Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

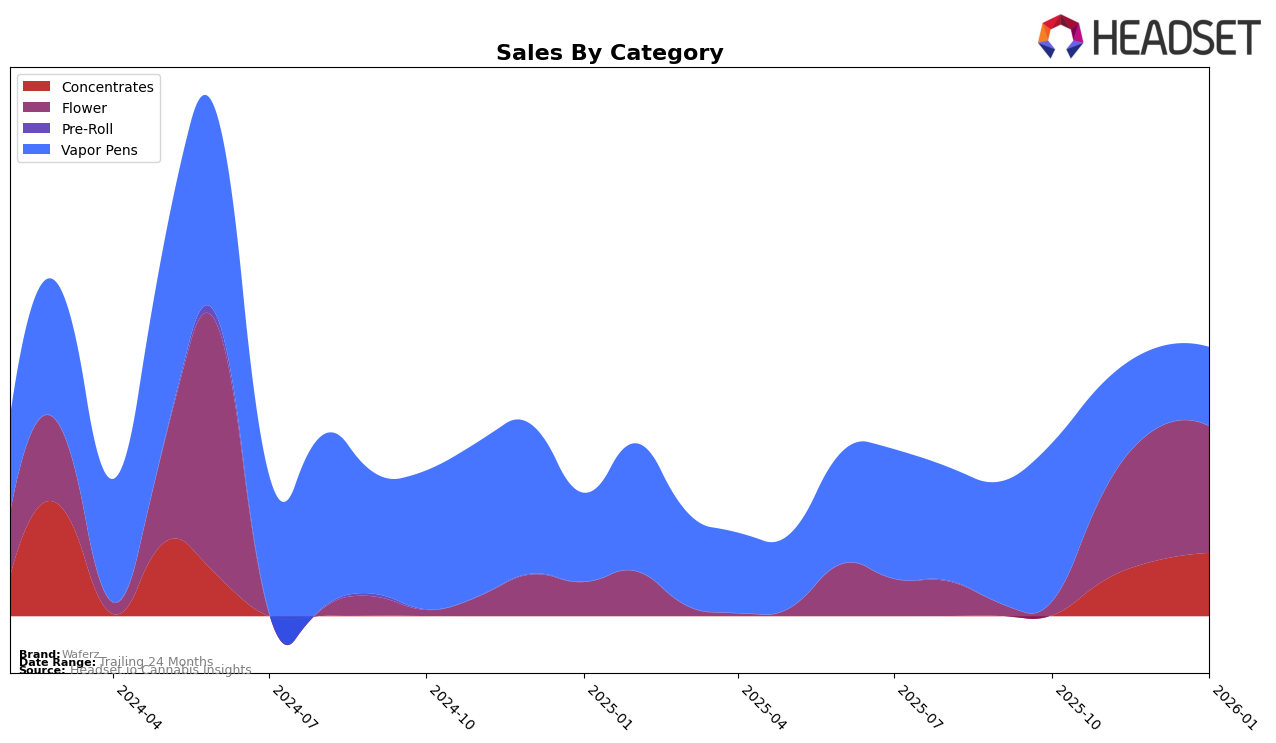

Waferz has shown some interesting movements across different states and categories. In California, Waferz's performance in the Vapor Pens category has been notable, although it did not make it into the top 30 rankings from October 2025 onwards. This absence from the top rankings could indicate a competitive market or a need for Waferz to reassess its strategies in this category. Despite this, the brand recorded sales of $87,936 in October 2025, suggesting a presence in the market that might not yet translate into top rankings but still holds potential for growth.

