Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

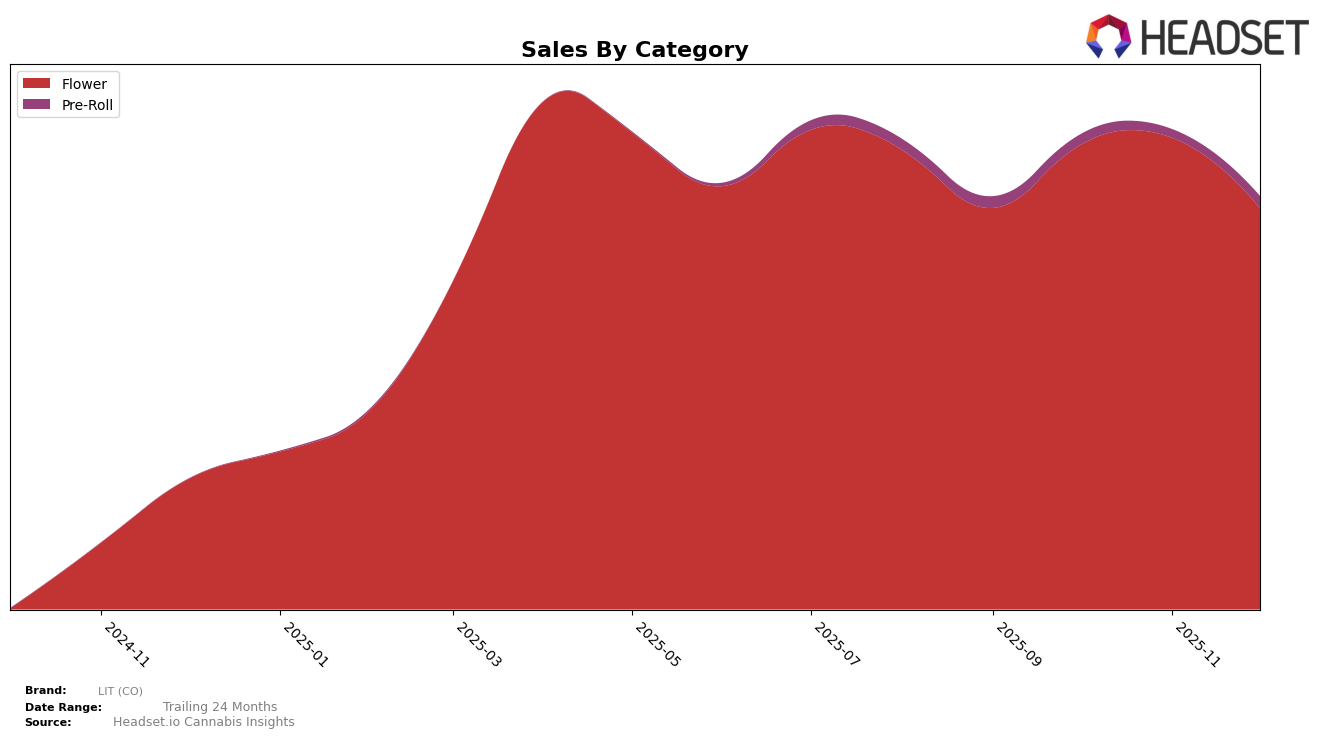

In the state of Colorado, LIT (CO) has shown a consistent performance in the Flower category throughout the last quarter of 2025. The brand moved up from the 7th rank in September to 5th in November, before settling back to 7th in December. This suggests a strong competitive presence in the market, with only slight fluctuations in their ranking. The sales figures for December indicate a decrease from the previous month, aligning with the drop in rank. However, the overall trend for the quarter shows resilience and a capacity to maintain a top 10 position consistently.

In contrast, LIT (CO)'s performance in the Pre-Roll category in Colorado presents a different narrative. The brand was not ranked in the top 30 for November, indicating a potential struggle in maintaining a foothold in this category. Despite this, they managed to re-enter the rankings in December at the 63rd position. The sales figures mirror this volatility, with a noticeable dip in October followed by a recovery in December. This fluctuation suggests that while LIT (CO) has a strong presence in the Flower category, there is room for improvement in their Pre-Roll offerings to achieve a more stable market position.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, LIT (CO) has experienced some fluctuations in its ranking over the last few months of 2025. While LIT (CO) maintained a strong position, ranking 7th in September and December, it climbed to 5th place in November, indicating a temporary surge in market performance. This fluctuation is notable when compared to competitors such as 710 Labs, which showed a consistent upward trajectory, moving from 18th in September to 6th by November and December. Similarly, 14er Boulder made a significant leap from 11th to 5th place in December, surpassing LIT (CO) in the process. Meanwhile, In The Flow and Equinox Gardens maintained relatively stable positions, with minor fluctuations. These dynamics suggest that while LIT (CO) remains a strong contender, it faces stiff competition from brands that are either rapidly ascending or maintaining stable positions in the market, highlighting the importance of strategic adjustments to sustain and improve its market rank.

Notable Products

In December 2025, the top-performing product for LIT (CO) was Super Lit Pre-Roll (1g) from the Pre-Roll category, which climbed to the first position with sales reaching 4066. Flight Risk (28g) from the Flower category secured the second rank, showing a significant leap from fourth place in November. Blue Garlic (Bulk) maintained a strong presence, ranking third, though it dropped from its first-place position in November. Cherry Sudz (Bulk) advanced to fourth place, improving from fifth in the previous month. Notably, Runtz (Bulk) appeared in the rankings for the first time, capturing the fifth position in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.