Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

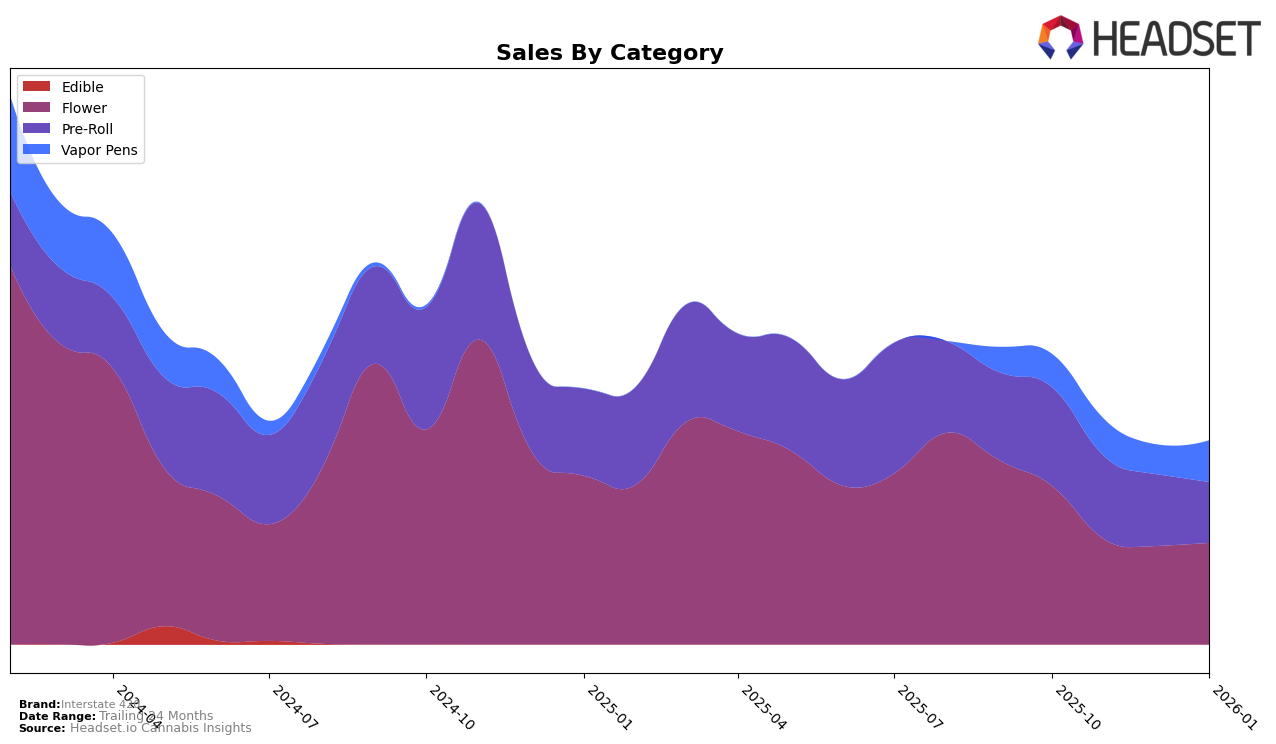

Interstate 420's performance in Illinois has shown varying trends across different product categories. In the Flower category, the brand experienced a decline in its ranking, moving from 26th in October 2025 to 38th by January 2026. This drop indicates a potential challenge in maintaining its competitive edge in this category. Conversely, the Vapor Pens category saw some improvement, with the brand moving up from the 53rd position in December 2025 to 45th in January 2026, suggesting a positive reception or strategic adjustments in this segment. However, the brand did not make it into the top 30 in this category, which could be seen as a missed opportunity to capture more market share.

The Pre-Roll category presents a more stable picture for Interstate 420 in Illinois. While the brand's ranking slipped slightly from 13th in October 2025 to 19th by January 2026, it consistently remained within the top 20. This steady presence could indicate a strong customer base or effective product offerings in this segment. Despite the downward trend, maintaining a position in the top 20 suggests a solid foothold in the Pre-Roll market. The sales figures reflect these movements, with the brand experiencing fluctuations in revenue across the months, highlighting the dynamic nature of consumer preferences and competitive pressures in the cannabis industry.

