Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

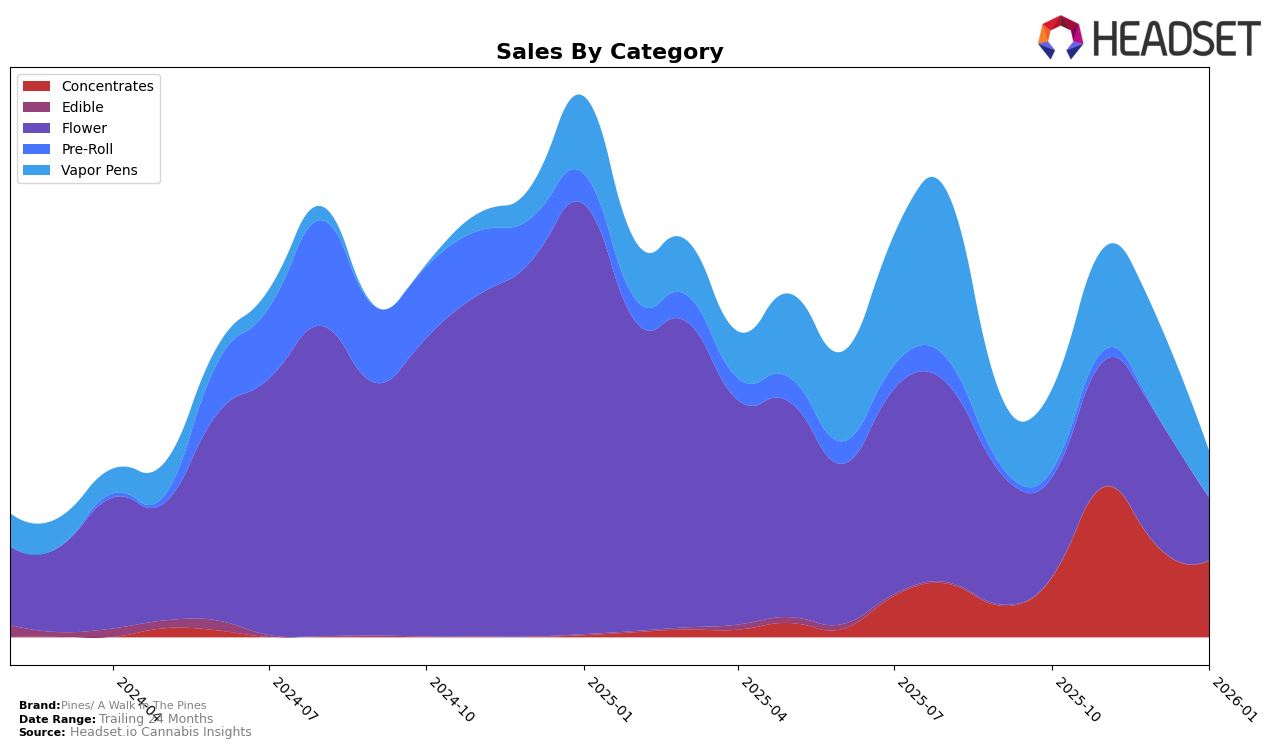

Pines/ A Walk In The Pines has shown varying performance across different categories and states over the recent months. In the Concentrates category within New York, the brand experienced a fluctuating ranking, starting at 28th in October 2025, moving up to 18th in November, then down to 25th in December, and back to 28th by January 2026. This indicates a volatile presence in the market, with a notable peak in November. The brand's ability to break into the top 30 in this category is commendable, although maintaining a consistent upward trajectory remains a challenge.

In contrast, the Vapor Pens category in New York presents a different story for Pines/ A Walk In The Pines. Despite starting at a lower ranking of 82nd in October 2025 and briefly improving to 77th in November, the brand struggled to maintain its position, eventually slipping to 95th by January 2026. This indicates that the brand is facing significant competition or challenges in this segment. The absence from the top 30 rankings highlights the need for strategic adjustments to enhance their market presence in this category. Such insights reveal both opportunities for growth and areas requiring attention for Pines/ A Walk In The Pines.

Competitive Landscape

In the competitive landscape of the New York concentrates market, Pines/ A Walk In The Pines has experienced fluctuating rankings and sales over the past few months. Starting at rank 28 in October 2025, the brand saw a significant improvement to rank 18 in November, driven by a notable increase in sales. However, by December, the brand's rank slipped to 25, and further to 28 in January 2026, indicating a challenging market environment. In contrast, Waferz showed a consistent upward trend, climbing from outside the top 20 to rank 27 by January, suggesting a growing consumer preference. Meanwhile, International Hash maintained strong sales, peaking at rank 12 in December before dropping to 30 in January, highlighting volatility in consumer demand. Additionally, Mind Melters demonstrated resilience, ending January at rank 26, slightly ahead of Pines/ A Walk In The Pines. These dynamics underscore the competitive pressures Pines/ A Walk In The Pines faces, emphasizing the need for strategic marketing efforts to regain and sustain higher market positions.

Notable Products

In January 2026, the top-performing product for Pines/ A Walk In The Pines was Iced Sangria 3.5g in the Flower category, which climbed to the number one spot with a notable sales figure of 289. Crazy Train 3.5g, also in the Flower category, followed closely in second place, maintaining a consistent presence among the top ranks from the previous month. Papaya Bomb 3.5g made its debut in the rankings, securing the third position in January. Pie Piss 3.5g, which had been ranked second in November, dropped to fourth place by January. Lemon Pines Live Resin Disposable 1g entered the top five for the first time, highlighting a growing interest in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.