Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

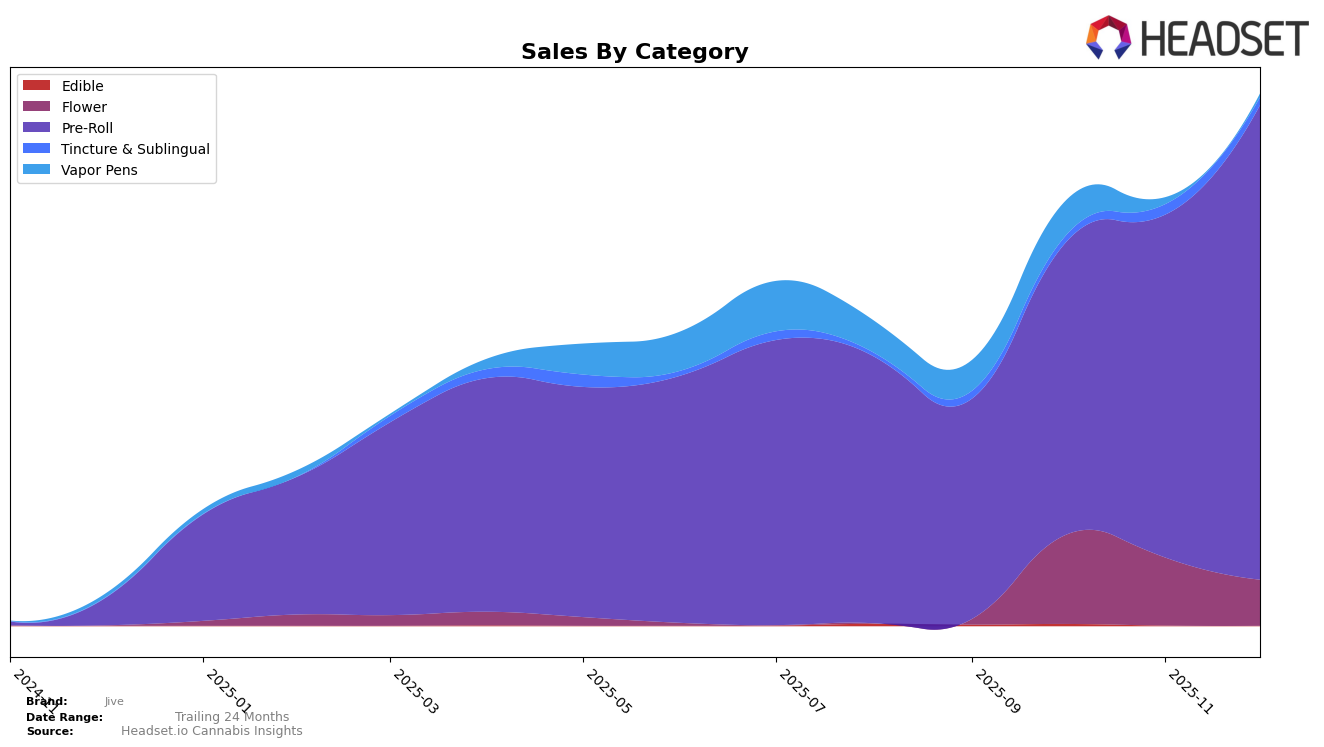

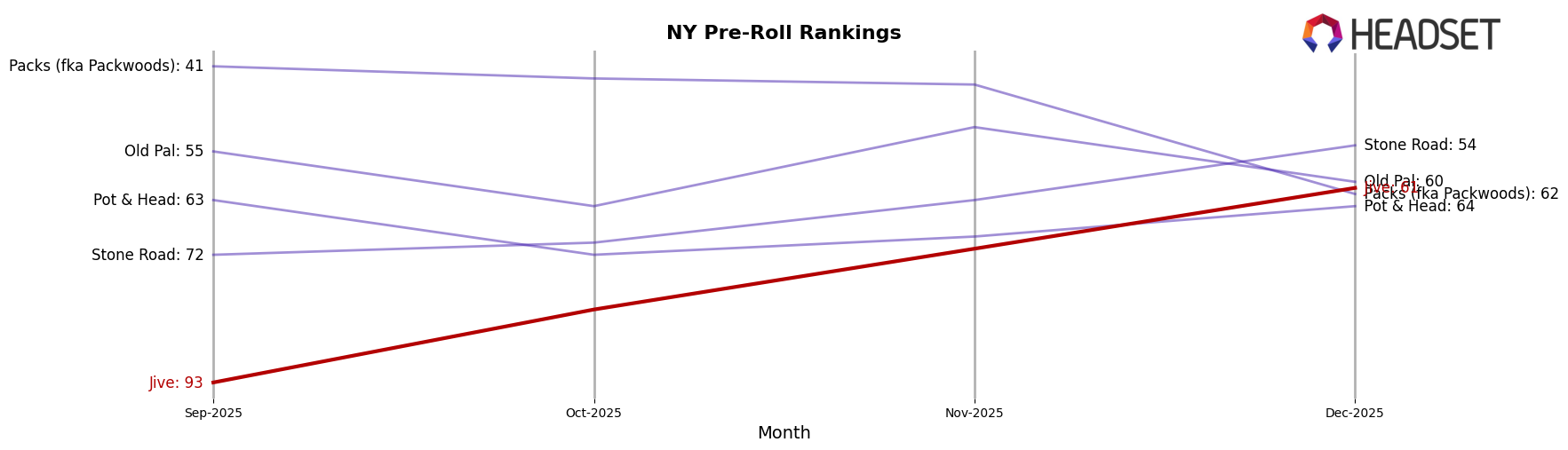

In the competitive landscape of cannabis brands, Jive has been making notable strides, particularly in the New York market. Focusing on the Pre-Roll category, Jive has shown a consistent upward trajectory in its rankings over the final months of 2025. Starting from a rank of 93 in September, Jive climbed to 81 by October, moved up to 71 in November, and further improved to 61 by December. This steady improvement in rankings coincides with a significant increase in sales, indicating a growing consumer preference for Jive's offerings in this category. The brand's ability to break into the top 30 remains a goal, as it has yet to achieve this benchmark in New York's competitive market.

While Jive's performance in New York's Pre-Roll category is promising, it is important to note that the brand has not yet appeared in the top 30 rankings for any other states or categories, suggesting that their market presence might be more localized or focused. This could be seen as a limitation or an opportunity for growth, depending on the strategic goals of the company. The absence of Jive in the top 30 in other regions might highlight areas where the brand could expand its reach or diversify its product offerings to capture a larger market share. As the cannabis industry continues to evolve, monitoring Jive's strategic moves in both existing and new markets will be essential for understanding its long-term potential.