Competitive Landscape

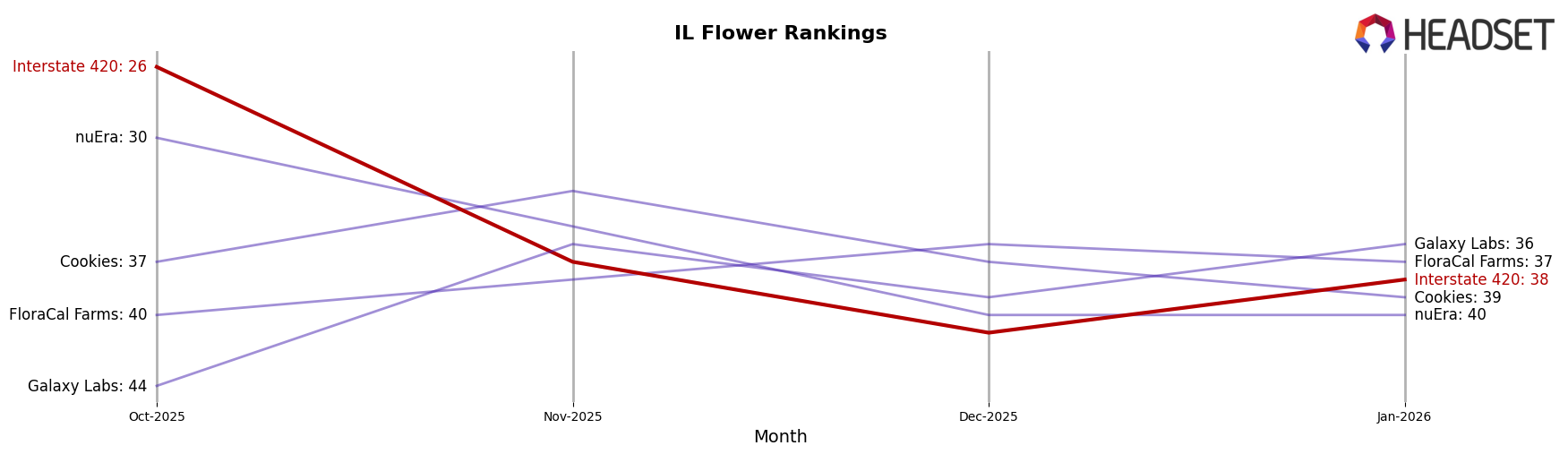

In the competitive landscape of the Illinois flower category, Interstate 420 has experienced notable fluctuations in its market position over the past few months. Starting from a rank of 26 in October 2025, it saw a decline to 37 in November, further dropping to 41 in December, before slightly recovering to 38 in January 2026. This downward trend in rank suggests increasing competition and challenges in maintaining market share. Notably, Cookies, although not in the top 20, consistently outperformed Interstate 420 in sales, indicating a strong customer preference. Meanwhile, FloraCal Farms showed a positive trajectory, improving its rank from 40 in October to 37 in January, potentially capturing some of Interstate 420's market share. Similarly, Galaxy Labs demonstrated resilience, improving its rank from 44 in October to 36 in January, suggesting a competitive edge in product offerings or pricing strategies. These dynamics highlight the need for Interstate 420 to reassess its marketing and product strategies to regain its competitive position in the Illinois flower market.

Notable Products

In January 2026, Black Cherry Gelato Pre-Roll (0.7g) maintained its position as the top-selling product for Interstate 420, continuing its lead from the previous three months despite a slight decrease in sales to 2851. Black Inferno Pre-Roll (0.7g) also held steady in second place, showing consistency in its ranking since November 2025. Stella Blue Pre-Roll (0.7g) remained in third place, although its sales saw a slight dip compared to December 2025. Jungle Pie Pre-Roll (0.7g) re-entered the rankings at fourth place, indicating a resurgence in popularity. Notably, Don Shula Cured Resin Cartridge (1g) appeared in the rankings for the first time, debuting at fifth place, suggesting a growing interest in vapor pens among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.