Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

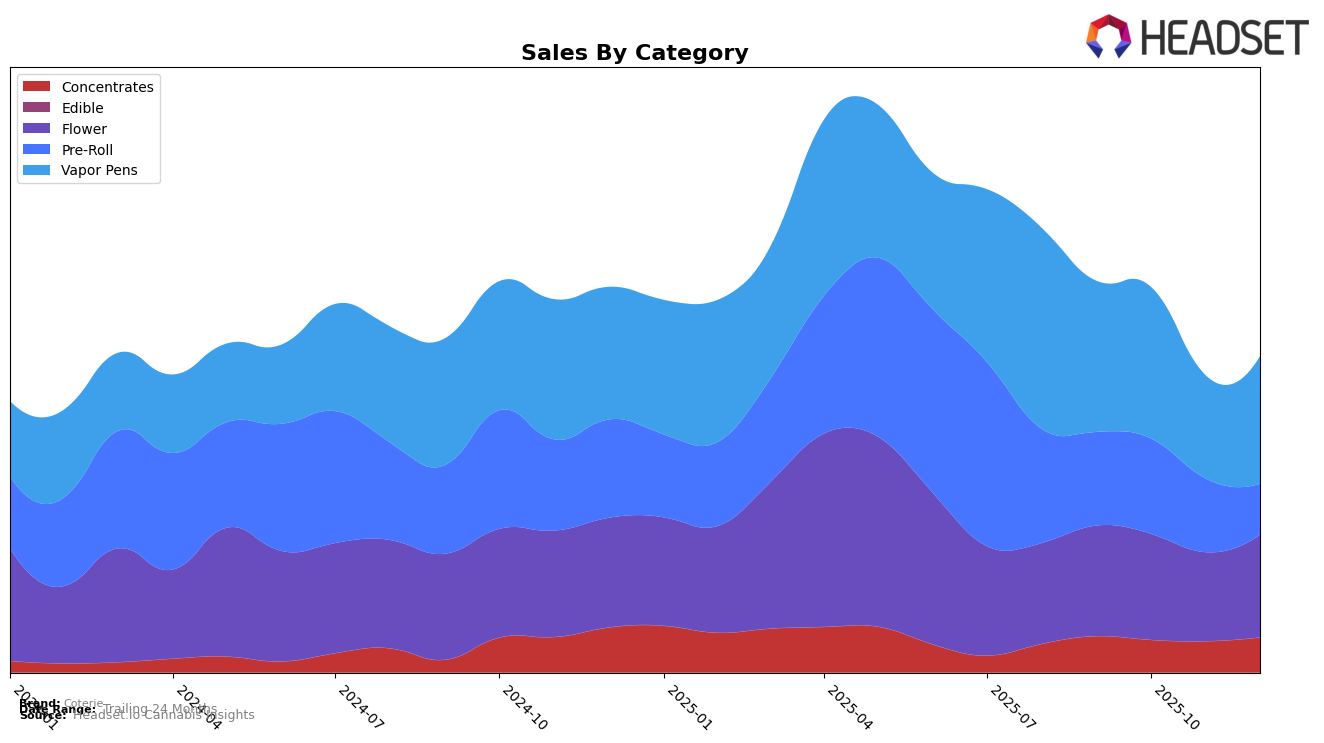

Coterie's performance in the Alberta market shows a mixed trajectory across different categories. In the Concentrates category, Coterie maintained a consistent position at rank 22 from October to December 2025, after a slight drop from rank 19 in September. This stability, despite a small fluctuation in sales, reflects a steady demand for their concentrates. On the other hand, their Flower category saw significant movement, dropping to rank 61 in November before rebounding to 49 in December. This volatility indicates a competitive landscape, possibly affected by seasonal or market-specific factors. The Pre-Roll category presents a more challenging picture, with Coterie's rank plummeting to 87 in December from 59 in the previous months, suggesting a need for strategic adjustments to regain traction in this segment.

In Ontario, Coterie's presence in the Concentrates category was short-lived, as they appeared in the rankings only in September at position 47. This absence in subsequent months highlights potential challenges in gaining a foothold in this category. The Flower category also shows a downward trend, with Coterie's rank slipping from 71 in September to 76 in December, indicating increasing competition or shifting consumer preferences. Vapor Pens, however, show more resilience, with Coterie maintaining a relatively stable presence, fluctuating slightly but remaining within the top 60 throughout the observed months. This suggests a stronger market position and potential opportunity for growth in the Vapor Pens category.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, Coterie experienced notable fluctuations in its ranking from September to December 2025. Initially ranked at 21st in September, Coterie saw a decline to 28th in November before slightly recovering to 27th in December. This volatility contrasts with competitors like Four54, which improved its rank from 30th in September to 25th by December, and Irisa, which consistently climbed from 32nd to 26th over the same period. Despite these shifts, Coterie's sales showed a positive trend in December, indicating potential resilience in market presence. However, the brand faces challenges from Gas and Good Buds, both of which maintained relatively stable rankings, suggesting a need for strategic adjustments to regain and sustain higher market positions.

Notable Products

In December 2025, Granny Smith Live Resin Cartridge (1g) maintained its top position in the Vapor Pens category, continuing its lead from November with sales reaching 3489 units. Platinum Pressed Hash (2g) saw a notable improvement, climbing to second place in the Concentrates category from a consistent fourth place in prior months. Double Mango Liquid Diamonds Disposable (1g) made a significant debut in third place within the Vapor Pens category, showing a strong performance with a resurgence in December sales. Purple Zushi (7g) entered the rankings for the first time in fourth place in the Flower category, while Tangerine Double Infused Blunt (1g) held steady in fifth place in the Pre-Roll category. Overall, Coterie's product lineup demonstrated dynamic shifts in rankings, with several products improving their standings significantly from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.