Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

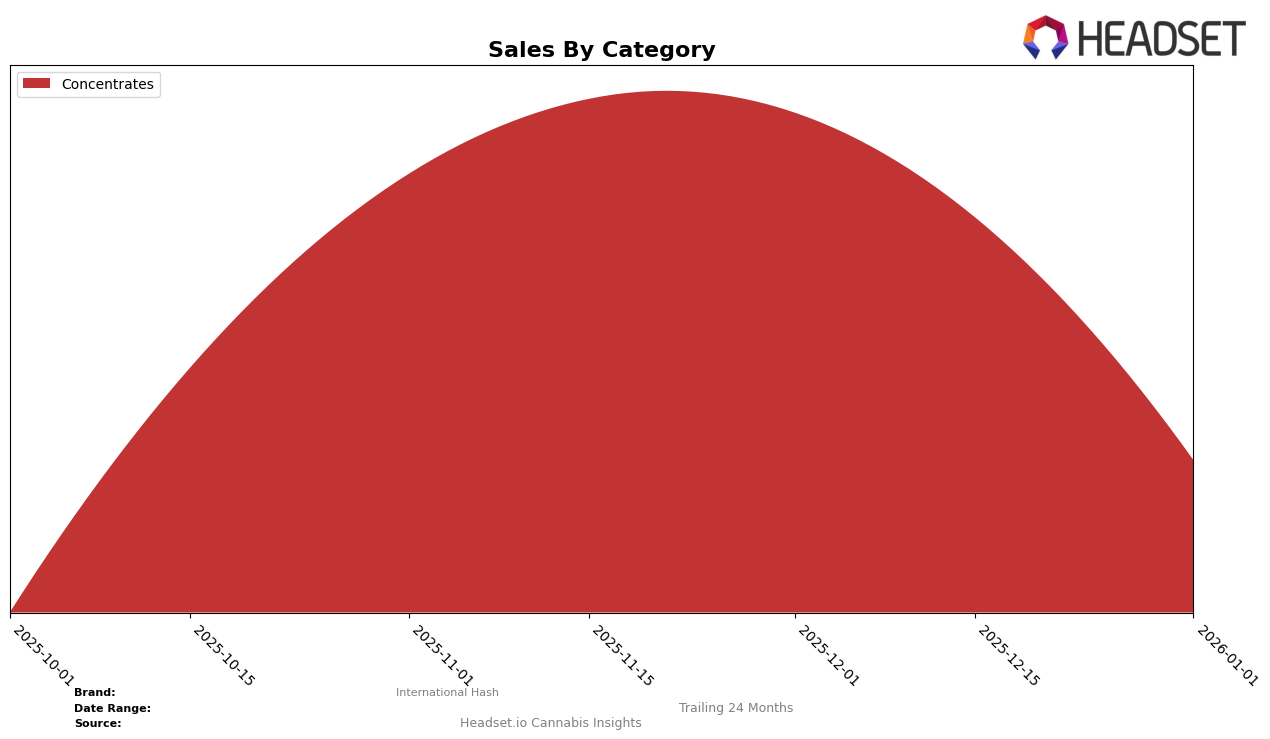

International Hash has shown notable fluctuations in its performance across different states and categories. In the New York market, the brand has experienced a significant rise in the Concentrates category, moving from an unranked position in October 2025 to securing the 15th spot by November. This upward trajectory continued into December with a climb to the 12th position, although a drop to the 30th position was observed in January 2026. Such movements indicate a strong but inconsistent presence in the New York market, suggesting potential challenges in maintaining a steady market position.

