Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

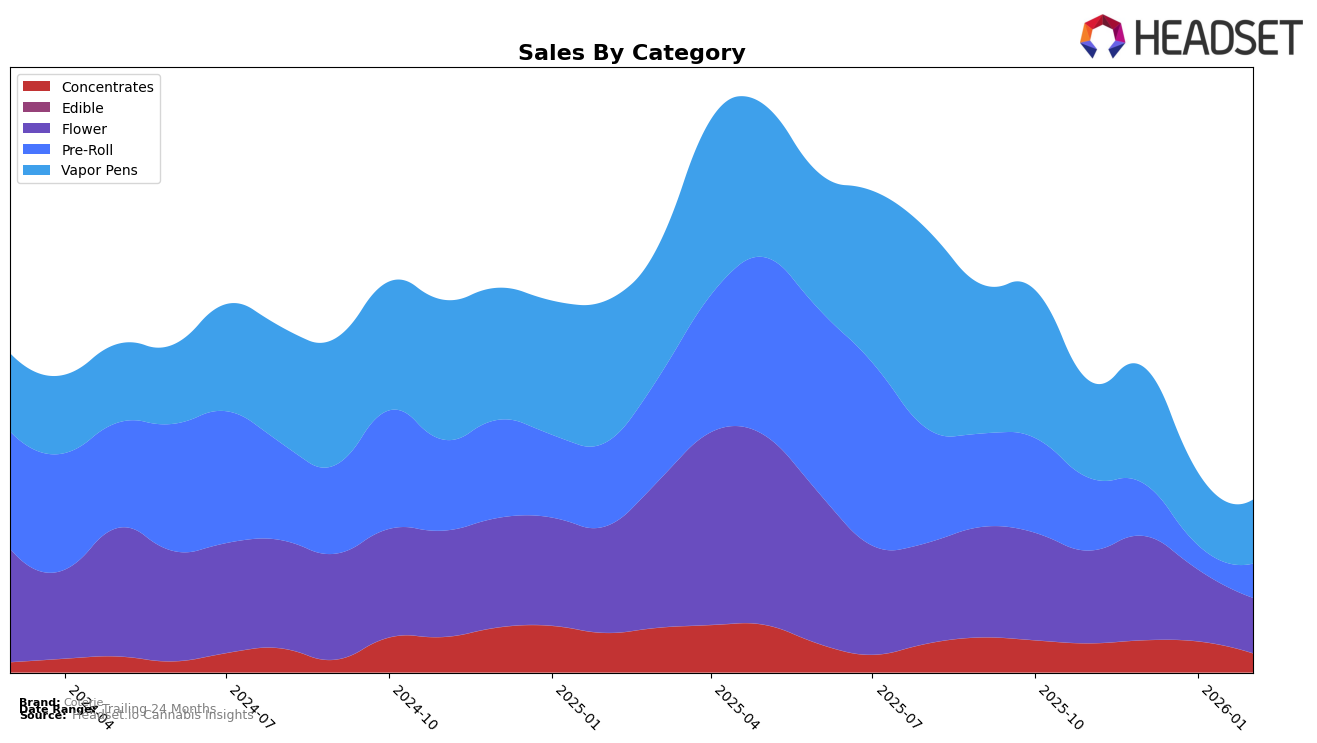

In Alberta, Coterie's performance across various cannabis categories has shown mixed results. Notably, in the Concentrates category, Coterie maintained a relatively stable presence, with rankings fluctuating slightly from 23rd to 26th place over the months. However, their sales in this category decreased from November 2025 to February 2026, indicating a need for strategic adjustments. In the Flower category, Coterie saw some improvement, moving from 63rd to 57th place, suggesting a positive reception or effective marketing strategies during this period. Conversely, the Pre-Roll category saw a significant drop, with Coterie falling out of the top 30 in January 2026, highlighting potential challenges in this segment. The Vapor Pens category remained relatively stable, though sales saw a decline, which may warrant further analysis to understand consumer preferences.

In Ontario, Coterie's performance presents a different narrative. The brand made its debut in the Concentrates category in December 2025, maintaining its position at 52nd in January 2026, which could be seen as a promising start in this market. However, in the Flower category, Coterie experienced a downward trajectory, dropping from 70th to 86th place before disappearing from the top 30 in February 2026. This decline suggests potential competitive pressures or shifting consumer preferences that the brand needs to address. Meanwhile, in the Vapor Pens category, Coterie managed to maintain a consistent presence, although there was a noticeable drop from 56th to 63rd place by February 2026, indicating a need to bolster their market strategy to regain momentum.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, Coterie has experienced notable fluctuations in its rankings over recent months, indicating a dynamic market environment. While Coterie improved its position from 30th in November 2025 to 29th in December, it saw a decline to 34th by January and February 2026. This downward trend contrasts with Versus, which improved its rank from 31st in November to 30th in February, suggesting a more stable or slightly upward trajectory. Meanwhile, Good Buds consistently remained outside the top 30, indicating a more significant decline in market presence. Interestingly, No Future made a remarkable leap from being unranked in November to 35th by February, showcasing potential growth momentum. This competitive pressure, coupled with Coterie's sales dip from December to February, underscores the need for strategic adjustments to regain market share and improve its standing in this vibrant sector.

Notable Products

In February 2026, the top-performing product from Coterie was Fruity Pebbles Live Resin Infused Blunt (1g) in the Pre-Roll category, securing the number one rank with sales of 1983 units. Prickly Pear Liquid Diamonds Cartridge (1g) climbed to the second position in the Vapor Pens category, marking a significant rise from its fifth position in January. Platinum Pressed Hash (2g) in the Concentrates category saw a drop to third place after leading in January. Double Mango Liquid Diamonds Disposable (1g) in Vapor Pens fell to fourth place, continuing its decline from second in January. Strawberry Gary (7g) maintained a steady presence in the Flower category, rounding out the top five products for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.