Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

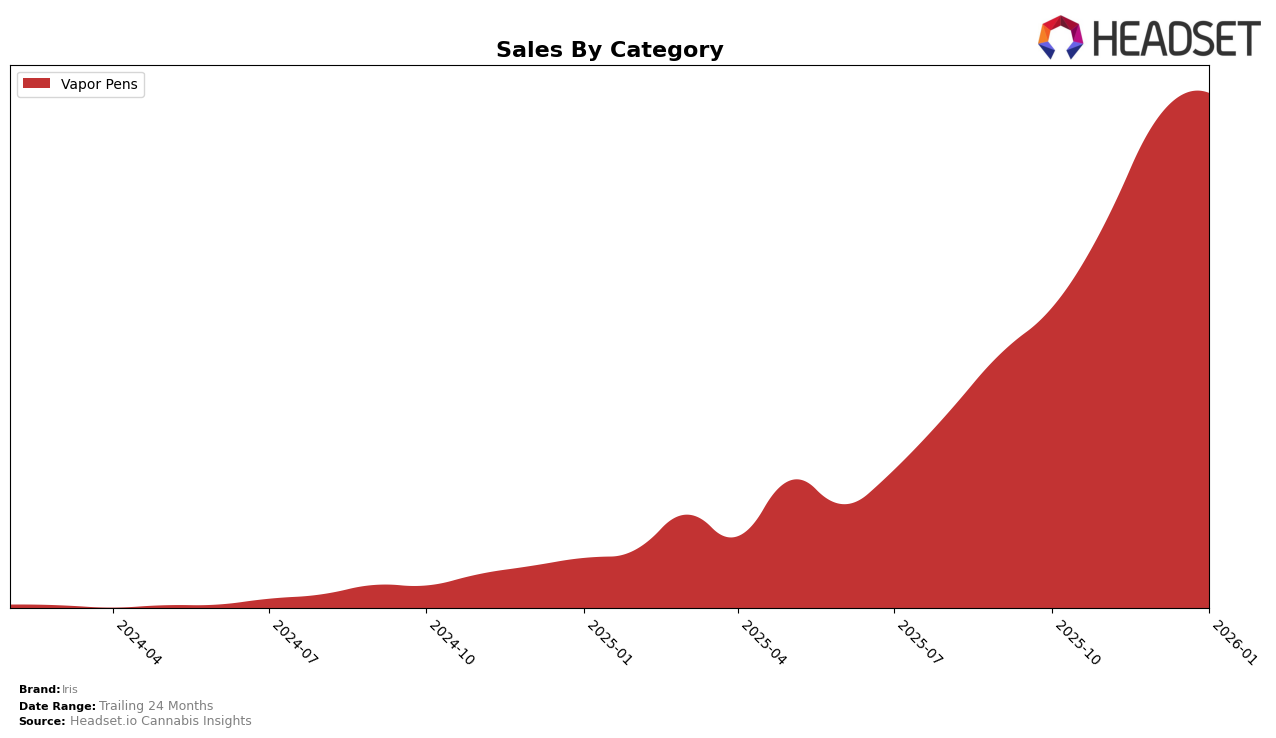

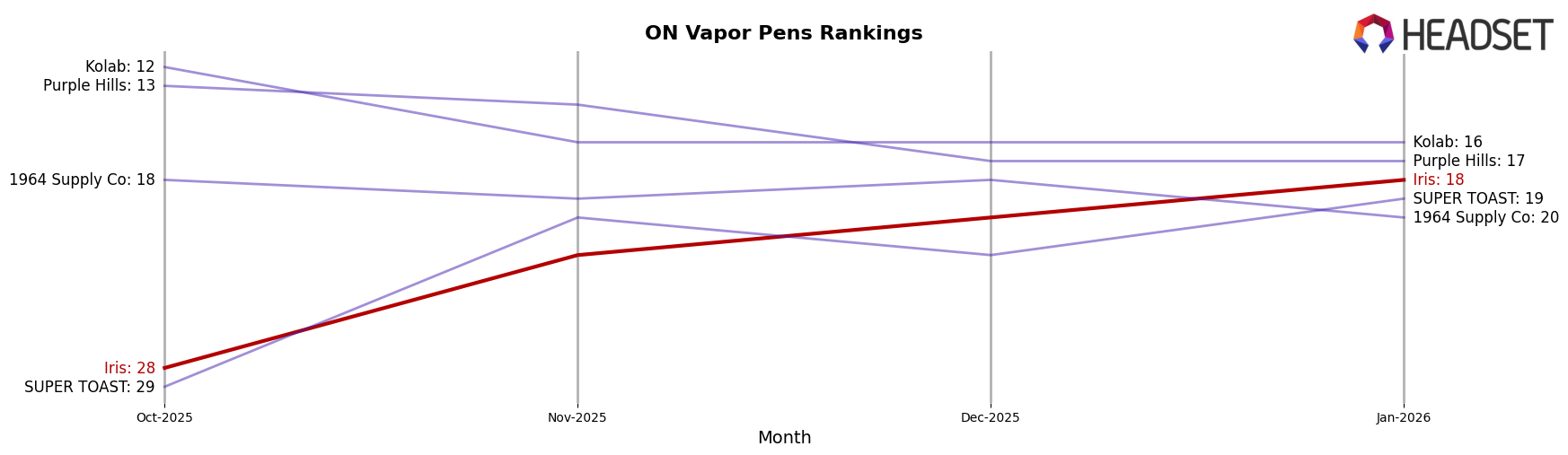

In the province of Ontario, Iris has demonstrated a consistent upward trajectory in the Vapor Pens category. Starting from the 28th position in October 2025, Iris climbed to the 18th spot by January 2026. This steady improvement in rankings over four months indicates strengthening brand recognition and consumer preference in the region. The data suggests that Iris is successfully capturing market share, which is further evidenced by their increasing sales numbers. The brand's ability to break into the top 20 is a significant achievement, especially in a competitive market like Ontario.

However, the absence of Iris in the top 30 rankings in other states or provinces across different categories highlights areas where the brand has room for growth. This lack of presence implies potential opportunities for Iris to expand its footprint and diversify its product offerings to capture a broader audience. By focusing on strategic marketing and product innovation, Iris could leverage its success in Ontario to replicate similar performance in other regions. Despite the challenges, the upward trend in Ontario serves as a promising indicator of what could be achieved with targeted efforts in new markets.