Despite these fluctuations, the sales figures for International Hash in the Concentrates category in New York reveal an interesting trend. The brand's sales increased from $87,297 in October to $99,350 in November, showcasing a positive growth trajectory. However, by January 2026, sales had declined to $30,895, reflecting the drop in ranking. This decline suggests possible market saturation or increased competition, which might have impacted the brand's ability to sustain its earlier gains. These dynamics highlight the volatile nature of the cannabis market and the challenges brands face in maintaining consistent performance across different periods.

```Competitive Landscape

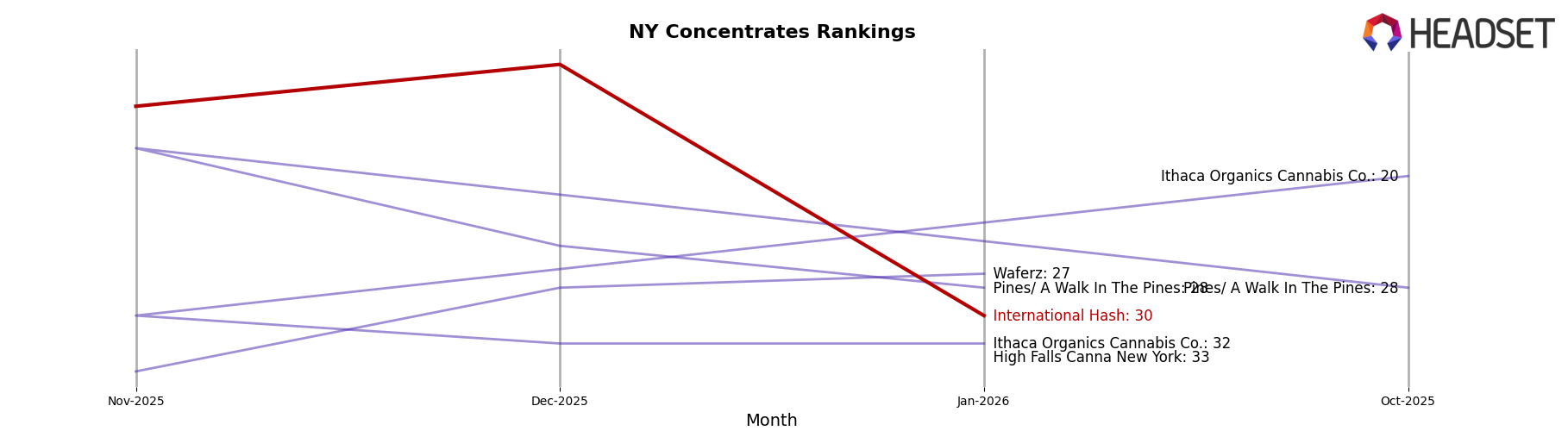

In the New York concentrates market, International Hash experienced a notable fluctuation in its ranking and sales from October 2025 to January 2026. Initially absent from the top 20 in October, International Hash surged to rank 15 in November and further climbed to 12 in December, before dropping to 30 in January. This volatility contrasts with competitors like Pines/ A Walk In The Pines, which maintained a relatively stable presence, peaking at rank 18 in November and ending at 28 in January. Meanwhile, Waferz showed a consistent upward trend, improving from outside the top 20 in October to rank 27 by January. Despite the January dip, International Hash's sales in November and December were significantly higher than those of Ithaca Organics Cannabis Co., indicating a strong competitive position during those months. However, the sharp decline in January suggests potential challenges that may need addressing to sustain its market presence.

Notable Products

In January 2026, Sour Diesel (Sour Diesel x Biker Kush) Live Rosin (1g) emerged as the top-performing product for International Hash, ranking 1st with notable sales of 94 units. Bonanza Live Rosin (1g) followed closely in 2nd place, while Cherry Capri Sun Live Rosin (1g) secured the 3rd spot. Grape Kool Aid Live Rosin (1g) ranked 4th, showing strong sales performance. Interestingly, Cherry Capri Sun Cold Cure Hash Rosin (1g) experienced a drop to 5th place from its previous higher rankings, indicating a shift in consumer preference. This change in rankings highlights a dynamic market where new products are gaining traction over previously popular ones.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.