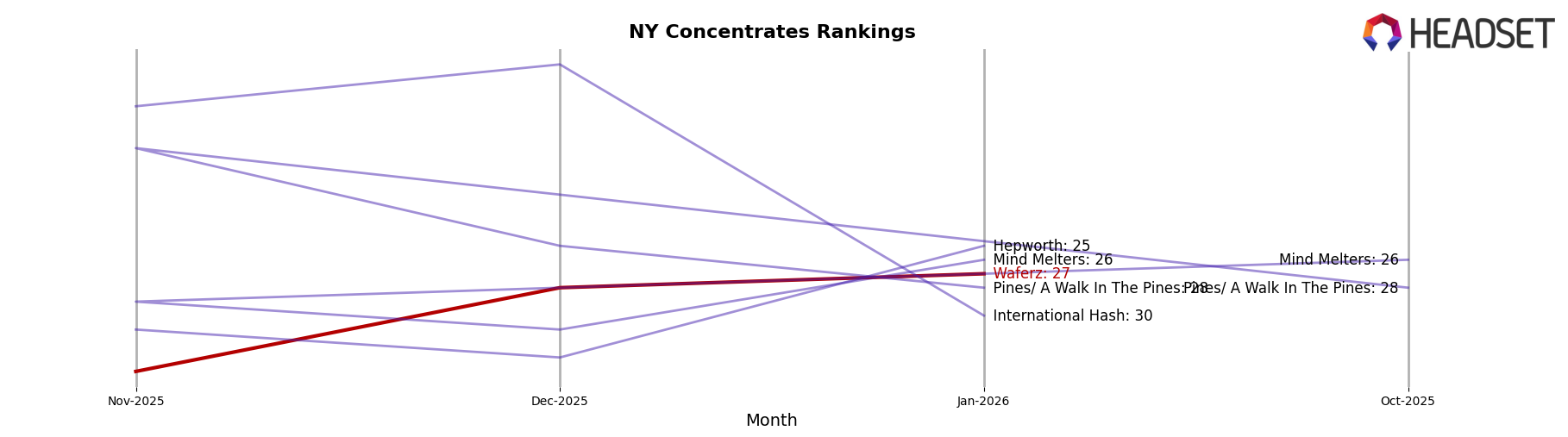

In contrast, Waferz has demonstrated a positive trajectory in the Concentrates category in New York. Starting from being outside the top 30 in October 2025, Waferz climbed to 34th in November, subsequently reaching 28th and 27th in December 2025 and January 2026, respectively. This upward trend in rankings, coupled with increasing sales figures—culminating in $32,834 in January 2026—suggests a strengthening position within the New York market. This growth trajectory in the Concentrates category highlights Waferz's potential to continue improving its standing and expanding its market share in the state.

Competitive Landscape

In the competitive landscape of the New York concentrates market, Waferz has shown a steady improvement in its rankings from November 2025 to January 2026, moving from 34th to 27th place. This upward trend is indicative of a positive reception and growing market presence, although it still trails behind competitors like Hepworth, which jumped to 25th place by January 2026, and Pines/ A Walk In The Pines, which fluctuated but ended at 28th place. Notably, International Hash experienced a significant drop from 12th to 30th place, potentially opening up opportunities for Waferz to capture more market share. Meanwhile, Mind Melters maintained a competitive edge, closely aligning with Waferz's trajectory by ending at 26th place. The sales figures reflect these dynamics, with Waferz seeing consistent growth, yet still needing to bridge the gap with higher-performing brands like Hepworth, which saw a notable sales increase in January 2026. This competitive analysis highlights the importance for Waferz to continue leveraging its upward momentum to further close the gap with its competitors in the New York concentrates market.

Notable Products

In January 2026, the top-performing product for Waferz was the Orange Cake Live Resin Badder (1g) in the Concentrates category, which climbed to the number one rank with sales reaching 550 units. The Lemon Orange Cake Live Resin Crushed Diamond Coated Flower (7g) in the Flower category, which held the top spot in December 2025, dropped to second place with 447 units sold. OG Kush Live Resin Cartridge (1g) maintained its position at third in the Vapor Pens category, with sales of 444 units. Master Bubba Live Resin Cartridge (1g) experienced a decline, moving from an unranked position in previous months to fourth place. Classic - Granddaddy Purple Live Resin Cartridge (1g) entered the rankings at fifth place, marking its first appearance in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.