Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

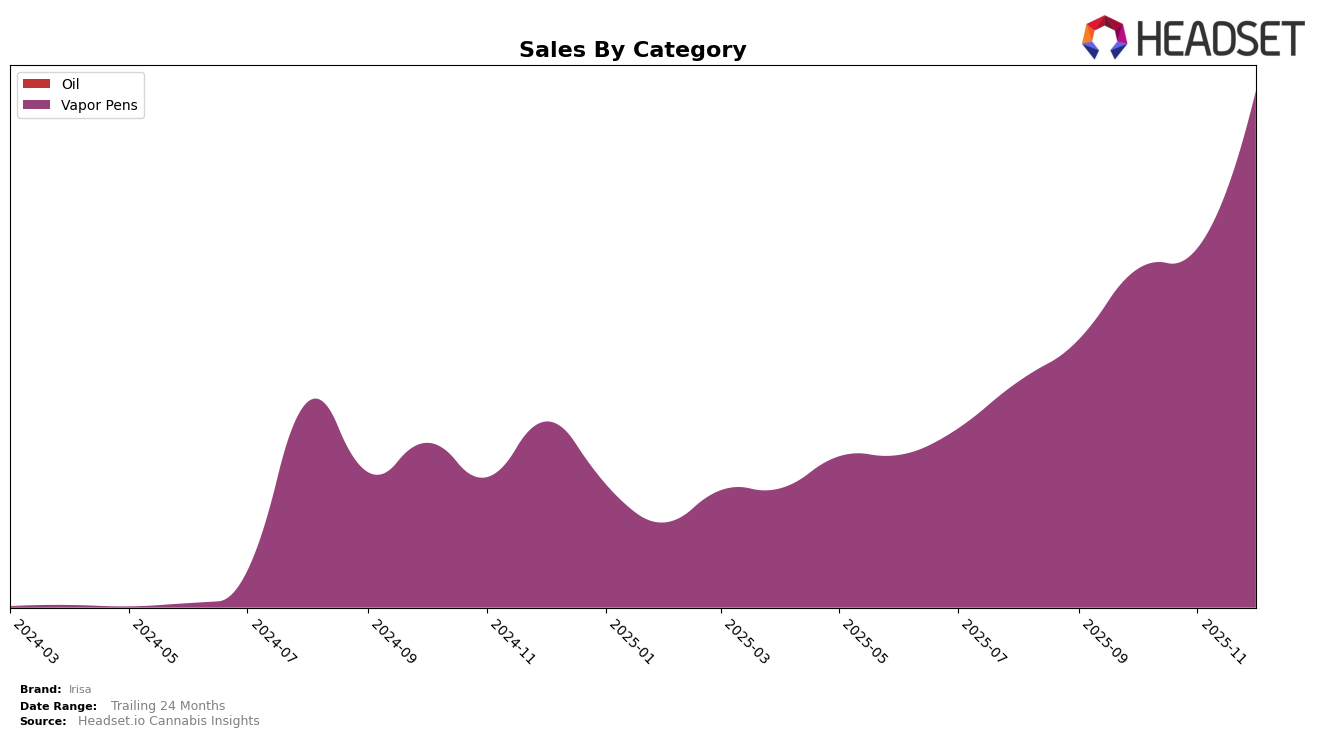

Irisa's performance in the Vapor Pens category has shown notable improvements in both Alberta and Ontario over the last few months of 2025. In Alberta, the brand managed to break into the top 30 by November with a rank of 30, climbing further to 26 by December. This upward movement indicates a positive reception among consumers, resulting in a significant increase in sales, particularly noticeable in December. Meanwhile, in Ontario, Irisa has been consistently climbing the ranks, moving from 58 in September to 44 by December. While they haven't yet cracked the top 30 in Ontario, the steady improvement suggests that the brand is gaining traction in the market.

Despite not being in the top 30 in Ontario, the consistent upward trend in rankings and sales indicates that Irisa is strengthening its foothold in the Vapor Pens category. The brand's ability to improve its position month over month in both provinces highlights a growing consumer base and increasing brand recognition. However, the absence from the top 30 in September and October in both markets suggests there is still room for growth and potential areas for strategic enhancement. This performance trajectory presents an intriguing scenario for stakeholders interested in the brand's future prospects in these regions.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, Irisa has shown a promising upward trajectory in its rankings from September to December 2025. Starting at rank 32 in September, Irisa climbed to rank 26 by December, indicating a significant improvement in market positioning. This positive shift is contrasted by brands like Gas, which saw a decline from rank 23 to 28 over the same period, and Coterie, which fluctuated significantly, peaking at rank 21 in September but dropping to 27 by December. Meanwhile, Bold maintained a relatively stable position, hovering around the early 20s, and Four54 experienced a notable rise from rank 30 to 25. Irisa's sales growth trajectory, particularly the substantial increase in December, suggests a strengthening brand presence and consumer preference, positioning it well against competitors who are either declining or maintaining steady sales figures.

Notable Products

In December 2025, the top-performing product from Irisa was the Fantasm Live Resin Cartridge (1g) in the Vapor Pens category, maintaining its number one position from November with a notable increase in sales to 3664 units. The Purple Sundaze Live Resin FSE Cartridge (1g) followed closely in second place, having swapped ranks with Fantasm from the previous month. Blackwater Live Resin Cartridge (1g) consistently held the third position across the last four months, showing steady sales growth. These rankings highlight a strong preference for live resin cartridges among consumers. The consistent top-three ranking of these products underscores their popularity and sustained demand in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.