Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

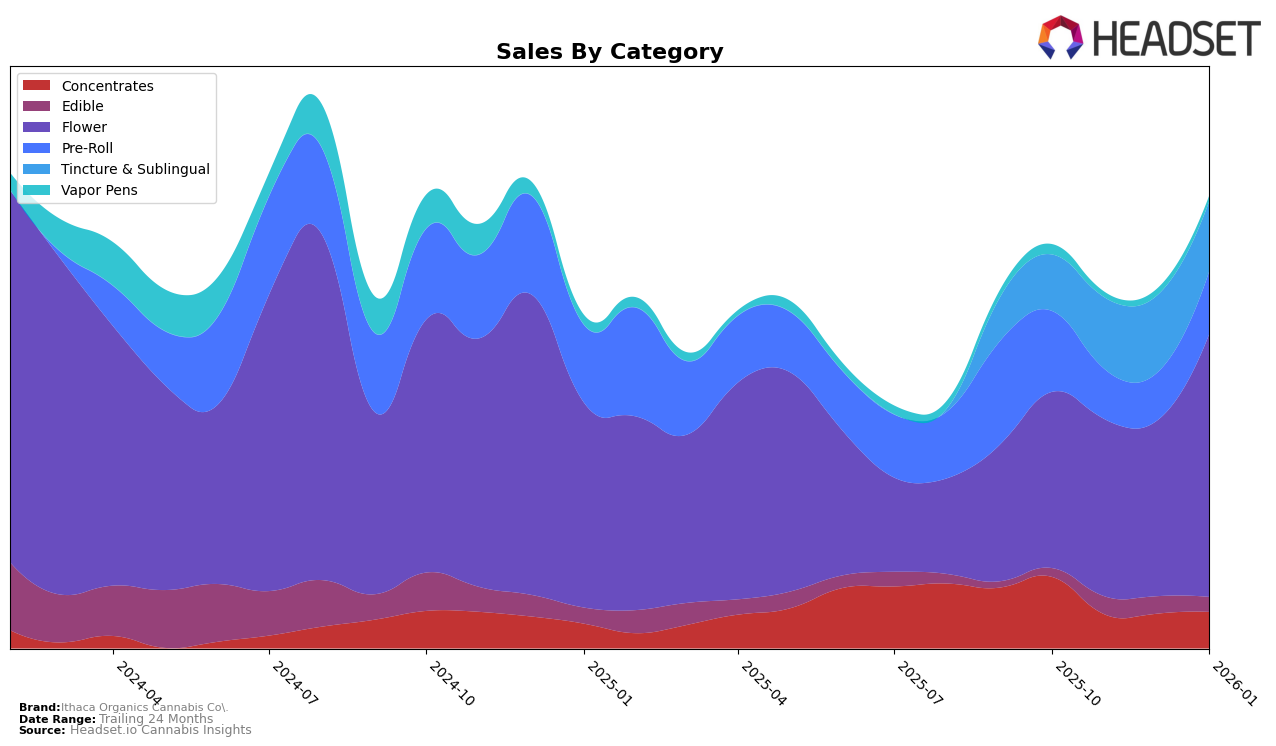

Ithaca Organics Cannabis Co. has shown varied performance across different product categories in New York. In the Concentrates category, the brand experienced a downward trend, slipping from 20th place in October 2025 to 32nd place by January 2026. This indicates a need for strategic adjustments to regain market share. Meanwhile, the Edible category tells a slightly different story. Ithaca Organics was not in the top 30 in October 2025, but entered the rankings at 67th in November, although it further declined to 75th by December. This initial entry into the rankings could be seen as a positive step, but the subsequent drop suggests challenges remain in capturing consumer interest. The Flower category has been a bright spot, with a significant jump from 89th in December to 66th in January 2026, showing a promising upward trajectory that might be worth exploring further.

In the Pre-Roll category, Ithaca Organics made an appearance in October 2025 at 94th place but then fell out of the top 30 entirely in subsequent months, which could be a concern for the brand in maintaining visibility in this segment. On a more positive note, the Tincture & Sublingual category has consistently been a strong performer for the brand, maintaining a solid presence within the top 10, peaking at 6th place in November and December before settling at 7th in January 2026. This consistency suggests that Ithaca Organics has a strong foothold in this category, which could serve as a model for improving performance in other segments. Overall, while there are areas of concern, particularly in Concentrates and Pre-Rolls, the brand's performance in the Flower and Tincture & Sublingual categories provides a foundation for potential growth in New York.

Competitive Landscape

In the competitive landscape of the New York flower category, Ithaca Organics Cannabis Co. has demonstrated a notable upward trajectory in recent months. From October 2025 to January 2026, Ithaca Organics Cannabis Co. improved its rank from 85th to 66th, indicating a significant enhancement in market presence. This upward movement is particularly impressive when compared to competitors such as Binske and Pot & Head, both of which experienced fluctuating ranks and a general decline in sales. Meanwhile, Major and ghost. have maintained relatively stable positions, with Major showing a slight upward trend in sales. Ithaca Organics Cannabis Co.'s sales surge in January 2026, reaching a peak that surpassed its previous months, suggests a growing consumer preference and effective marketing strategies that have bolstered its competitive standing in the New York market.

Notable Products

In January 2026, the top-performing product from Ithaca Organics Cannabis Co. was Zoap Pre-Roll (1g) in the Pre-Roll category, achieving the number 1 rank with sales of $1,035. Peach Maraschino Pre-Roll (1g) followed closely in second place, also in the Pre-Roll category. Strawberry Bubbles (3.5g) maintained its consistent performance in the Flower category, securing the third rank for three consecutive months from November 2025 to January 2026. Honolulu Haze (3.5g) and Piff Haze (3.5g) rounded out the top five, ranking fourth and fifth respectively, both making their debut in the January rankings. Notably, the rankings have shown stability for Strawberry Bubbles, while the other products made significant entries in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.