Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

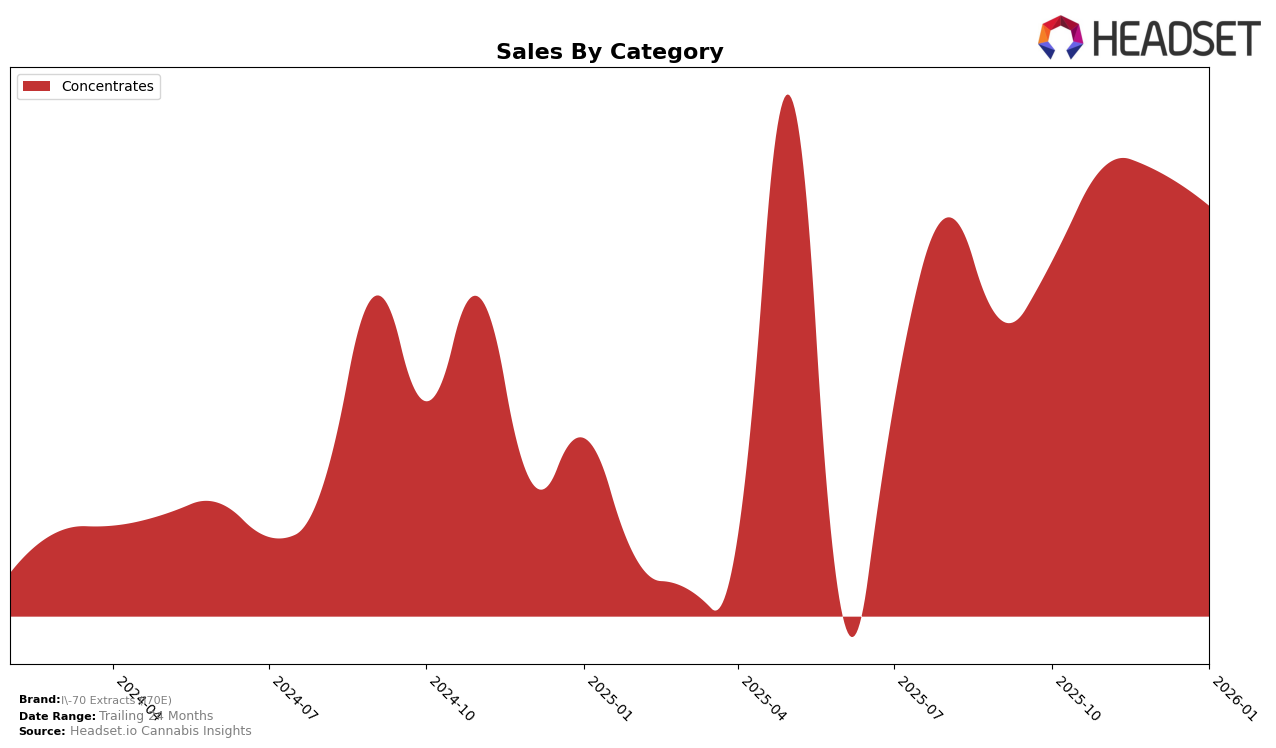

I-70 Extracts (I70E) has demonstrated a steady presence in the Colorado market, particularly within the Concentrates category. The brand has maintained a consistent ranking within the top 30, with notable fluctuations over the past few months. Starting from 23rd position in October 2025, I70E improved to 19th by November, briefly dipped to 21st in December, and regained its 19th spot by January 2026. This movement suggests a resilient market performance, with the brand managing to hold its ground amidst competitive pressures in the Concentrates category. The sales figures reflect a peak in November 2025, indicating a successful strategy that month, although a slight decline was observed by January 2026.

While I-70 Extracts (I70E) has maintained a strong presence in Colorado, the absence of rankings in other states or provinces highlights potential areas for growth. The lack of top 30 placements outside of Colorado could be viewed as a missed opportunity to expand the brand's footprint and capitalize on emerging markets. This limitation suggests that while I70E is a recognized player within its home state, there is room for strategic expansion to enhance its market share across broader regions. Focusing on diversifying its geographical reach could be a beneficial strategy moving forward, potentially leading to increased brand recognition and revenue across new territories.

Competitive Landscape

In the competitive landscape of the Colorado concentrates market, I-70 Extracts (I70E) has shown a fluctuating performance in terms of rank from October 2025 to January 2026. Starting at the 23rd position in October, I70E improved to 19th in November, dropped slightly to 21st in December, and regained the 19th spot by January. This indicates a resilient positioning amidst a competitive field. Notably, Colorado's Best Dabs (CBD) consistently maintained a higher rank than I70E, although it showed a downward trend from 16th to 20th over the same period. Meanwhile, El Sol Labs remained ahead of I70E, albeit with a slight decline from 14th to 17th. TFC (The Flower Collective LTD) showed a similar pattern of fluctuation, ending in the same 18th position as in October. Interestingly, Lazercat Cannabis experienced a notable jump from 24th to 15th in November, before settling back to 21st by January. These dynamics suggest that while I70E is holding its ground, there is significant movement among competitors, highlighting the need for strategic initiatives to enhance market share and rank stability.

Notable Products

In January 2026, the top-performing product for I-70 Extracts (I70E) was Oreoz Biscotti Sugar Wax (1g) in the Concentrates category, securing the number one rank with sales of 691 units. Following closely were Devil Driver Sugar Wax (1g) and Devil Driver Sugar Wax (4g), ranked second and third, respectively. Chimera Sugar Wax (1g) held the fourth position, while Oreoz Biscotti Sugar Wax (4g) rounded out the top five. Notably, these rankings represent a strong performance for the Concentrates category, as all top five products belong to it. Compared to previous months, these products have shown an impressive rise, as earlier rankings were not available, indicating a potential introduction or relaunch in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.