Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

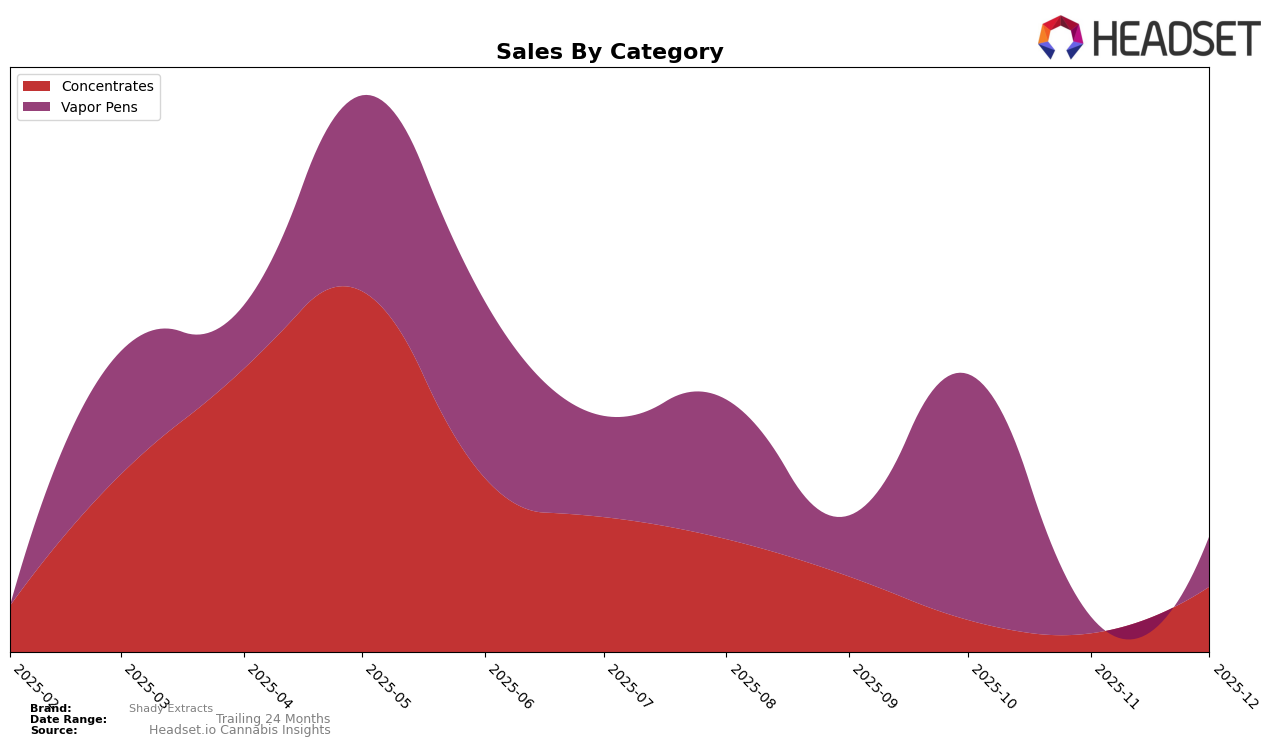

In New Jersey, Shady Extracts has shown some fluctuations in their performance across different product categories. In the Concentrates category, the brand experienced a dip in rankings from September to November 2025, where they fell out of the top 30, only to recover slightly by December, climbing back to the 28th position. This pattern suggests a volatile market presence that may be influenced by seasonal demand or competitive pressures. Interestingly, the sales figures reflect a recovery in December, nearly doubling from November, which could indicate effective promotional strategies or a shift in consumer preference back towards their products.

Meanwhile, in the Vapor Pens category, Shady Extracts has struggled to maintain a consistent ranking in New Jersey. They were not in the top 30 in November 2025, highlighting a significant challenge in capturing market share during that period. However, their ranking in October at 51 suggests there was potential for upward movement, though it was not sustained. By December, they re-entered the top 75, indicating some regained traction, albeit not as robust as in October. The absence of sales data in November may hint at a strategic pullback or inventory issues, which could have impacted their market visibility and consumer reach during that month.