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, Iris has shown a promising upward trajectory in brand rank over the past few months. Starting from a rank of 28th in October 2025, Iris has climbed steadily to 18th by January 2026. This improvement in rank is reflected in its sales growth, which has seen a consistent increase, indicating a strengthening market presence. In contrast, 1964 Supply Co experienced a slight decline, dropping from 18th to 20th in the same period, suggesting a potential loss of market share. Meanwhile, Kolab and Purple Hills have maintained relatively stable positions, with Kolab consistently ranking at 16th and Purple Hills fluctuating slightly but remaining in the top 20. SUPER TOAST has also shown improvement, similar to Iris, moving from 29th to 19th. These dynamics suggest that while Iris is gaining momentum, it faces stiff competition from established brands, necessitating strategic marketing efforts to further enhance its market position.

Notable Products

In January 2026, Blackwater Live Resin FSE Cartridge (1g) maintained its position as the top-performing product from Iris, with sales reaching 5,459 units. Following closely, Fantasm Live Resin Cartridge (1g) held onto the second spot, showing consistent performance with an increase in sales over previous months. Purple Sundaze Live Resin Cartridge (1g) also retained its third-place ranking, continuing its steady climb in sales figures. Notably, the rankings for these top three Vapor Pens have remained unchanged since October 2025, indicating a strong brand loyalty and product preference among consumers. This consistency highlights the sustained popularity and demand for Iris's top-tier products in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.