Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

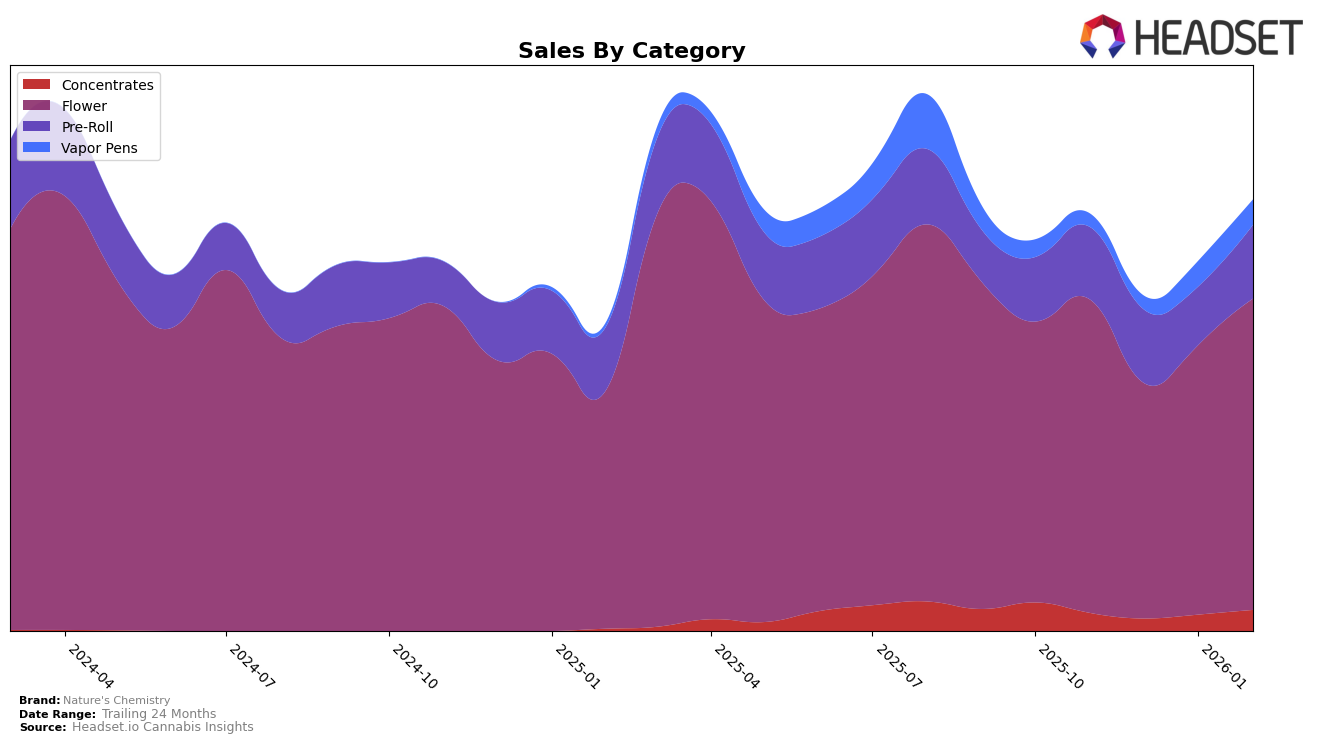

Nature's Chemistry has demonstrated notable performance across various cannabis categories in Nevada. In the Concentrates category, the brand saw a positive trend, moving from rank 21 in December 2025 to 14 by February 2026, indicating a strengthening position in this segment. The Flower category also showed resilience, maintaining a consistent presence in the top 10, ranking 7 in both November 2025 and February 2026. This stability in the Flower category suggests a strong consumer base and brand loyalty. However, in the Vapor Pens category, Nature's Chemistry was not in the top 30 for November and December 2025 but improved to rank 29 by February 2026, signaling a potential growth opportunity for the brand in this area.

In the Pre-Roll category, Nature's Chemistry maintained a steady performance, consistently ranking within the top 11 throughout the observed months, with a slight dip to rank 11 in January 2026 before rebounding to 9 by February. This consistency indicates a reliable demand for their pre-roll products in Nevada. The brand's overall sales trajectory in the state shows a positive trend, particularly in the Concentrates and Flower categories, where sales figures recovered significantly by February 2026, pointing towards a robust market presence. The absence of Nature's Chemistry from the top 30 in certain months for Vapor Pens highlights an area that may require strategic focus to capitalize on potential market share.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Nature's Chemistry has demonstrated resilience and strategic positioning. Over the observed months, Nature's Chemistry maintained a steady presence within the top 10, with a notable improvement from a rank of 10 in December 2025 to 7 in both November 2025 and February 2026. This upward trend in rank is mirrored by a recovery in sales, which dipped in December but rebounded by February. In contrast, Redwood showed a significant climb from rank 22 in November to 6 in February, suggesting aggressive market penetration strategies. Meanwhile, Medizin consistently held a strong position at rank 5, indicating stable market dominance. Good Green experienced fluctuations, peaking at rank 5 in November but dropping to 8 by February, while Lavi showed volatility, missing the top 20 in December but recovering to rank 9 by February. These dynamics highlight the competitive pressures and opportunities for Nature's Chemistry to leverage its brand strength and capitalize on market shifts to enhance its sales trajectory.

Notable Products

In February 2026, the top-performing product for Nature's Chemistry was Garlic Cookies (3.5g) in the Flower category, maintaining its number one rank from previous months with a notable sales figure of 2847. Coconut Milk (3.5g) emerged as the second-best seller in the Flower category, marking its first appearance in the rankings. Garlic Cookies Pre-Roll (1g) experienced a slight drop, moving from second to third place in the Pre-Roll category. OMG Pre-Roll (1g) entered the rankings for the first time, securing the fourth position. Onion Ring (3.5g) in the Flower category ranked fifth, down from its January position, indicating a competitive shift in product preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.