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in New York, Jive has demonstrated a notable upward trajectory in its rankings over the last few months of 2025. Starting from a rank of 93 in September, Jive climbed to 81 in October, 71 in November, and reached 61 by December. This consistent improvement highlights Jive's growing market presence and appeal among consumers. In contrast, Old Pal and Packs (fka Packwoods) experienced fluctuating ranks, with Old Pal moving from 55 to 60 and Packs dropping from 41 to 62 over the same period. Meanwhile, Stone Road showed a positive trend, improving from 72 to 54, and Pot & Head remained relatively stable. Jive's sales growth aligns with its rank improvement, suggesting effective market strategies and increasing consumer preference, positioning it as a formidable competitor in the New York Pre-Roll market.

Notable Products

In December 2025, the top-performing product for Jive was Lemon Berry OG Pre-Roll 2-Pack (1g) in the Pre-Roll category, maintaining its number one position from November with impressive sales of 3,400 units. Blueberry Muffin Pre-Roll 2-Pack (1g) held steady at the second rank, showing consistent popularity. Mandarin Temple Pre-Roll 2-Pack (1g) also retained its third place, indicating stable demand across these months. Notably, Planet of the Grapes Pre-Roll 2-Pack (1g) entered the rankings in December at fourth place, while Don Carlos Pre-Roll 2-Pack (1g) dropped to fifth, down from fourth in November. This shift highlights a dynamic market where new entrants and consistent performers vie for top positions.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.