Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

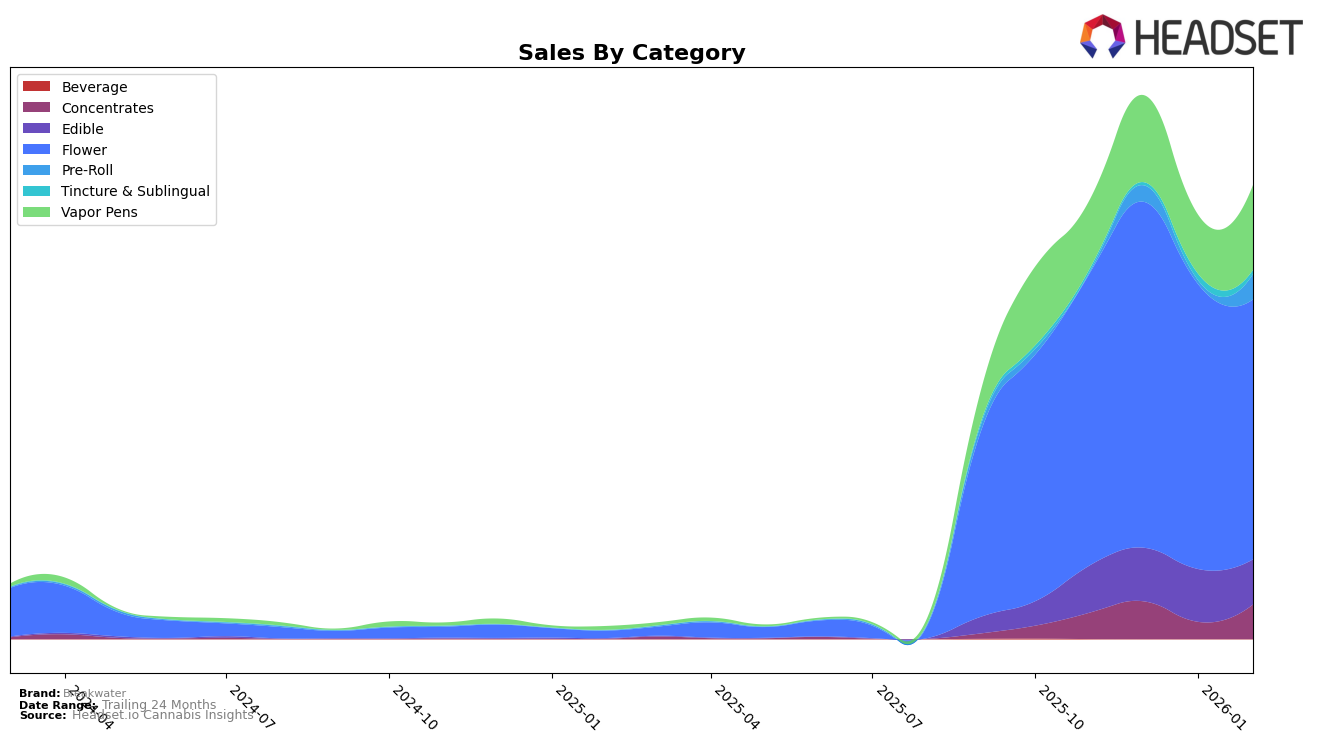

In the state of New Jersey, Breakwater has shown a dynamic performance across various cannabis categories. For Concentrates, the brand saw a noticeable improvement, climbing from the 17th position in November 2025 to 15th in December, then briefly dropping to 26th in January 2026 before recovering to 15th in February. This fluctuation indicates a volatile but ultimately resilient presence in the Concentrates market. In the Edibles category, Breakwater maintained a relatively stable ranking, moving from 27th in November to 23rd in January, before slightly slipping to 24th in February. Such consistency suggests a steady demand for their edible products. However, the Flower category saw a slight decline, moving from 26th in November to 28th by February, which might indicate increasing competition or shifting consumer preferences in this segment.

Breakwater's performance in the Pre-Roll category is worth noting as they did not rank in the top 30 in November 2025, but made a significant appearance at 67th in December, and later improved to 53rd by February 2026. This upward trajectory suggests a growing acceptance or popularity of their Pre-Roll products. In contrast, their Vapor Pens have faced challenges, consistently ranking at 33rd in November and December before dropping to 40th in January and returning to 33rd by February. The sales trends in this category might reflect a competitive market environment or changing consumer preferences. Overall, Breakwater's presence in the New Jersey market is marked by both opportunities for growth and areas needing strategic focus.

Competitive Landscape

In the competitive landscape of the Flower category in New Jersey, Breakwater has experienced fluctuations in its rank, moving from 26th in November 2025 to 28th by February 2026. This slight decline in rank is notable as competitors such as (the) Essence and Verano have shown more stable or improving positions, with (the) Essence peaking at 14th in December 2025 and Verano gradually climbing to 26th by February 2026. Despite Breakwater's decrease in rank, its sales figures remain relatively consistent, though slightly lower than those of (the) Essence, which saw a significant sales peak in December 2025. Meanwhile, Agri-Kind has made a notable leap from 57th in December 2025 to 29th in February 2026, indicating a rapid increase in market presence that could pose a challenge to Breakwater if the trend continues. As Breakwater navigates this competitive environment, understanding these dynamics is crucial for strategizing future growth and maintaining its market share.

Notable Products

In February 2026, the top-performing product for Breakwater was (Headband x ChemD) x Skunkdog Bx1 (3.5g), maintaining its first-place rank consistently since November 2025 despite a drop in sales to 844 units. Kush VIII Pre-Roll 2-Pack (1g) rose to second place, showing a notable improvement from December 2025 when it was ranked third. Strawberry Cherry Pie (3.5g) emerged in third place, marking its first appearance in the rankings. The THCV/THC 6:10 Lemon Lime Gummies 10-Pack (60mg THCV, 100mg THC) secured the fourth spot, also debuting in the rankings. Blissful Wizard (3.5g) fell to fifth place from its previous third-place position in January 2026, indicating a decline in its relative performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.