Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

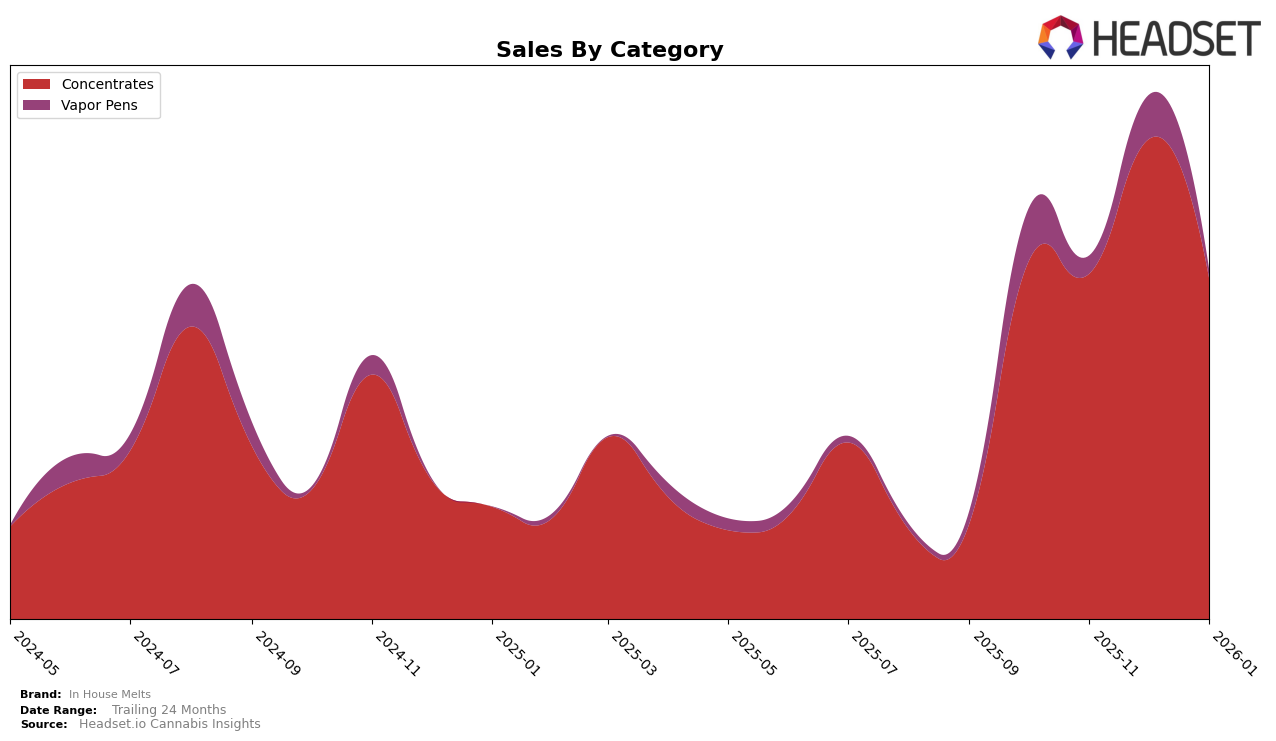

In House Melts has demonstrated varied performance across different product categories and states. In the Concentrates category within Colorado, the brand experienced a fluctuating ranking over the months. Starting at 25th in October 2025, it saw a rise to 17th in December before dropping back to 25th by January 2026. This movement suggests a competitive market where In House Melts managed to briefly capture a more significant market share but struggled to maintain its position. Such volatility could be indicative of external market factors or shifts in consumer preferences, which may require strategic adjustments from the brand to stabilize or improve its ranking.

In the Vapor Pens category, also in Colorado, In House Melts did not consistently appear in the top 30, with rankings available only for October and December 2025. The brand ranked 79th in October and improved to 75th in December, but it did not maintain its presence in the top 30 for the other months. This sporadic visibility suggests challenges in gaining a foothold in this category, possibly due to intense competition or limited product differentiation. The absence of a ranking in certain months can be a critical area for the brand to address if it aims to achieve sustained growth and visibility in the Vapor Pens market.

Competitive Landscape

In the competitive landscape of the concentrates category in Colorado, In House Melts has demonstrated notable fluctuations in its market position from October 2025 to January 2026. Starting at rank 25 in October 2025, In House Melts improved its standing to 17 by December, before experiencing a decline to rank 25 again in January 2026. This volatility contrasts with competitors like Olio, which saw a consistent downward trend from rank 10 in October to falling out of the top 20 by January, and Bud Fox Supply Co, which also dropped from rank 13 to 24 over the same period. Meanwhile, West Edison maintained a relatively stable position, hovering around the low 20s, and The Greenery Hash Factory remained consistently in the mid-20s. Despite the fluctuations, In House Melts' sales in December were notably higher compared to other months, indicating potential for growth if the brand can stabilize its ranking amidst the competitive pressures.

Notable Products

In January 2026, the top-performing product from In House Melts was Foul Fingers Live Rosin (1g), maintaining its number one rank from December 2025 with notable sales of 170 units. Grape Piepaya Full Spectrum Live Rosin (1g) emerged as the second top seller, a new entry in the rankings for January. Saru Full Spectrum Live Rosin (1g) secured the third spot, also making its first appearance in the monthly rankings. Death Coast 90u Live Rosin (1g) dropped from its November 2025 third-place rank to fourth in January, with sales figures reflecting this shift. Papaya Petrol Full Spectrum Rosin (1g) debuted in the rankings at fourth place, indicating a strong market entry.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.