Competitive Landscape

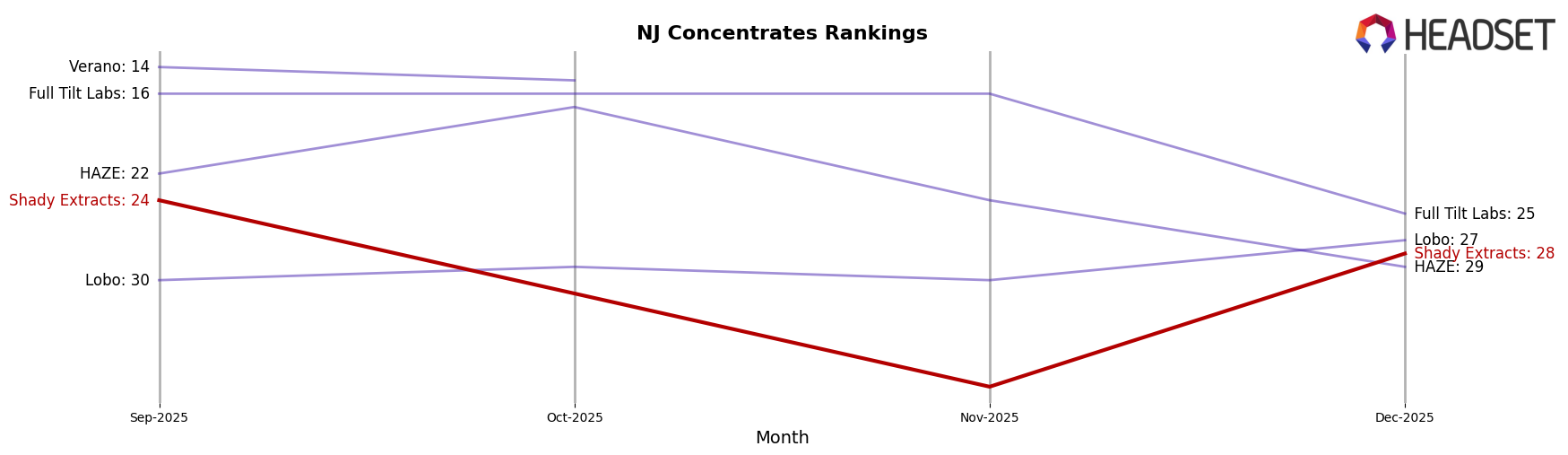

In the competitive landscape of concentrates in New Jersey, Shady Extracts has experienced fluctuating rankings and sales, indicating a challenging market environment. In September 2025, Shady Extracts was ranked 24th, but by October, it had dropped to 31st, and further declined to 38th in November before recovering to 28th in December. This volatility contrasts with competitors like Verano, which maintained a relatively stable position in the top 20, and Full Tilt Labs, which consistently ranked 16th until a drop in December. Meanwhile, Lobo showed a positive trajectory, climbing from 30th in September to 27th by December, suggesting a growing market presence. The sales trends for Shady Extracts reflect these ranking shifts, with a notable dip in October and November, but a resurgence in December, highlighting the brand's potential to rebound despite competitive pressures. This dynamic environment underscores the importance for Shady Extracts to strategize effectively to regain and maintain a stronger market position.

Notable Products

In December 2025, the top-performing product from Shady Extracts was Mythic Candy Live Resin Cartridge (1g) in the Vapor Pens category, securing the number one rank with sales reaching 202 units. Following closely was Truth Serum Live Resin Cartridge (1g), also in the Vapor Pens category, which held the second rank. Cookies and Chem Live Sugar (1g) from the Concentrates category took the third spot, demonstrating strong performance. Notably, Fruity Gum Live Resin Sugar (1g) improved its position, climbing from fourth in September to third in December. Crotch Knocker Cured Resin Sugar (1g) maintained a steady presence in the top five, ranking fourth in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.