declining from 21st to 34th over the same period. Interestingly, Mischief, which was not in the top 20 initially, made a significant leap to 29th by January 2026, highlighting a potential emerging competitor. These dynamics suggest that while LoCol Love has maintained a presence in the market, it faces stiff competition and must strategize to enhance its market share and stabilize its ranking.

Notable Products

In January 2026, the top-performing product for LoCol Love (TWG Limited) was Drunken Strawberries (Bulk), which ascended to the number one position with a notable sales figure of 8,741 units. Orange Apricot Mac (Bulk), previously ranked first, dropped to the second position with sales of 4,518 units. Colorado Cream Soda (Bulk) made its debut in the rankings at third place, followed closely by Colorado Cream Soda (14g) in fourth. Double Lemon Gucci (14g) entered the top five, securing the fifth spot. This shift in rankings suggests a dynamic change in consumer preferences, with Drunken Strawberries (Bulk) showing significant growth compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.