Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

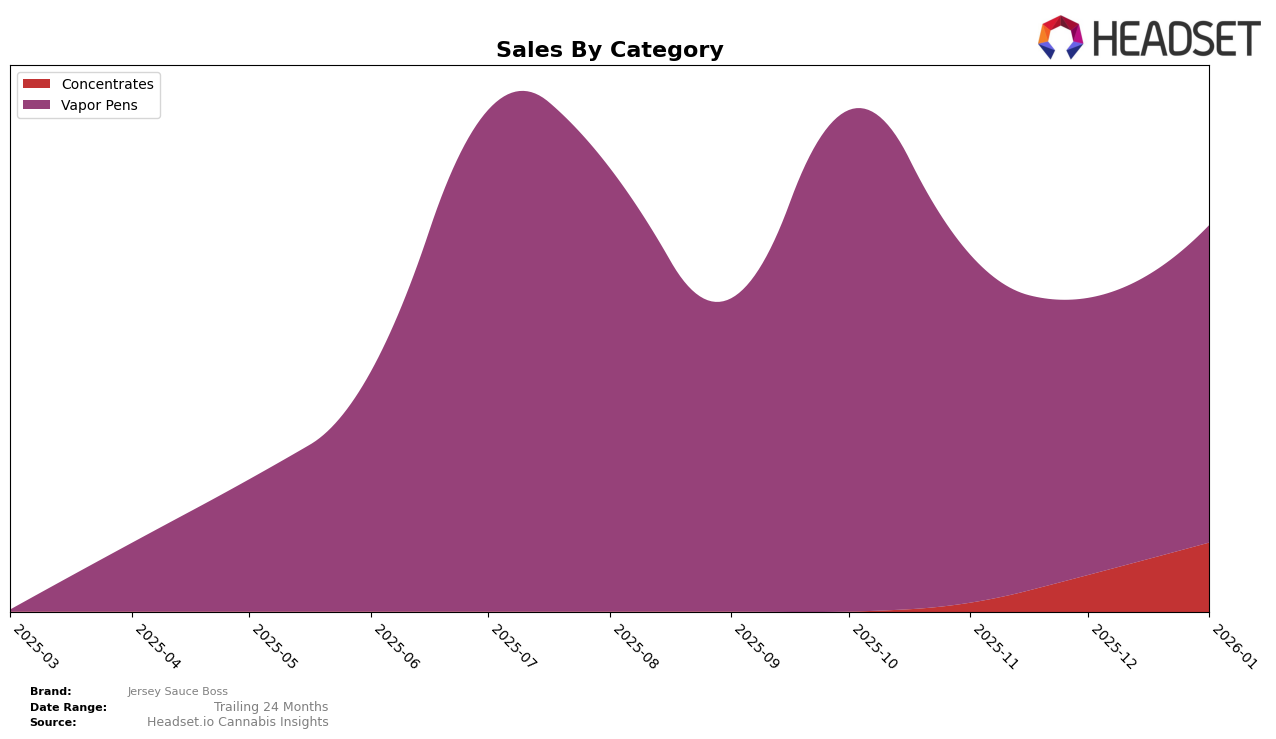

Jersey Sauce Boss has demonstrated notable movement across different categories in New Jersey. In the Concentrates category, the brand was not ranked in the top 30 for October and November 2025, indicating a challenging period for the brand in this segment. However, by December 2025, they managed to break into the rankings at 39th place and improved to 27th by January 2026. This upward trajectory suggests a growing acceptance or strategy shift that has started to pay off, potentially positioning them for continued success if the trend persists.

In the Vapor Pens category, Jersey Sauce Boss began at 25th place in October 2025, but saw a decline in the following months, dropping to 32nd in November and further to 43rd in December. By January 2026, they had recovered slightly to 35th place. Despite the fluctuations in ranking, the brand's sales figures indicate a significant volume, with October 2025 sales reaching over $200,000. This suggests that while their position among competitors has varied, they maintain a substantial customer base. The challenge for Jersey Sauce Boss will be to translate this sales volume into improved rankings, potentially through enhanced marketing or product innovation.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, Jersey Sauce Boss has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 25th in October, the brand saw a decline to 43rd in December before rebounding slightly to 35th in January. This trajectory indicates a volatile market presence, potentially affecting consumer perception and sales momentum. In contrast, ONYX (NJ) maintained a relatively stable ranking, hovering between 27th and 34th, suggesting a more consistent market performance. Meanwhile, SUN demonstrated a significant rise in December, climbing from 60th in October to 31st, before settling at 37th in January, which could pose a competitive threat to Jersey Sauce Boss. The fluctuating ranks and sales trends of these brands highlight the dynamic nature of the vapor pen market in New Jersey, emphasizing the need for Jersey Sauce Boss to strategize effectively to regain and sustain its competitive edge.

Notable Products

In January 2026, Jersey Sauce Boss saw its top-performing product as the Sauce Stick - Planet of the Grapes Live Resin Cartridge (1g) in the Vapor Pens category, securing the number one rank with sales reaching 356 units. Following closely, Punch N Pie Live Badder (1g) in the Concentrates category took the second spot. The third rank was shared by Sauce Stick - Velvet Halo Live Resin Disposable (1g) and Sauce Stick XL - Catalina Winer Mixer Live Resin Disposable (1g), both in the Vapor Pens category. Chem Gem Live Resin Cartridge (0.5g) also performed well, ranking fourth. Compared to previous months, these products have maintained strong positions, with the Sauce Stick - Planet of the Grapes Live Resin Cartridge showing a significant rise to the top rank.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.