Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

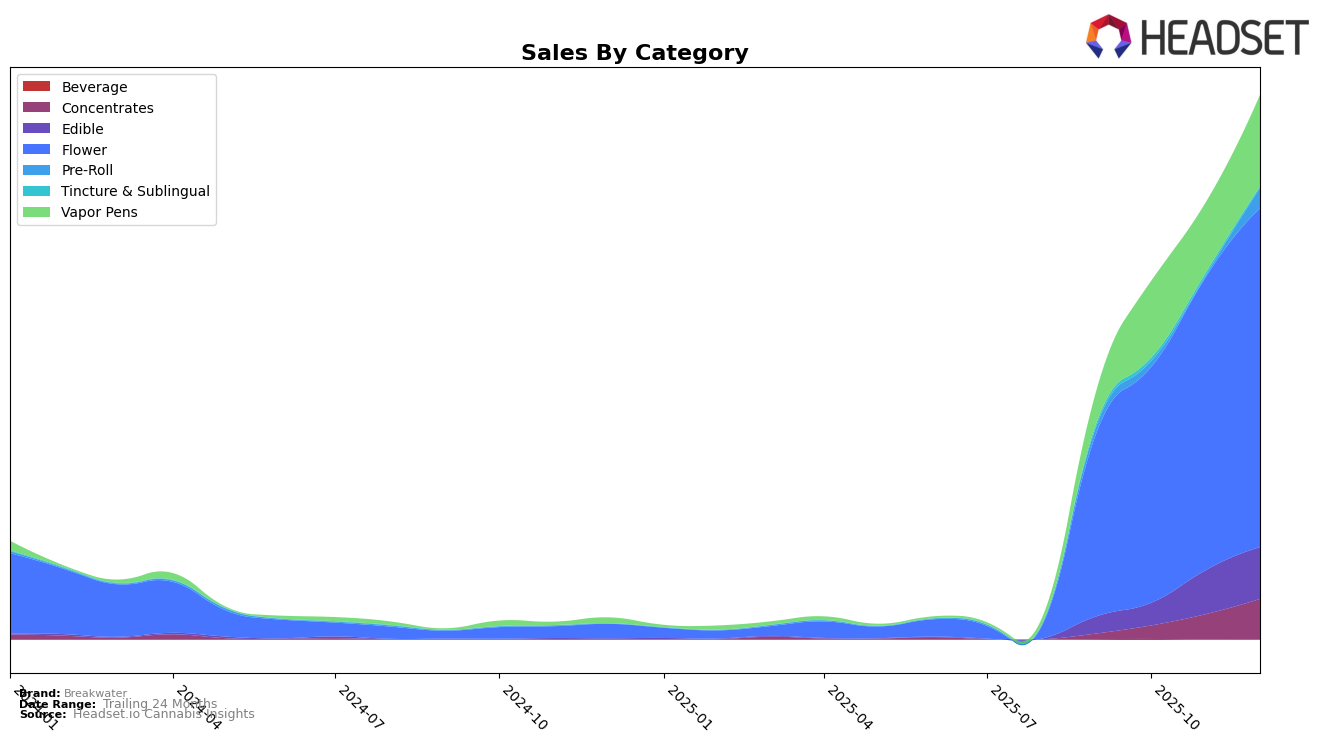

Breakwater has shown a notable upward trajectory in the New Jersey cannabis market, particularly in the Concentrates category. Starting from outside the top 30, Breakwater made a significant leap to rank 28th in October 2025, and continued to climb to 17th by November, reaching 14th place by December. This rapid ascent is indicative of a strong market presence and growing consumer preference for their concentrate products. In the Edible category, Breakwater also demonstrated consistent progress, moving up from 42nd place in September to 24th by December, showcasing their ability to capture a larger share of the market over time.

In the Flower category, Breakwater maintained a steady climb in New Jersey, improving from 30th place in September to 23rd in December. This steady rise suggests a growing consumer base and possibly an expansion of their product offerings. The Vapor Pens category saw Breakwater fluctuating slightly but ultimately improving from 48th place in September to 30th by December, indicating a positive but more gradual growth trajectory. However, in the Pre-Roll category, Breakwater only entered the rankings in December at 57th place, signaling potential challenges in gaining a foothold in this segment. This mixed performance across categories highlights areas of both strength and opportunity for Breakwater in the New Jersey market.

Competitive Landscape

In the competitive landscape of the flower category in New Jersey, Breakwater has shown a steady improvement in its rank and sales over the last few months of 2025. Starting from a rank of 30 in September, Breakwater climbed to 23 by December, indicating a positive trajectory in market presence. This upward trend is noteworthy when compared to competitors like Cookies, which hovered around the 20s rank, and Old Pal, which experienced fluctuations, peaking at 17 in November before dropping to 24 in December. Meanwhile, Yeti made a significant leap from 55 in September to 20 in November, although it slightly declined to 22 in December. Full Tilt Labs also saw a notable rise to 17 in October but fell back to 25 by December. Breakwater's consistent climb in rank and sales, amidst the volatility of its competitors, suggests a strengthening market position, potentially driven by strategic marketing or product differentiation efforts.

Notable Products

In December 2025, Breakwater's top-performing product was Peanut Butter Breath #240 (3.5g) in the Flower category, which climbed to the first position with notable sales of 962 units. The product (Headband x ChemD) x Skunkdog Bx1 (3.5g) also in the Flower category, ranked second, slipping from its previous top position in November. Kush VIII Pre-Roll 2-Pack (1g) emerged in the third spot, marking its entry into the top rankings. Cali Burger #80 (3.5g) showed a significant improvement, advancing to fourth place from its absence in November's rankings. Lastly, Sour Super Skunk Pre-Roll 2-Pack (1g) completed the top five, entering the list for the first time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.