Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

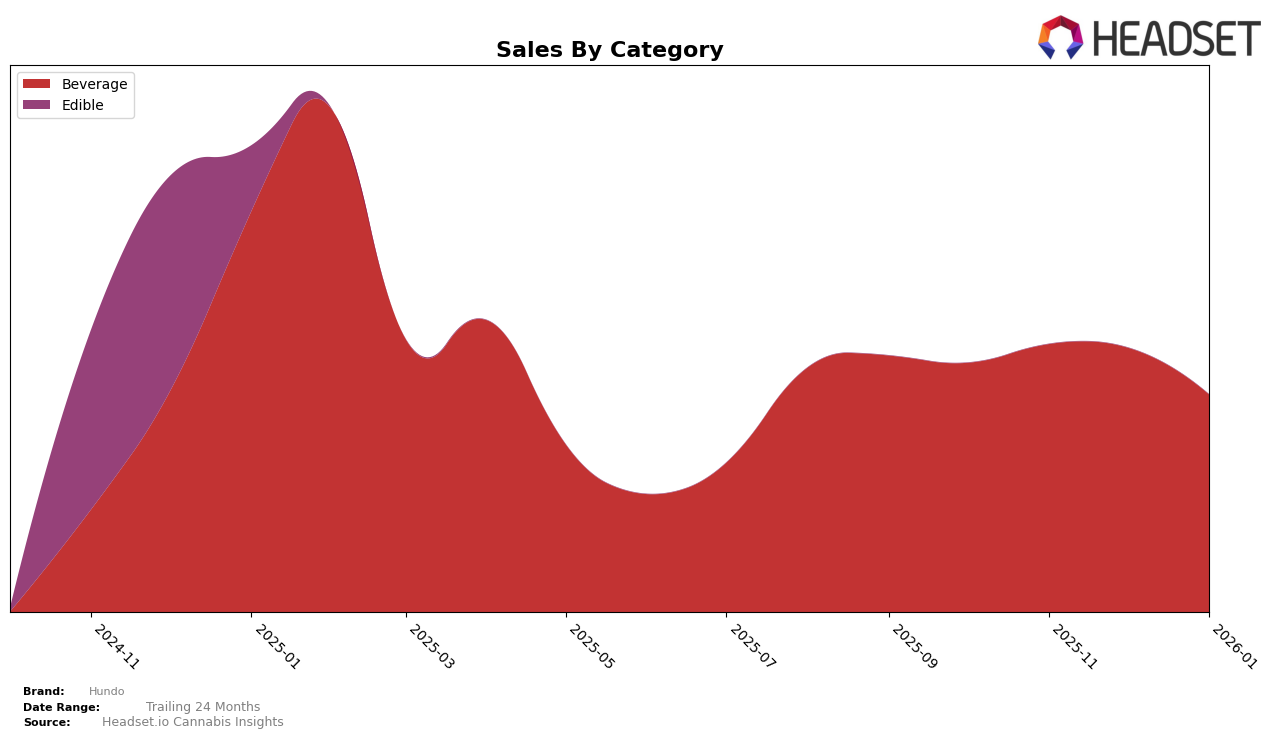

Hundo has demonstrated consistent performance in the Beverage category in California, maintaining a steady position at rank 22 in October and November 2025, and improving slightly to rank 21 in December 2025 and January 2026. This slight upward movement indicates a positive trend in consumer preference or market penetration for Hundo's products within this category. Despite the slight decline in sales from December 2025 to January 2026, Hundo's ability to remain within the top 30 brands is noteworthy, suggesting a stable consumer base or effective market strategies that keep them competitive in a crowded market.

While Hundo's presence in the Beverage category in California is commendable, the absence of rankings in other states or categories could imply either a strategic focus on specific markets or potential areas for growth. The brand's consistent performance in California may serve as a blueprint for expansion strategies in other regions or categories. Keeping an eye on Hundo's future movements could provide insights into their market strategies and potential shifts in consumer preferences across different states and categories.

```Competitive Landscape

In the competitive landscape of the California beverage category, Hundo has shown resilience amidst fluctuating market dynamics from October 2025 to January 2026. Hundo maintained a steady rank at 21st position in December 2025 and January 2026, showing a slight improvement from its 22nd position in October and November 2025. This stability is notable given the volatility experienced by competitors such as Cannavis Syrup, which fell out of the top 20 by January 2026, and High Power, which also dropped out of the top 20 in December 2025 but regained the 20th spot in January 2026. Meanwhile, Voila! demonstrated upward momentum, climbing from 17th to 19th place over the same period. Despite Hundo's consistent ranking, its sales showed a downward trend, culminating in a decrease by January 2026, which suggests a need for strategic adjustments to enhance market share and compete more effectively with brands like Voila! that are gaining traction.

Notable Products

In January 2026, the top-performing product for Hundo was Strawberry Lemonade (100mg THC, 12oz) in the Beverage category, maintaining its first-place position from previous months with sales of 728 units. Classic Lemonade (100mg THC, 12oz) continued to hold the second rank, although its sales figures showed a decline compared to the previous months. Iced Tea Lemonade (100mg THC, 12oz) remained consistently in third place, with a slight decrease in sales. Original Lemonade (100mg THC, 12oz) also maintained its fourth-place ranking, showing some improvement in sales from December 2025. Overall, the rankings for Hundo's top products remained stable from October 2025 to January 2026, despite fluctuations in sales figures.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.